Consumer Credit Card Use Falls for 24th Consecutive Month

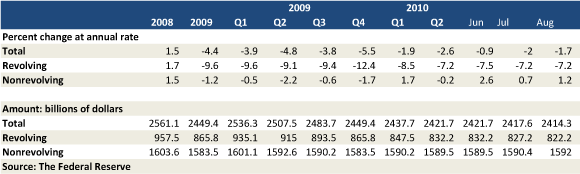

U.S. consumers have cut back on their outstanding revolving credit lines, comprised mostly of credit card balances, for the 24th month in a row, according to the latest data released by the Federal Reserve. Outstanding revolving credit fell by $4.99 billion in August from July, a decrease of 7.2 percent at an annualized rate. This comes after a fall of $4.98 billion the previous month.

These latest figures mark a continuation of the debt-cutting trend that started with the beginning of the financial crisis two years ago. Overall, since the end of 2008, revolving credit in the U.S. has dropped by $135.3 billion, from $957.5 billion to $822.2 billion, a decrease of 14.1 percent.

Fed’s data come a week after Fitch Ratings, a credit ratings agency, issued a report, according to which the 60-day delinquency rate, measuring the rate of credit card payments late by 60 days or more, fell in August for the 23rd month in a row, from 4.27 percent to 4.18 percent. Early stage delinquencies, payments late by 30 days or more, also fell – by 0.21 percent to 5.53 percent.

However, charge-offs – loans lenders no longer expect to be repaid and have written off their books as losses – rose 0.17 percent to 11.10 percent in August, after reaching a 16-month low in July. Issuers typically charge off balances 180 days after the latest payment on the account.

The sharp decrease in consumer credit card debt is due in part to lower credit card use and a rise in the repayment rate. Again according to Fitch, Americans are paying back a larger percentage of their monthly credit card balances than they have in a long time. Fitch’s monthly payment rate (MPR) has been rising steadily, after reaching a six-year low of 15.78 percent in February 2009, during the peak of the crisis. The MPR rose 0.09 percent in August from July and is now approaching 20 percent, a level last reached in 2007.

Another reason for the fall in consumers’ credit card indebtedness, the biggest factor according to some analysts, is the spike in the amounts written off by banks. It is hard to argue with this view. Just in the first half of 2010, credit card companies charged off $43.5 billion, according to CardHub.com, a credit card comparison website. Issuers have charged-off more than $20 billion each quarter, beginning in the second quarter of 2009, according to the same source. This figure is about equal to the amount of the decline in outstanding credit card balances.

We may get an idea of how valid the notion is that consumers have become more conservative in their credit card spending during the upcoming Holiday season. Many expect that alternative payment types like debit cards, cash, prepaid cards and checks will gain ground on credit card use. We’ll have to wait and see.