Why Do We Use Prepaid Cards?

The U.S. prepaid card market is still small, but is growing rapidly, a new report from the Pew Charitable Trusts reminds us. Americans have loaded about $65 billion onto general purpose prepaid cards in 2012, we learn, more than double the amount loaded in 2009. And these are not necessarily consumers who lack access to more traditional payment instruments. On the contrary, the researchers find that prepaid users are a mix of consumers who have checking accounts and those who do not, consumers with credit cards and those without, consumers who use alternative payment services and those who do not.

Furthermore, the report finds that today’s prepaid card users are more experienced financially than previously thought. But if that is the case, one might wonder why they would turn to a payment product that is generally considered to be inferior to the alternatives. Well, the researchers believe that they have found the answer: most prepaid users have previously struggled with credit card debt, overspending and unpredictable fees and have found a “safe haven” in prepaid cards, where there is no risk of overdraft fees, interest charges and overspending. For most users, they conclude, “prepaid cards are a mechanism to avoid the temptations and problems of the past”. Let’s take a closer look at the report.

What Is a General Purpose Prepaid Card?

First, though, let’s define the product under discussion: the general purpose reloadable (GPR) prepaid card. Pew defines GPR as cards that are “widely available to the public, allow customers to load funds via cash and direct deposit, and provide the ability to spend money at unaffiliated merchants and to access funds through ATMs”.

GPR is often referred to as an “open-loop” prepaid card. Its opposite — the “closed-loop” prepaid card — is a non-reloadable card that is typically sold by, and usable only at, a given merchant or a merchant chain (for example, a Barnes & Noble prepaid card). Furthermore, a closed-loop card cannot be issued to a specific consumer, which is an option with the open-loop system. Closed-loop cards bear only the logo of the merchant at whose locations they can be used, whereas an open-loop card would display the logo of the payment network, which is processing the payments made with it.

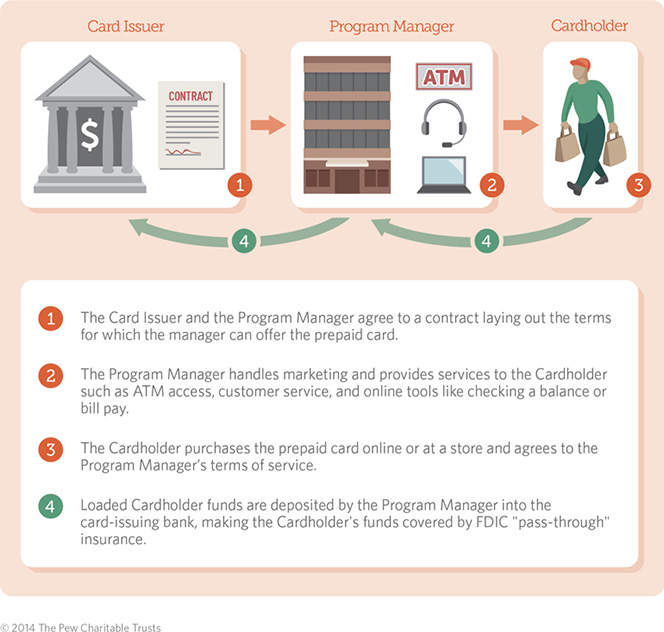

The Pew researchers have produced this infographic to illustrate the GPR payment process:

Who Uses GPR Prepaid Cards?

In Pew’s survey, 5 percent of the responders (roughly 12 million people) said they used GPR prepaid cards at least monthly. The researchers find that Americans across the demographic spectrum use prepaid cards instead of — or in addition to — debit cards. They have lower incomes than the general population, although 14 percent of users earn $75,000 or more annually. Yet, prepaid card users appear to be demographically different from the general population in several ways. They are:

- More likely to be renters.

- Less likely to be married.

- More likely to earn less than $25,000.

- More likely to be African-American.

- More likely to be younger than 50 years of age.

Even after accounting for income, homeownership, marital status and retirement status, the odds of using a prepaid card are still higher for African-Americans, parents and those under age 50.

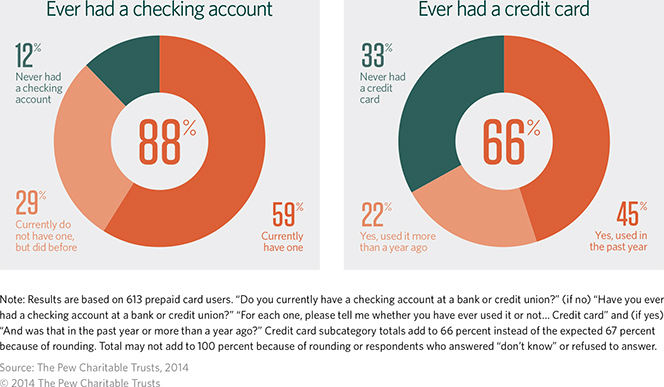

Most Prepaid Card Users Also Have a Bank Account

Fifty-nine percent of prepaid card users in the U.S. currently have a checking account, while 41 percent do not. Among those who currently have a checking account, 77 percent consider it their primary way of managing money. For 12 percent the primary budgeting tool is their prepaid card, for about 5 percent it is cash or a credit card and another 5 percent use some other method or a combination of two methods to manage money.

So, even though prepaid cards are often seen as a substitute for a bank account, a majority of prepaid card users nevertheless have one. As the report notes, this “finding is striking and somewhat counterintuitive”.

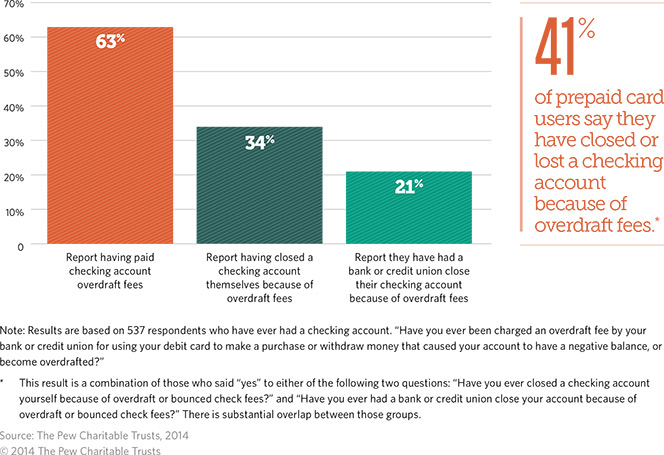

Overdraft Fees Are Prepaid Cards’ Best Ally

Well, it all becomes less striking and counterintuitive once it is revealed that these prepaid users have not exactly been enjoying their checking account experience. It turns out that the biggest reason why prepaid users have fallen out of love with their checking accounts is the overdraft. Most prepaid card users who have had a checking account in the past have paid overdraft fees.

Among prepaid card users who have ever had a bank account, 41 percent have said that they have closed or lost a checking account because of overdraft or bounced check fees.

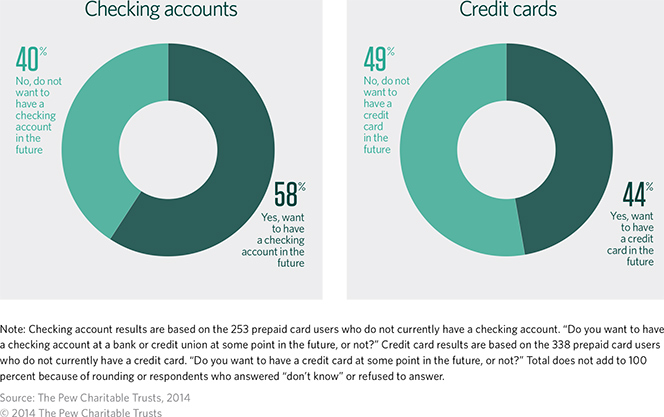

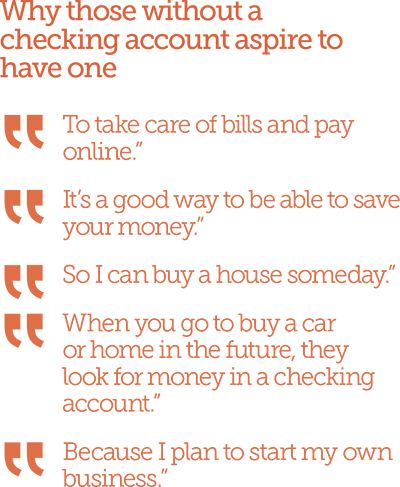

Yet, counterintuitively (again), most of the prepaid cardholders in the 41-percent group of those who have closed or lost their checking account, nevertheless want to have one again in the future. As the researchers say, this result suggests that they see benefits in having a traditional checking account.

Here is how the respondents themselves explain their desire to have a checking account once again:

Why Do People Use Prepaid Cards?

The Pew report reminds us of a previous FDIC research, which found that 68 million Americans either do not use traditional banking services at all or use at least one alternative financial product, such as a prepaid card. Furthermore, as already noted, approximately $65 billion was loaded onto prepaid cards in 2012, more than double the amount loaded in 2009.

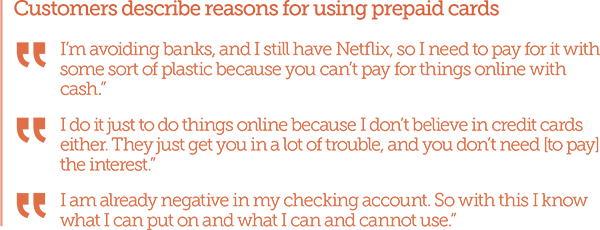

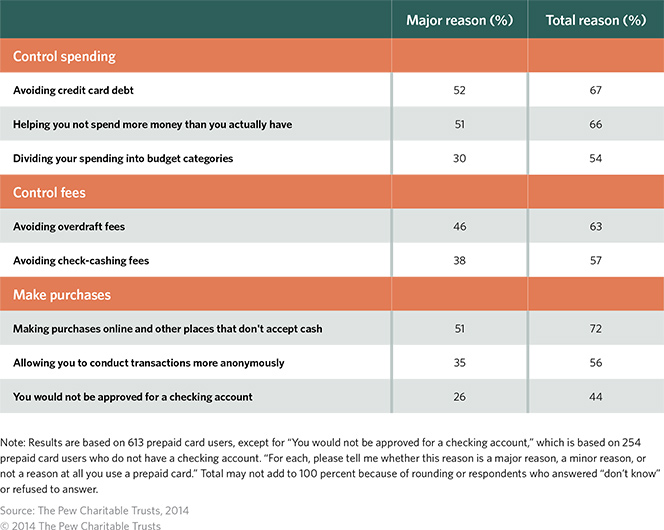

Pew’s survey finds that one clear reason for the shift toward prepaid is consumers’ need to make purchases online or where cash is not accepted. The report reveals that prepaid card users are trying to regain control of their financial lives, mostly by avoiding debt, fees and the possibility of spending beyond their means. Here is what prepaid users have to say on the matter:

Another reason why Americans use prepaid cards is to avoid carrying large amounts of cash. Pew has found that, at least in Los Angeles, households that primarily use cash are vulnerable to “cash loss, whether by theft, damage, or loss”.

What Do People Want in Prepaid Cards?

When asked whether or not they would like certain features to be added to their prepaid cards, two-thirds said they would want a feature that allows them to keep some of the card balance in savings. This, the researchers note, would be challenging, considering that the median prepaid card user reports household income of around $30,000, far below the U.S. median of approximately $51,000.

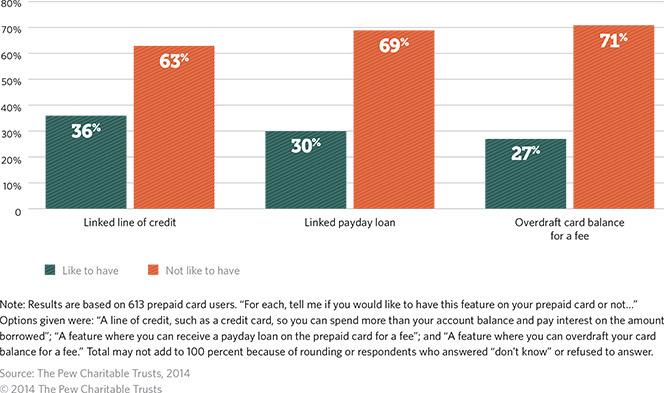

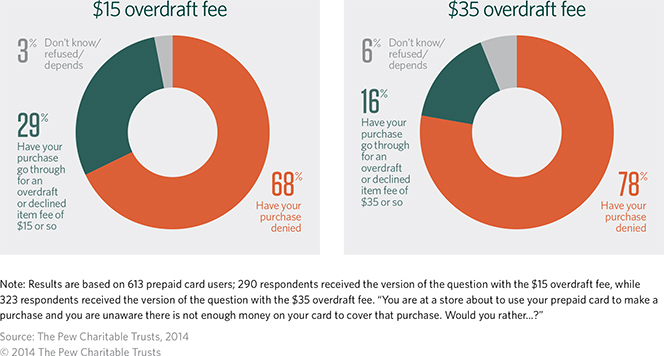

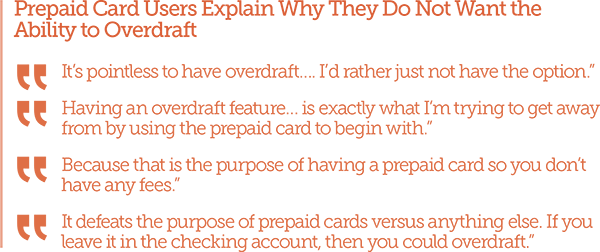

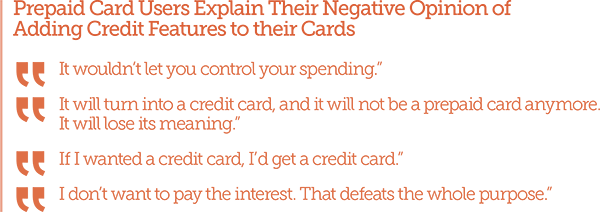

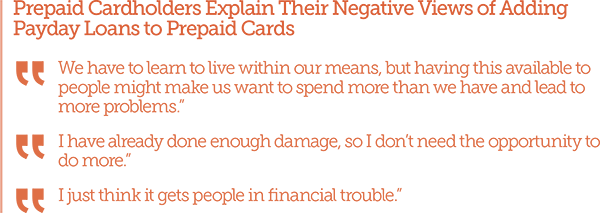

Unsurprisingly, consumers do not want overdraft or linked credit features, added to their prepaid cards. As we’ve already seen, avoiding overdraft fees and credit card debt are two of the primary reasons why consumers use prepaid cards in the first place, so it’s hardly surprising that they would reject the idea of adding fee-based overdraft protection, lines of credit and payday loan features to their prepaid accounts.

A large majority of prepaid card users would prefer to have their transactions declined.

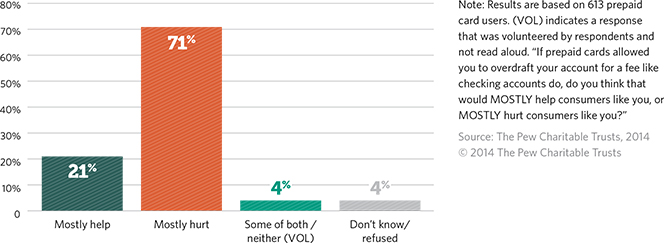

In general, respondents believe that allowing cardholders like themselves to overdraft their accounts for a fee would mostly hurt them.

Here are the reasons prepaid users themselves give for not wanting overdraft:

Although they would want to have a credit card one day, consumers don’t want it linked to their prepaid card:

Payday loans are also unpopular with users as potential prepaid card features:

So there you have it. People seem to like their prepaid cards mostly the way they are, but a bit more like checking accounts.

The Takeaway

Here is the report’s conclusion:

In sum, most prepaid customers are using the cards as a way to gain control over their finances. A large majority are using the cards to avoid debt and overspending, and most do not want features on the cards that will facilitate debt and overspending. These views indicate that prepaid card users recognize having lines of credit and overdraft features will undermine the control these cards provide. Policymakers have stated their intentions to extend consumer protections to prepaid cards.29 For these protections to succeed, it will be important to remember cardholders’ goals of limiting spending and fees and, instead, saving money for the future.

Image credit: Pewstates.org.