Why You Should not Use Dwolla Credit

As regular readers know well, at UniBul we’ve been very tough on Dwolla in the past. We’ve never liked the company’s business model, which revolves around charging low fees for peer-to-peer money transfers between the bank accounts of Dwolla users. As I’ve said many times before on this blog, Dwolla’s problem is that, cheap as its service may be, P2P money transfers have long been provided to consumers by the likes of PayPal, whose bank-to-bank transfers are free. Banks have also offered free intrabank transfers for a very long time and are now doing it on an interbank basis. However, whereas banks can afford to be doing it for free — for them it is merely a supplemental service — for Dwolla it is the main thing and the company has to charge something for it. So, would you want to be in Dwolla’s position?

Well, today I learn that the Des Moines-based company has launched a new credit program, which its founder and CEO characteristically talks up as though it were the best thing since sliced bread. Dwolla had found a way, we are told, to extend credit to the masses, to be used at participating merchants who would be charged the same low fees for accepting it as for Dwolla’s regular, cash-like payments. Yet, I am decidedly unconvinced that this is a good deal for consumers — quite the contrary. Let me explain.

Dwolla Credit

Yes, that’s how the company’s new service is called. But before I get going, I have to once again note how difficult it was to figure out exactly what was being offered here; in fact, I still don’t know exactly what it is. I had the same complaint when I first looked at Dwolla more than two years ago — it was impossible to get a clear picture of how the service worked. These guys are really stingy on details about their offerings and I wonder why.

Anyway, what we do know is that Dwolla Credit is a new payment option that is offered through a partnership with Alliance Data Retail Services and its banking subsidiary Comenity Capital Bank. Here is what one the press releases announcing the deal tells us:

The partnership will help the Dwolla network extend hundreds of millions of dollars in purchasing power, replacing traditional card transaction fees with Dwolla’s simple pricing structure of 25 cents per transaction or free, if $10 or less. The “cardless” credit product will provide approved consumers the ability to instantly access and spend advanced funds at qualified online businesses.

That’s it! If someone can figure out from that statement how Dwolla Credit works, and on what terms, please enlighten me and the rest of us. The remainder of the press release is full of typical PR tripe, such as the following statement from Dwolla’s CEO:

Credit is not new, but providing it on a real-time network that replaces interchange fees and positions credit to evolve is, and that’s what Dwolla Credit does… Dwolla Credit places millions of dollars in immediate buying power right at the fingertips of a network at a transaction cost that’s next to nothing and in a way that’s as simple as logging into your email.

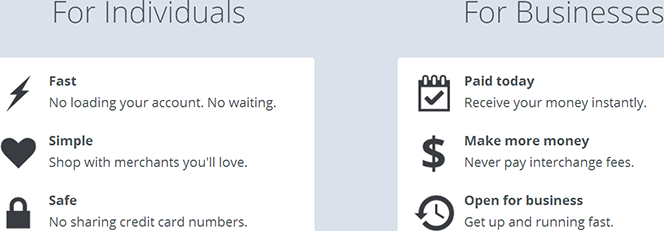

OK, but what are the financing terms for the consumers taking out the credit? What are the associated fees and interest rates? Would you take out a loan without knowing the answers to these questions? There are absolutely no details on Dwolla’s website either. What we are told instead is what you see below.

And here is the promotional video:

Why You Should not Use Dwolla Credit

As I don’t know how Dwolla Credit works, I am left with no other option but to speculate about it. So here is my educated guess. Alliance Data would almost certainly evaluate applicants using standard underwriting procedures and, upon approval, would make the credit line available for use through a master Dwolla account. That would be necessary in order to avoid paying interchange fees — Dwolla would be funding its users’ payments to participating merchants from its own account. That way, each user’s payment would, in effect, be a Dwolla-facilitated bank-to-bank transfer and so no interchange fees would apply.

One way of looking at the arrangement would be as a loan that Alliance Data is extending to Dwolla, to be accessed by Dwolla’s end users and used only through Dwolla’s payment network. So, an Alliance Data-funded Dwolla transaction could only take place when a borrower initiated a Dwolla payment on a merchant’s website. By definition, the merchant in question must have signed up for Dwolla and offer that payment option.

So, if my guesswork is correct, what do I think about the whole thing? Well, I am wholly unimpressed. Dwolla is offering a line of credit on unknown terms, which we can only use inside the company’s small network of merchants and we get no benefits for doing so. At the same time, I have in my pocket a credit card, of whose terms I am fully aware, which I can use anywhere and which gives me cash-back every time I use it. Now, I ask you, why should I use Dwolla’s credit instead?

The Takeaway

My guesswork could, of course, be all wrong and Dwolla’s new service could indeed be the best thing since sliced bread. But, if that is the case, why aren’t we told all about it? Why are we left guessing? I really have no sympathy for financial start-ups, which scream about how great their service is, rail against the way the incumbents do business, but treat their customers much worse than them. As far as I can tell, Dwolla fits squarely into that category.

Image credit: YouTube / Dwolla.

Speculate much?

They seem to be hyping it but you can’t even “get” access yet- do you really think anyone would apply for credit w/o knowing the terms? Isn’t it illegal for a publicly traded company to not disclose terms in the application? Why don’t you request access, and once you get in read the terms before this nonsense of speculation.

“Don’t try dwolla credit because I don’t have access for it yet so it *must* bad”

Not sure you saw but they also released dwolla.com/storefront that has about 40 merchants. Almost half of those merchants offer deals when using Dwolla. That seems to be like a benefit- one of them is giving as much as 20% more off if you use Dwolla on your first transactions. It’s not hard to see a slew of merchants pushing their users to use dwolla and dwolla credit as they would save money on that transaction in the long term. I see subscription services liking dwolla credit bc there are lower fees and, if I understand it correctly, there is no expiration date bc there is no card.

Anyways, you also seem to not understand Dwolla and what they are trying to do. From my understanding they are trying to do two things: Become the next big payment network (after MasterCard, Visa, American Express, Discover) as well as build an ACH replacement that moves money in real-time (whether it is a business day or not). These are two really hard things to do and we all should commend them for going after that.

It also seems that on payment network side of things- ACH is only a mechanism to get money into Dwolla cheaply. That’s why they don’t have credit cards, it cost too much money to get money from Credit Cards to Dwolla (or anywhere else). So Dwolla is a glorified ACH, but as a means to an end. The problem is though that while ACH is cheap, it is crazy slow and old. From their blog post and the TechCrunch article- it seems that they built Dwolla Credit to speed up getting money in the network, and according to them it is free to use dwolla credit (but I’m sure there is a cost if you roll over or don’t pay back on time). But this solves their biggest problem of getting money in (so they can build a real competitor to Mastercard, Visa).

I will end this rant by saying that I used to use Dwolla for bitcoin- haven’t used it since they cut off BTC and I’m not saying I will use Dwolla credit, but I felt compelled to comment on this article bc it was speculation at its worst- not understanding.

Hey,

Is that how you evaluate the terms of a loan in the real world: “request access, and once you get in read the terms”? Really? If any mainstream lender did that — anyone — they would be crucified, and rightly so. Why should Dwolla be held to a different standard?

Maybe because it is in beta? Maybe you also didn’t request access?

But I did and all it says is we will let you know when you have the ability to apply. I didn’t have to give any information or anything. I am sure once I get the ability to apply (like every other mainstream lender) I will know ALL OF THE TERMS BEFORE I APPLY. All this is doing is giving Dwolla the ability to gauge demand of how many people want in- they aren’t asking for anything except for either my email (to email me when I CAN see what the deal is) or for me to log in with an already existing dwollla account. Can you explain me the downside?

Man, and also why ignore the rest of my comment? No response? Doesn’t jive with your agenda?

maybe the better question is- what do you think “request access” actually means? Bc where I am sitting it sounds like you think you are actually applying for something- which this is not.

Booooom! Uni got dunked on!

For what it is worth, you are totally wrong.. PayPal does NOT offer an ACH solution for companies..