The Evils of Credit Cards, Turkish Edition

Having finally managed to crush popular unrest over a development plan in a public park in his country’s biggest city, Turkish Prime Minister Recep Tayyip Erdogan has lost no time identifying a brand new and a far more nefarious enemy — the “interest-rate lobby” which seeks to destabilize the country just so it could make some profit, The Wall Street Journal’s Emre Peker reports. And credit card companies are Mr. Erdogan’s primary targets.

Peker tells us that the Prime Minister’s new foe is being made a scapegoat “for everything ranging from a sell-off in markets to the political unrest”. It is a fascinating development in a country which, according to figures cited by Peker, is clearly living beyond its means. Well, as I had never before even looked into Turkey’s credit card statistics, I thought Mr. Erdogan’s latest antics gave me the perfect excuse to do so and thought I’d share my findings with you.

Turkey’s Credit Card Explosion

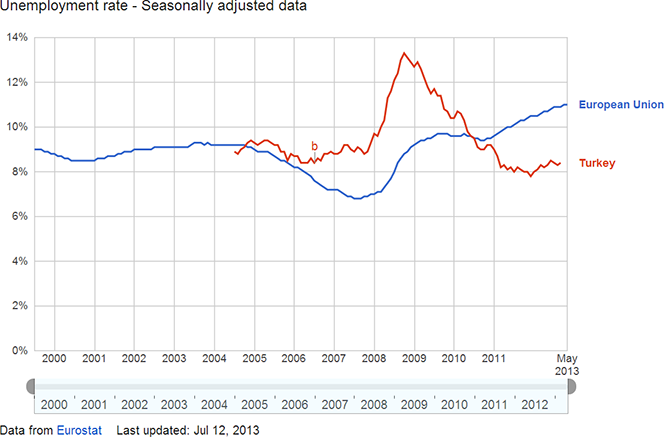

It turns out that Turkey has indeed experienced a credit card boom, much as you would have expected to see in a country whose gross domestic product (GDP) has grown by 64 percent in real terms in the decade after Mr. Erdogan came to power in 2002. On a per-capita basis, GDP has grown by 43 percent for the period. Moreover, at 8.4 percent (as of March of this year), the country’s unemployment rate is now lower than it was in the years immediately preceding the financial crisis of 2008 and it is 2.5 percent lower than the European Union average.

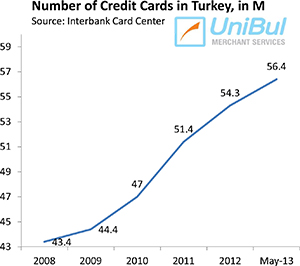

Feeling richer than ever before, and having an easier access to credit than ever before, the Turkish citizens started opening up new credit cards at an unprecedented rate. Between 2008 and 2012, the number of active credit cards in the county had risen from 43.4 million to 54.3 million — an increase of 25 percent — and as of May of this year it stands at 56.4 million.

Feeling richer than ever before, and having an easier access to credit than ever before, the Turkish citizens started opening up new credit cards at an unprecedented rate. Between 2008 and 2012, the number of active credit cards in the county had risen from 43.4 million to 54.3 million — an increase of 25 percent — and as of May of this year it stands at 56.4 million.

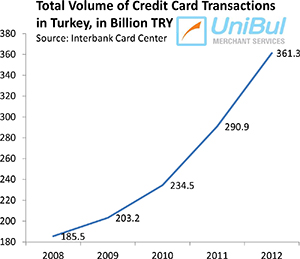

According to the Interbank Card Center’s latest data, the total amount of credit card transactions in 2012 was TRY (Turkish Lira) 361.3 billion ($188 billion), up from TRY185.5 billion ($96.5 billion) in 2008, a growth of 95 percent. In the first five months of 2013 the volume was TRY168.2 billion ($87.5 billion), so it looks as though we may well have another record at the end of this year.

of 95 percent. In the first five months of 2013 the volume was TRY168.2 billion ($87.5 billion), so it looks as though we may well have another record at the end of this year.

On a per-card basis, the average annual transaction volume has also increased substantially, from TRY4,562 ($2,373) in 2008 to TRY6,805 ($3,540) in 2012.

Attacking the “Interest Rate Lobby”

So there has indeed been a credit card boom in Turkey and when that happens, it is inevitable that some borrowers will overextend themselves (I have no data on the country’s overall charge-off and delinquency rates). Presumably, it is horror stories involving such consumers that has set off the Prime Minister to inveigh against the “shadowy cabal of investors, economists and journalists”, as Peker puts it. Here is a taste of Mr. Erdogan’s feelings toward the “interest-rate lobby”:

Interest-rate lobby, set yourself in order. For years you have exploited the sweat of my nation. No more… Those who tried to crash the stock market without any shame: Tayyip Erdogan doesn’t have money in the stock market, it will be you who will crash.

But the Prime Minister isn’t content with just threatening the “interest-rate lobby”. He goes on to exhort his countrymen to stay away from the wicked plastic rectangles:

It’s not for nothing that I recently mentioned the interest-rate lobby… and there’s also a lobby that prospers with non-interest gains. Those credit cards you keep talking about, don’t get them… Who’s footing the bill? Not the rich but my poor brothers.

Precisely how Mr. Erdogan’s poor brothers are footing their rich compatriots’ credit card bills isn’t specified but it does make for great theater. Of course, a Mr. Erdogan’s initiative would not be complete without an invocation of a higher power and a reference to a global conspiracy, which is why we get this:

May God give them salvation, they love getting their hands on a credit card, as if that will let them show off… Then the salary is spent before month’s end, there is interest payments, etc. This is a big game being played [on Turkey], we need to get together and disrupt it. If everyone can learn cut one’s coat according to one’s cloth, they [the interest rate lobby and credit card issuers] won’t see this money.

Yet, even as Mr. Erdogan is inveighing against the “interest-rate lobby”, his country’s fiscal position is becoming ever more precarious. Citing figures released by Turkey’s central bank, Peker reports that the country’s international debt stock due in one year has climbed to $163 billion in May and short-term debt is up by about 25 percent since the end of last year. Current-account deficit has climbed in May to an eight-month high of $53.6 billion — 6.8 percent of GDP. Short-term foreign-funding needs are expected to hit 7.5 percent of GDP by the end of the year, according to a central bank survey (according to Peker, “economists say” that 5 percent is the maximum level Turkey can afford). Furthermore, Turkey’s foreign liabilities are currently at about $220 billion, or about 28 percent of GDP — “a huge number, relative to the size of the economy”, according to an economist cited by Peker.

The Takeaway

So is Mr. Erdogan’s attack on the “interest-rate lobby” just a ruse designed to divert peoples’ attention from the brutal crackdown on the Taksim Gezi Park protesters and from the real issues facing Turkey’s economy? Perhaps. But it is also possible that the Prime Minister has genuinely strong feelings against charging interest rates on loans. After all, Mr. Erdogan is a devout Muslim and Islam prohibits the payment of interest. Of course, if that were the case, the Prime Minister’s religious scruples clearly have no bearing on the management of government affairs. In any case, this whole thing is hugely entertaining for those of us who don’t live in Turkey.

Image credit: Wikimedia Commons.