Why Are Ever More Americans Turning to Quick Cash?

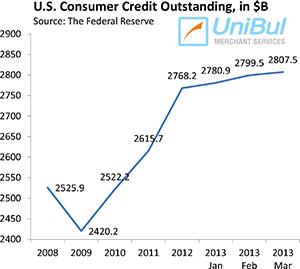

About 15 million Americans are taking out payday loans, pawn loans, deposit advance loans, auto title loans and non-bank installment loans every year and their number is growing, Rob Levy and Nick Bianchi from the Center for Financial Services Innovation remind us in a new paper. Tens of millions more use sub-prime credit cards, checking account overdrafts and other expensive types of credit. Why do Americans turn to such low-quality credit sources and are there better and cheaper alternatives?

To answer this question, the authors analyze the factors driving consumer demand for small-dollar credit (SDC) products and identify four distinct borrower profiles. These “need cases” differ in their ability to manage credit, the frequency with which they turn to SDC products and the types and amounts of small-cash loans they take out. What all of them can benefit from, the authors argue, is higher-quality SDC products, ones that would help borrowers “reduce cash flow shortages and help build emergency savings”. Unfortunately, the researchers don’t make any specific product recommendations, which, they say, is “beyond the scope of this report”. Still, it is an interesting paper and I thought I’d share its highlights with you.

Who Is Taking out Quick Cash and Why?

As already noted, the paper identifies four primary categories of consumers who take out small-dollar credit. Each of them represents a unique borrower profile and SDC usage pattern. Here are the main characteristics of each user profile:

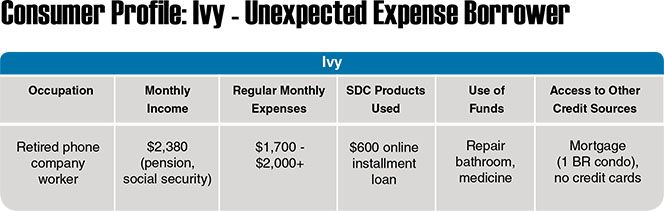

1. Unexpected Expense borrowers. These consumers take out small-dollar loans somewhat infrequently and for relatively larger amounts. Just about half (47 percent) of Unexpected Expense borrowers take out only one or two loans per year. They tend to use a wide range of SDC products, usually to pay for unexpected or emergency events (hence, the name), such as car repairs, medical bills, home repairs and helping family or friends.

Although they have a limited access to traditional forms of credit, a third (32 percent) of these borrowers have some savings at the time of taking out the SDC loan and more stable finances than the average borrower in the other groups. Here is how the Unexpected Expense borrower’s profile looks like:

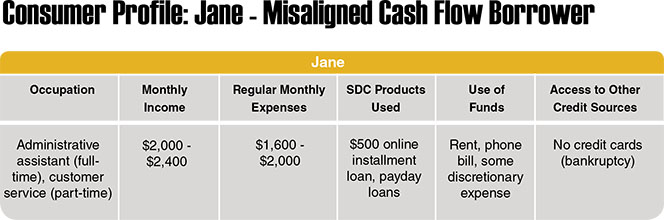

2. Misaligned Cash Flow borrowers. These consumers tend to frequently use small payday loans and other very short-term types of credit to pay utility bills, rent, and household expenses. They are among the most credit-dependent users. Four out of ten of these borrowers (42 percent) take out 6 or more loans per year and 16 percent of them take out more than 12 loans.

These borrowers’ cash flow shortages are recurring, but are usually short-term and may occur because borrowers have a low or variable income or financial management issues. Here is how their profile looks like:

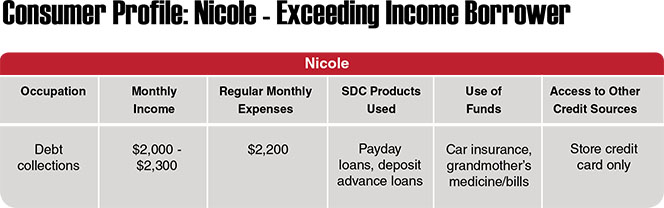

3. Exceeding Income borrowers. Consumers in this group have expenses that regularly exceed their income and are also among the heaviest users of small-dollar credit, which they are likely to use for everyday expenses, such as food and clothing. They tend to borrow the smallest loan amounts, with 77 percent of loans being under $500 and 30 percent — under $100.

These borrowers are most likely to use very short-term loans repeatedly and to roll them over from one month to the next. Here is their profile:

4. Planned Purchase borrowers. Unique among their fellow SDC users, these borrowers use small-dollar loans for relatively large, planned purchases, often related to a personal asset. Planned Purchase borrowers tend to use installment loans, typically to buy a car, make home repairs, buy furniture and appliances and cover small business expenses.

Although they are the least frequent borrowers, members of this group take out the largest loan amounts in the SDC market. Just over half (51 percent) of them take out only one or two loans a year and about as many (50 percent) borrow more than $1,000 per loan.

As a group, Planned Purchase borrowers are the most financially stable SDC users. They have the highest average household income levels and close to two-thirds of them (65 percent) have some savings at the time of the loan. Here is their profile:

How Are Borrowers Using Short-Term Loans?

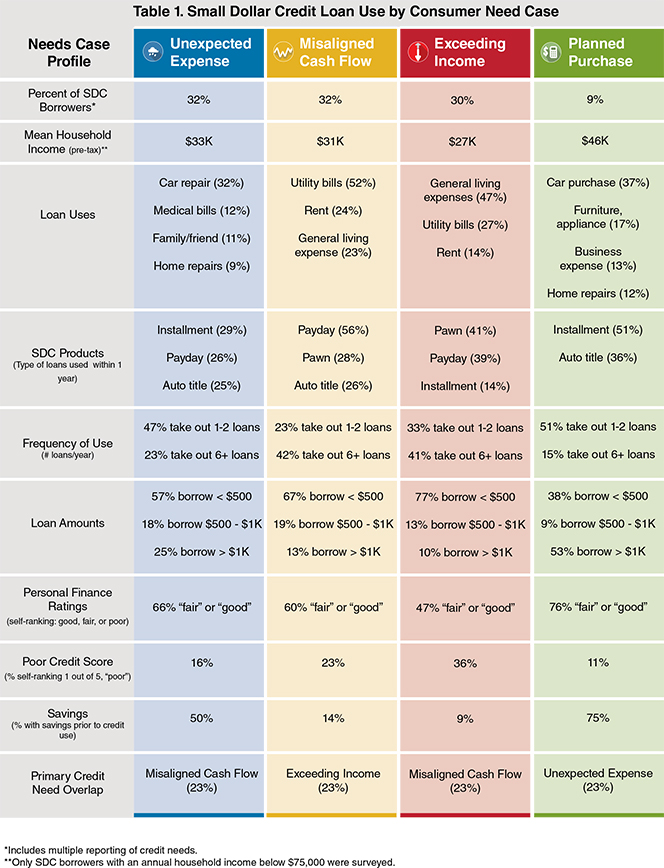

The table below gives us some more details about the four groups of borrowers and shows how they use their loans.

You can immediately see how different the “Planned Purchase” borrowers are, compared to the other three groups. They have a much higher income and personal finance rating and are much more likely to have savings at the time of the loan. That makes you wonder why they turn to SDC loans in the first place.

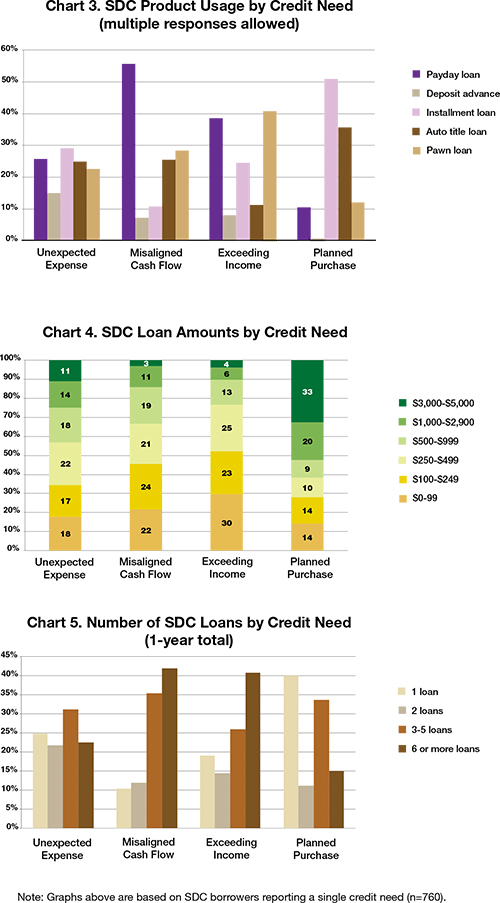

Now here is a series of charts breaking down the borrowers’ usage of short-term loans by type of product, loan amount and number of loans:

Once again, you can see that the Planned Purchase borrowers’ usage pattern stands out: they are the most infrequent SDC users and take out the biggest loans. Furthermore, they are least reliant on payday loans, deposit advances and pawn shops, favoring instead installment and auto title loans.

The Takeaway

Unfortunately, the researchers stop short of suggesting what such products might look like, instead producing the rather bland recommendation that the “small-dollar credit industry should continue to develop new consumer-focused products and related services, with an emphasis on serving consumers’ financial needs and promoting their financial health.”

Well, these are all admirable goals, but how do you achieve them and maintain lender profitability at the same time? After all, such products do exist in the traditional financial world, but are unavailable to the types of borrowers examined in this paper. And, if you ask the traditional lenders in question, they will tell you that there is a good reason for it.

Image credit: Flickr / Alan Stanton.