This Infographic Is Strikingly Beautiful. What It Tells Us Is Shocking.

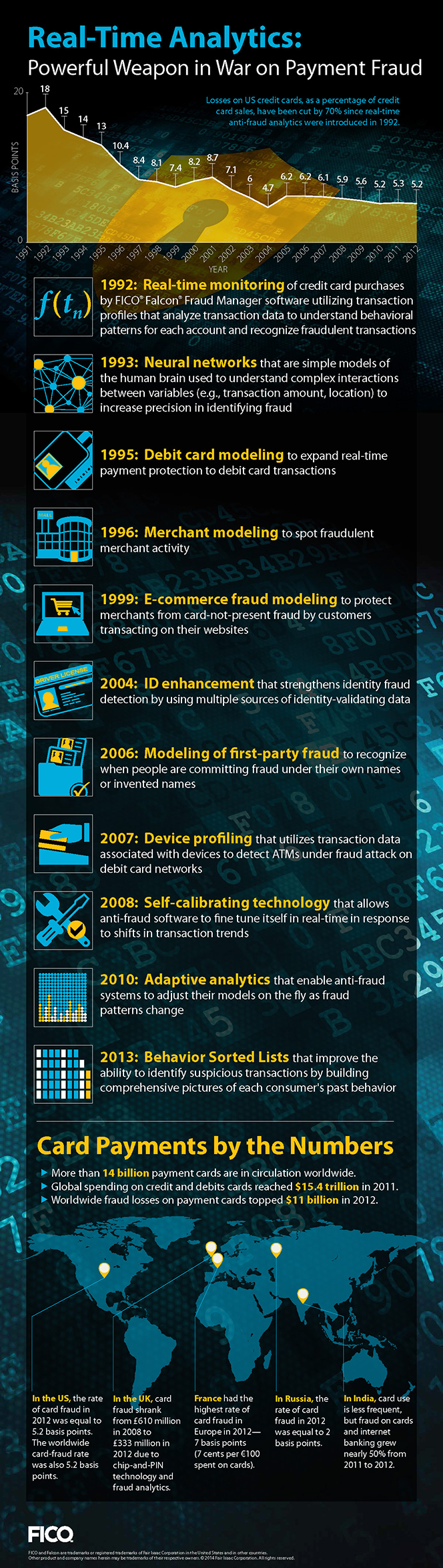

It is always refreshing to see that someone is learning from his or her mistakes, which is why I thought I’d share with you the latest infographic released by FICO — the maker of the most widely used consumer credit score in the U.S. That, and because it is very well done and it visualizes some interesting data for us.

Above all, however, it is plainly evident that the authors of FICO’s infographic didn’t want to be the butt of yet another UniBul joke. And it is true that on a couple of occasions over the past few months I did take aim at them, but how could I resist? After all, as I’ve noted before, FICO’s graphic designers had produced an otherwise strikingly beautiful infographic and one which, unlike most others I come across, actually did have some useful information to visualize. It was quite obvious that its authors had spent a lot of time working on it. And yet, they had nevertheless managed to badly mangle it to the point of making it useless for all intended purposes.

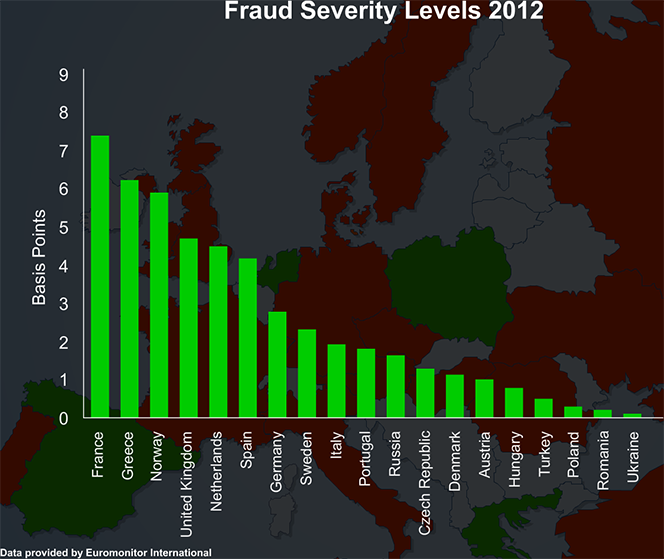

So it is great to see that those same designers (and I’m fairly confident that they are the same) have now corrected their error. They have also visualized some interesting comparative statistics about credit card fraud losses in five different countries. And I would bet that many readers will be shocked to discover that France’s credit card fraud losses are substantially higher than ours here in the U.S. Wait, wasn’t the EMV smart-chip technology (a.k.a. chip-and-PIN), of which France was the founder and one of the first adopters, supposed to decrease, not increase, card fraud losses? Well, as ever in the payment processing world, things are rather complicated. Let’s take a look.

On Card Fraud Losses

FICO’s new graph is telling us that there are more than 14 billion payment cards in circulation worldwide. In 2011, the total spending volume on debit and credit cards was $15.4 trillion and, on the following year, card fraud losses totaled $11 billion. Now, I wish that the authors had selected one year, for which to present data and stuck to it, so that they could have done some basic calculations about things like average spending volume per card and, more to the point, average fraud losses per unit of spending.

Still, we do get some useful data on the fraud losses suffered by five selected countries in 2012:

- In the U.S. the fraud-loss rate was 5.2 basis points, meaning that, on every $1 spent on a payment card, $0.052 were lost to fraud. As it turns out, 5.2 basis points is also the worldwide fraud-loss rate.

- In the U.K., card fraud losses fell from ?ú610 million ($1 billion) in 2008 to ?ú333 million ($554.2 million) in 2012, “due to chip-and-PIN technology and fraud analytics”. But what is the fraud-loss rate? The authors won’t tell us.

- In France, the 2012 fraud-loss rate was 7 basis points — the highest in Europe and 34.6 percent above the U.S. level. Why didn’t the EMV implementation lead to lower fraud losses, as it did in the U.K.?

- In Russia, the 2012 card fraud-loss rate was 2 basis points.

- In India, an underdeveloped card market, “fraud on cards and internet banking grew nearly 50% from 2011 to 2012”. Well, that doesn’t help us much in our effort to assess the comparative success, or lack thereof, of different countries in their fraud management efforts, but there it is.

So, the authors could have done a much better job with their data, but fortunately we have other sources to tap.

On France

The data used in FICO’s infographic is supplied by Euromonitor International, a London-based market intelligence firm, and was originally used in another FICO report about a year ago, which we covered at the time. The report’s big news was that the overall European credit card fraud rate had increased in 2012, even though it had by then been a while since The Old Continent had switched to the supposedly safer EMV card technology. And yes, France had taken over the lead as the European country with the highest card fraud rate. Here is what Martin Warwick, FICO’s fraud chief for Europe, had to say about his findings:

France was the founder of the chip and PIN strategy for Europe, but the UK has taken a particularly tough stance against fraud in recent years, using the latest advanced fraud technology. Despite a rise of 14 percent last year, UK card fraud losses were still 36 percent lower in 2012 than at their peak in 2008. By contrast, France’s overall fraud losses grew 65 percent between 2007 and 2012, which translated to an additional ?é¼174 million of card fraud losses over the period. France also has the highest lost-and-stolen card fraud level of all the countries in Europe.

As you can see in the chart below, France was the only European country whose fraud level in 2012 was above seven basis points. By comparison, the U.K.’s level was 4.6 basis points and Germany’s — 2.8 basis points (amazingly, while the U.K. had experienced a 10-percent decrease in fraud since 2006, Germany had seen a 140 percent increase over the same period).

Unfortunately, FICO’s report failed to tell us anything useful about the reasons for France’s (or Germany’s, for that matter) rising card fraud rates, despite the implementation of the more secure technology. The closest the authors got to offering a plausible explanation was this:

Any successful reduction in fraud, like that driven by Chip & PIN, typically results in criminals changing their modus operandi to find a different weak spot, and fraud levels starting to climb again. Fraud is like a balloon — if you squeeze it out of one scheme, or one country, it bulges somewhere else.

Needless to say, that is nowhere good enough. And unfortunately I don’t have enough data to be able to suggest an explanation. If someone understands what’s going on here, let the rest of us know.

On Getting Infographics Right

Finally, let’s take a look at FICO’s graphs, with which I started. First, here is the original one, which tracked the evolution of fraud prevention, among other things like the explosion of debit card use over the past two decades, e-commerce, m-commerce, etc.

As you can see, you can see… nothing (if you want to make anything out, you will have to click on the image). And here is the new graph, which tracks the very same fraud prevention evolution, along with the other things I reviewed in the preceding paragraphs.

You can see the difference: you can actually see what authors have intended you to see.

Image credit: www.LendingMemo.com.

The FICO authors were correct when they said fraud is comparable to a balloon in that, when squeezed, it bulges elsewhere. While the UK could still be involved in this balloon analogy, they are seeing shrinking fraud losses. This disparity shows that the UK is doing something in addition to chip and pin implementation that allows for better defenses against card fraud. The US needs to follow the UK?ÇÖs lead and tighten current security regulations prior to EMV implementation. All parties ?Çô card issuers, retailers and consumers ?Çô need to do their part to ensure security, or else the expensive switch to chip and pin cards will prove to be much less valuable (as we see with France).