U.S. Credit Card Delinquency, Default, Repayment Rates Set New Records

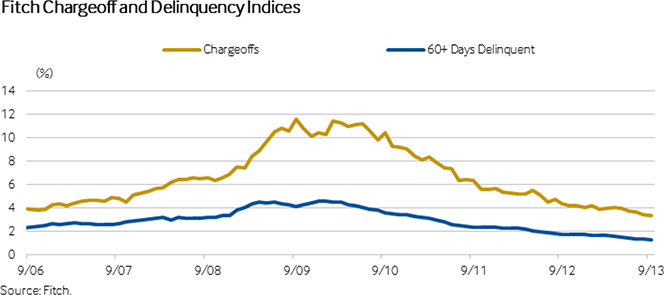

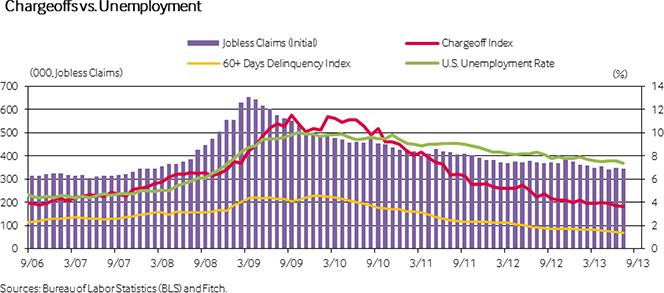

The charge-off rate on U.S. consumer credit cards continued its free fall throughout the third quarter of this year, in line with expectations, according to the latest data (registration required) released by Fitch Ratings — a credit ratings agency. The 60-day credit card delinquency rate also kept falling in the second trimester of the year, we learn, and both indices have reached new record-lows in the process.

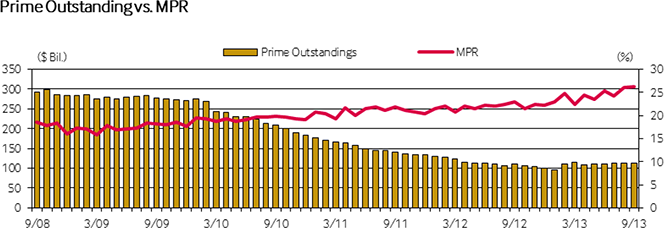

The credit card monthly payment rate (MPR) — this blogger’s favorite index for predicting future default and delinquency movements — rose for a fourth consecutive quarter, setting yet another quarterly record-high average along the way. And at the end of September, the MPR was much higher than the average for the quarter. It is truly amazing to watch how, five years after Lehman’s collapse set off the consumer credit card debt deleveraging process, Americans are not just maintaining credit card debt repayment discipline, but continually improving it, setting new records almost every month as they go. Let’s take a closer look at the latest quarterly data.

Credit Card Charge-offs down to 3.44%

The credit card charge-off rate continued to slide throughout the third quarter of this year, reaching 3.33 percent in September — the lowest point in seven years, Fitch tells us. The average for the trimester was 3.44 percent, down from 3.87 percent in the preceding quarter. The quarterly average is lower by 23 percent than the average of 4.49 percent for the third quarter of last year and 69 percent below the peak recorded in 2009. Fitch expects that charge-offs will remain at historically low levels throughout the rest of the year.

Charge-offs (defaults) are receivables, which lenders deem uncollectable. Fitch calculates its charge-off rate as a ratio of all individual credit card accounts with outstanding balances, which a card issuer no longer expect to be repaid by its cardholders, in relation to the total number of active accounts in that lender’s portfolio. Charge-offs occur either through contractual delinquencies or through a bankruptcy of the borrower, the ratings agency reminds us, and are written off of the lender’s books as losses, usually at 180 days after the last payment on the account has been posted or at 60 days after a notification of the bankruptcy has been received.

Credit Card Delinquencies Fall to 1.30%

Credit card delinquencies fell for a seventh consecutive quarter in the third trimester, Fitch tells us. Moreover, in September, the index decreased for a ninth month in a row, we learn. Consequently, the new quarterly average — 1.30 percent — is a new record-low. That was down from an average of 1.48 percent in the previous quarter and was lower by 26 percent than the rate recorded in the third quarter of last year.

Fitch’s delinquency rate is calculated as a ratio of the credit card accounts on which payments are overdue by 60 days or more, in relation to the total number of active accounts. Delinquencies are an important early indicator of charge-offs, as a large proportion of these occur further down the line through contractual delinquencies (the rest, as noted above, are the result of bankruptcies).

Monthly Payment Rate up to 25.50%

My favorite early guide to the future trends of both the credit card delinquency and charge-off rates remains the monthly payment rate (MPR). The MPR is calculated as the ratio of the total amount of credit card debt, which American cardholders are repaying at the end of each monthly cycle — payments applied to the principal, as well as finance charges and fees — in relation to the total outstanding balance at the beginning of the month.

During the third quarter of this year, the MPR averaged 25.50 percent, up from 24.43 percent in the previous trimester, and the highest quarterly average ever recorded. Even more impressively, the MPR ended the quarter at 26.27 percent — the highest monthly ratio ever measured since Fitch’s Prime Credit Card Index was launched in 1991. To get a sense of just how much higher credit card debt repayment now is on Americans’ financial priority list, consider that historically the MPR has hovered in the mid-teens.

The Takeaway

Fitch’s latest quarterly report gives us yet another strong indication that the post-Lehman credit card debt deleveraging craze is still very much under way. Fitch Managing Director Michael Dean explains it with the type of consumers to whom card issuers are now lending:

Credit card debt borrowers are of overall higher-quality and are steadily making on-time payments, as the record high MPR seems to indicate.

Naturally then, “[t]here appears to be no stop in sight for falling credit card ABS delinquencies”, he adds. And I agree: for as long as the MPR keeps rising, credit card delinquencies will keep falling. Of course, there is a floor to the late payments rate — called zero — and we are inching ever closer to it, but there is still some room left for improvement.

Image credit: Flickr / Normann Copenhagen.