Credit Card Companies Beef Up Their E-Commerce Presence

Credit card associations (Visa and MasterCard) and companies (American Express and Discover) are not exactly famous for their flexibility and nimbleness in adjusting to fast-changing circumstances. In fact, they are rather conservatively run institutions that would like nothing better than for everything to remain static, so that they can keep on making money the way they always have. Come to think of it, we should not be too hard on them, as most of us change our ways of doing things only when we are forced to do so.

Well, it seems like changes are being forced on the credit card behemoths and they are reluctantly beginning to expand their offerings and beef up existing ones. Oh, and they are opening up their wallets too, big time.

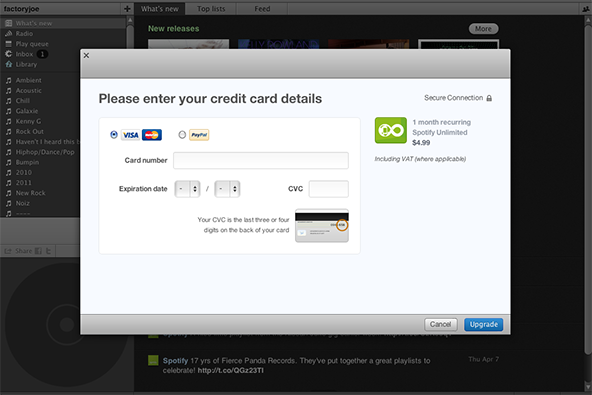

The e-commerce is where the current events are unfolding and DMNews.com’s Alex Palmer has a great article about the latest developments. As usual, young, aggressive competitors have spurred the incumbents into action. PayPal and Google Checkout have gradually evolved from smallish blips on Visa’s and MasterCard’s radar screens into major players on the e-commerce front.

“The card companies have to make sure that they are relevant. These guys are not oblivious to the fact that new entrants have taken a bite out of the purchase volume,” said Allen Weinberg, payments consultant for Glenbrook Partners, a payment strategy consulting firm, as quoted by Palmer.

Palmer goes on to list some of the old guard’ recent moves in response of the threat posed by the upstarts:

Visa is moving aggressively to promote, and add to, its e-commerce capabilities. The company recently initiated a marketing program for its Rightcliq online shopping service. The platform not only allows customers to store their payment card numbers with the service, even for competing cards, but also offers to track order delivery status.

Visa also acquired CyberSource, the online fraud prevention and payment gateway, this year.…

American Express announced last month that members will be able to use Membership Rewards points toward purchases on Amazon.com. Discover Financial Services said it will collaborate with Firethorn Holdings on the soon-to-be-released Swagg mobile gift card application, which will allow shoppers to purchase, customize and exchange gift cards on their smartphones.

MasterCard bought UK-based payment services company DataCash Group for $520 million in August to expand its online commerce business. It also launched the MasterCard MarketPlace, a discount site for card members, with e-commerce company NextJump.

It has to be pointed out, however, that although the newcomers pose a legitimate threat to the establishment, they are by no means total outsiders. In order for anyone, including PayPal and Google Checkout, to accept Visa and MasterCard cards, for example, they have to have a relationship with a processing bank that is a member of Visa and MasterCard. The processing bank “acquires” its client’s transactions and submits them for settlement with the credit card associations, all the while collecting its fees, as do the card issuer and the associations. Now, neither PayPal nor Google Checkout is a bank in the U.S., so they don’t even keep the processor’s fees for themselves, which are far lower than the issuer’s.

From a payment processor’s point of view, PayPal and Google Checkout look like oversized e-commerce businesses. What makes it slightly less obvious to the casual observer is the type of service they provide. Instead of downloadable software, the pair provides a means for payment on the internet.

But that is the present. The world of the e-commerce, and especially mobile, payments is evolving incredibly fast and in the not-too-distant future we may see payment services that completely circumvent the Visas of the world. We’ve actually already seen a glimpse of how this may look. A couple of months ago Verizon, AT&T and T-Mobile announced a partnership with Discover and Barclays to enable their customers to use their cell phones as credit cards. This is a potentially huge venture and Visa and MasterCard are out of the picture. True, a credit card company (Discover) and a major bank (Barclays) are in it, but it is not hard to imagine smaller-scale operations that completely circumvent the established players’ networks. Given time, some of these newcomers can grow sufficiently to change the face of the industry beyond recognition. This is exactly what keeps Visa and MasterCard on their toes.

Image credit: Merchantpaymentgateway.blogspot.com.