Falling Consumer Debt Troubles Credit Card Companies

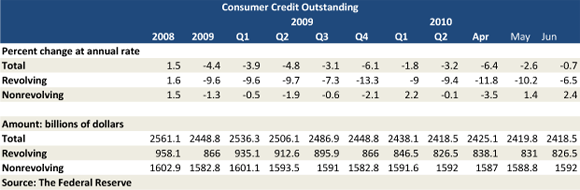

Federal Reserve data tell a story of a huge shift in consumer attitude toward debt that started when the financial crisis first hit a couple of years ago. Since September 2008, when Lehman Brothers collapsed, outstanding balances on consumer credit cards have fallen by $144.9 billion, or 14.85 percent, according to the Federal Reserve. The average U.S. household eliminated $2,683 of credit card debt during this period, although a substantial portion of it was charged-off by issuers as uncollectable, rather than paid off by cardholders.

The WSJ now tells us that cardholders “paid back 19.02% of their balances on average in June, up from 17.1% a year earlier, according to a Fitch Ratings index, which tracks about $231 billion of credit card loans.”

Now, it is great that consumers are making a sustained effort to reduce their credit card debt and it does look like it is not going to be just a blip on the radar screen, as it has been going on for almost two years now. But what about the credit card companies, how is this new trend affecting them? More importantly, what will be the implications for consumers?

According to the WSJ:

Lower card loan balances took a bite out of income for issuers in the second quarter. At Capital One, revenue fell 9% in the second quarter from the first quarter to $3.9 billion as average loan balances declined 4.5%.

…

For J.P. Morgan, revenue at its credit card unit fell 13% in the second quarter from a year ago to $4.2 billion. Its card balances fell 16% to $146.3 billion during the same period.

However, not all issuers are struggling. Again from the WSJ we learn that:

For American Express, consumers paying off their card balances more quickly may prove to have a silver lining as the company issues charge cards, which must be paid off each month, as well as credit cards that allow customers to carry a balance. AmEx’s revenue rose 13% to $6.86 billion in the second quarter, aided in part by higher cardholder spending. That was offset by lower card balances, which fell 9% to $57.3 billion during the period.

So what should we expect from issuers in response to this new trend? After all, it is not very likely that they will just sit idly by, while their revenues shrink.

It is unlikely that issuers will be able to offset the drop in revenues with higher fees or interest rates, partly because cardholders are becoming more disciplined in making payments on time and are generally more conscious of penalty fees, but mostly because the recently passed CARD Act restricts the issuers’ ability to raise interest rates, while preventing them from charging certain fees. For example, credit card companies are no longer allowed to charge overdraft fees, unless cardholders explicitly opt in for overdraft protection. Moreover, beginning this coming Sunday, late payment fees will be reduced from $35 to $25, while inactivity fees will be banned altogether.

Credit card companies seem to have realized that reliance on traditional card products will no longer be enough and have started to get creative. As the above American Express example shows, charge cards were the first sign of their creativity, and they are now also offered by Chase and other issuers. Requiring cardholders to pay in full each month is a sure way to boost revenues. More innovations are certain to be unveiled in the coming months and it will be very interesting to see what form they will take.