Americans Continue to Pay down Credit Card Debt

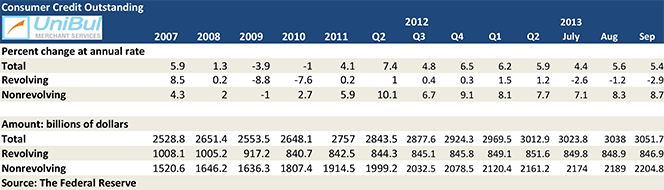

Americans added to the total amount of outstanding consumer debt yet again in September and, once again, the gain was larger than expected, the Federal Reserve told us in its latest consumer credit data release. This was also the 25th consecutive monthly increase. The total rose by $13.7 billion, following an upwardly revised $14.2 billion increase in August. For yet another month, the growth of the overall consumer debt total has been exclusively the result of the uninterrupted rise of its non-credit-card portion and, especially, of the auto and student loan totals, the former of which has been fueled by the continuing recovery in the housing and stock markets. But the latter has just kept expanding through crisis and recovery alike.

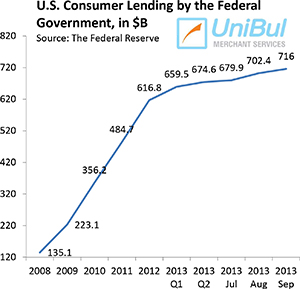

The growth of the federal student loan total had slowed down quite a bit since the beginning of this year, which has been good news, considering the sustained explosion it had experienced over the past decade, which naturally has led to a huge and ongoing spike in charge-off and delinquency rates. However, the slowdown came to an abrupt end in August and now September is reinforcing the previous month’s gains.

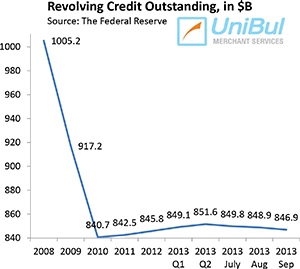

On the other hand, the credit card debt total fell again for its fourth consecutive monthly decline. Of course, that should come as surprise to no one who’s been paying attention, as both credit card delinquency and charge-off rates have long been into record-low territories and, amazingly, keep falling. For as long as that trend holds, credit card debt will not be an issue. It should be pointed out that, unlike the auto and student loan totals, the credit card total experienced a huge decline in the first couple of years after the financial meltdown of 2008 and has remained virtually flat since around the end of 2010. Now let’s take a look at the latest Fed data.

Credit Card Debt down 2.9% in September

The total amount of consumer revolving credit in the U.S., which is primarily made up of outstanding credit card balances, fell in September at a seasonally adjusted annual rate of 2.9 percent, or $2.1 billion, from the previous month’s level, after a 1.2 percent decline ($900 million) in August. As already noted, the Fed’s revolving credit total began its free fall in the immediate aftermath of Lehman’s collapse in September 2008 — a process that went on uninterruptedly until the end of 2010. Since then, however, it has bounced up and down, but has remained largely unchanged.

The total amount of consumer revolving credit in the U.S., which is primarily made up of outstanding credit card balances, fell in September at a seasonally adjusted annual rate of 2.9 percent, or $2.1 billion, from the previous month’s level, after a 1.2 percent decline ($900 million) in August. As already noted, the Fed’s revolving credit total began its free fall in the immediate aftermath of Lehman’s collapse in September 2008 — a process that went on uninterruptedly until the end of 2010. Since then, however, it has bounced up and down, but has remained largely unchanged.

The total for September — $846.9 billion — is just 0.74 percent, or $6.2 billion, above the total recorded at the end of 2010 ($840.7 billion) — at the height of the credit card debt deleveraging process. Moreover, the current total is lower by 15.7 percent, or $158.3 billion, than the all-time record-high of $1,005.2 billion reported at the end of 2008.

Non-Revolving Consumer Credit up 8.7%

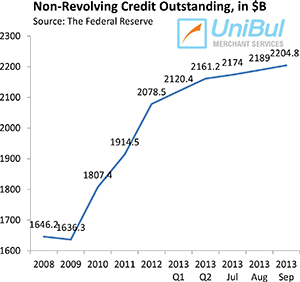

The non-revolving portion of the U.S. consumer debt total, a mixture of student loans, auto loans and loans for mobile homes, boats and trailers, but not including home mortgages and loans for other real estate-backed assets, continued its rise, in keeping with another long-standing trend. The Federal Reserve reported a $15.8 billion — or 8.7 percent — increase in September from August’s level, bringing the total up to $2,204.8 billion. That followed an upwardly revised 8.3 percent ($15 billion) increase in August.

The non-revolving portion of the U.S. consumer debt total, a mixture of student loans, auto loans and loans for mobile homes, boats and trailers, but not including home mortgages and loans for other real estate-backed assets, continued its rise, in keeping with another long-standing trend. The Federal Reserve reported a $15.8 billion — or 8.7 percent — increase in September from August’s level, bringing the total up to $2,204.8 billion. That followed an upwardly revised 8.3 percent ($15 billion) increase in August.

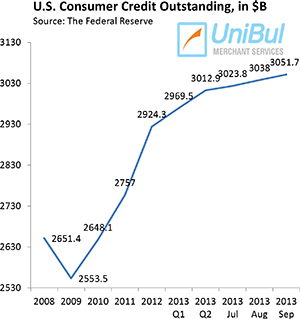

As you can see in the chart to the right, the non-revolving component of the total consumer debt didn’t fall nearly as steeply as the revolving one in the wake of the financial crisis and then it was much quicker to rebound.

In all, with the sole exception of August 2011 when it fell by 5.2 percent, the non-revolving debt total has risen in every month since July 2010. The figure for September of this year was higher by 36.3 percent, or $587.4 billion, than the pre-crisis peak of $1,617.4 billion, recorded more than five years earlier in July of 2008.

Student, Auto Loans Up

After a period of relatively slow growth from February through July, the federal student loan total rose considerably in the following two months. The Fed data tell us that lending to consumers by the federal government — which is primarily made up of educational loans — rose by $13.6 billion in September to $716.0 billion, following an upwardly revised $22.5 billion increase in August. The biggest increase this year occurred in January when that total grew by $25.9 billion. Overall, since the end of 2008, when it stood at only $135.1 billion, the total of outstanding federal government loans to American consumers has spiked by an astounding 430 percent, or $580.9 billion.

After a period of relatively slow growth from February through July, the federal student loan total rose considerably in the following two months. The Fed data tell us that lending to consumers by the federal government — which is primarily made up of educational loans — rose by $13.6 billion in September to $716.0 billion, following an upwardly revised $22.5 billion increase in August. The biggest increase this year occurred in January when that total grew by $25.9 billion. Overall, since the end of 2008, when it stood at only $135.1 billion, the total of outstanding federal government loans to American consumers has spiked by an astounding 430 percent, or $580.9 billion.

Buoyed by still-low, though slightly higher than in previous months, interest rates, cars and trucks continued to sell very well in September, at an annualized pace of 15.2 million, after a 16 million rate in August — the best showing since November 2007, according to Bloomberg.

Overall Consumer Credit up 5.4%

The total amount of outstanding U.S. consumer credit — the sum of its revolving and non-revolving portions — rose by 5.4 percent, or $13.7 billion, to $3,051.7 billion in September, mirroring the gains in the previous month. The numbers for August were revised slightly upwards, for a gain of 5.6 percent or 14.2 billion.

The total amount of outstanding U.S. consumer credit — the sum of its revolving and non-revolving portions — rose by 5.4 percent, or $13.7 billion, to $3,051.7 billion in September, mirroring the gains in the previous month. The numbers for August were revised slightly upwards, for a gain of 5.6 percent or 14.2 billion.

That new total is greater by $464.2 billion, or 17.9 percent, than the pre-Lehman record-high of $2,587.5 billion, recorded, once again, in July 2008. Almost the entire gain is the result of the rise in non-revolving debt, as the revolving portion has remained virtually flat for the period.

The Takeaway

So, even as Americans have continued taking out ever more auto loans and kept piling up student debt, they have remained obstinately reluctant to borrow more on their credit cards. And, looking at the latest data on credit card delinquencies and charge-offs, it seems as though we should expect more of the same in the months to come, as both credit card charge-off and delinquency rates remain in record-low territory.

The credit card delinquency rate in the U.S. remained virtually flat in September at 1.28 percent — a 25 percent decline on an annual basis, according to Fitch Ratings. At the same time, charge-offs fell to 3.12 percent — just two basis points above the all-time low and also 25 percent below the level of a year before. Furthermore, Fitch’s monthly payment rate (MPR) — measuring the portion of Americans’ total credit card debt they pay at the end of each month — stood at 25.29 percent, which is 17.5 percent above the level recorded in September 2012. As I’ve said previously, so long as the MPR remains at its current level or close, credit card debt will not be an issue.

Image credit: Flickr / StockMonkeys.com.