What Is Driving the Student Debt Increase?

A student debt crisis has been brewing in the U.S., even as we are still struggling to dig ourselves out of the wreckage of the financial one that struck in September of 2008. It is really not that difficult to see it coming, as the statistics are striking. For example, as Joseph Stiglitz reminded us recently, the student debt of seniors graduating with loans now totals more than $26,000, 40 percent above the level of just seven years ago (not adjusted for inflation). Moreover, according to the Federal Reserve Bank of New York, about 13 percent of student-loan borrowers of now owe more than $50,000, and close to 4 percent owe more than $100,000. As Stiglitz pointed out, persistently high unemployment and stagnant wage growth make these debts impossible to repay, as demonstrated by the rising delinquency and default rates.

Even more worryingly, as a new study by The Hamilton Project points out, the volume of student debt is rising much faster than the increase in the average net tuition — the actual cost to students after grant aid, scholarships, and other financial aid. The researchers — Michael Greenstone and Adam Looney — examine the possible reasons for the discrepancy and I thought I’d share their findings with you.

Student Debt Rising in Step with Delinquencies

Close to a fifth of American households owed student debt in 2010, the researchers remind us, and the share was twice as high (40 percent) for households headed by a person younger than thirty-five. Overall, as seen in the graph below, from 2002 to 2012 the volume of student loans grew by 77 percent. On a per-full-time student basis, the increase during that period was nearly 60 percent, to over $5,500. As you can see, the trajectory of student loan delinquencies had closely followed the one of the student loan total until sometime in 2011 when the student loan total began to slowly decrease, but the delinquencies kept rising.

The chart shows that the share of the national student loan balance past due by ninety days or more has risen by 4 percent over the past decade — from around 6 percent to over 10 percent. Similarly, the share of student loan borrowers whose are delinquent on their payments by ninety days or more has increased from under 10 percent in 2004 to about 18 percent in 2012. The researchers explain the rise in delinquencies partly with the rise in the unemployment rate — not having a job makes it harder to pay back one’s debts — and I don’t think anyone would argue with that. Yet, it seems to me that a major contributing factor must be the fact that the increase of the tuition cost has been outstripping the wage growth since well below the Great Recession began.

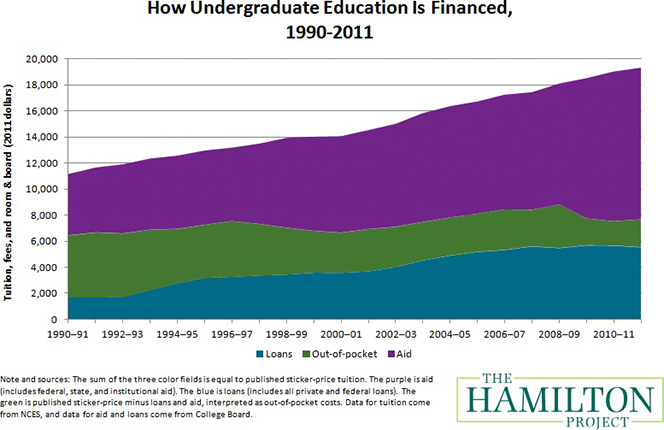

Financing Higher Education

Over the past decade, net tuition — the price that a student actually pays after financial aid is discounted from the total — has increased at a much lower rate that the “sticker price” of attending college. The researchers give the example of public four-year colleges whose net in-state tuition and fees have increased by an average of $1,420 since 2002 — less than half of the increase in the published rate of $3,450. The corresponding numbers for private four-year colleges are $230 and $6,090. Overall, average net tuition has increased by 8 percent for the period — far below the 77 percent increase in the student debt total. Nor can the rise of student debt be attributed solely to higher student enrollment, which has only increased by 27 percent since 2002.

Well, the graph below breaks down public tuition into aid, federal and non-federal loans, and the remainder — out-of-pocket costs. As you see, the only component that has shrunk since 2002 (in fact the trend began long before that) is the out-of-pocket expenditures. You can also see that an ever increasing share of the net tuition (excluding aid) is being financed by loans. The researchers tell us that the loans’ share of the net tuition costs has increased from 54 percent (about $3,600) in 2000 to nearly 75 percent ($5,500).

How to account for the rising share of loans in the financing of net tuition? The researchers offer the following possibilities:

- The Great Recession, which reduced family income and assets, may have left families with fewer resources available to pay directly for college and may have lead to greater reliance on student loans.

- The sharp contraction in the availability of many other forms of credit during and after the financial crisis—from personal loans to second mortgages—made it more difficult to borrow from traditional sources and therefore may have encouraged families to rely more on student loans instead of other means of borrowing.

- Student loans may have become relatively more available because of changes in the laws protecting creditors, which may have encouraged lenders to offer loans to a broader set of less creditworthy borrowers.

- The increase in enrollment in for-profit colleges, whose students rely more on federal aid and student loans, may have shifted the composition of students toward groups more likely to take out student loans.

- Changes in the composition of the student body more generally, such as an increase in enrollment of students from lower- or middle-income households may have increased the proportion of students taking out loans.

I find these possibilities mostly plausible, with the exception of the third one. Borrowers could not discharge student loans in bankruptcies since long before the period examined in the study and I can’t think of a recently enacted law that may have any relevance on the issue. On the other hand, as we’ve discussed on this blog many times before, it is true that it has been a government policy to give student loans to everyone who wants them, irrespective of the debtors’ ability to repay them. Considering that 85 percent of the outstanding student debt is owed to various government-funded programs, isn’t that a very good candidate to account for the rising share of loans in net tuition financing?

The Takeaway

Whatever is driving the rise in student debt, it is a huge burden on borrowers and especially on those unable to find a job. Yet, as we’ve argued before, the alternative is worse and our assertion is supported by some employment data cited in The Hamilton Project paper:

In April 2013, the unemployment rate for individuals twenty-five and older without a high school diploma was over 11 percent, but below 4 percent for those with a college degree. Indeed, because of the vast differences in job opportunities between high school graduates and college graduates, the rate of return to college exceeds 15 percent—far higher than comparable returns on other assets.

Given these numbers, it seems pretty clear to me that demand for student loans is bound to keep rising, at least until the economy is fully recovered and the unemployment rate is back down to more normal levels. Until those normal economic times return, it is also likely that the loan-financed portion of the net tuition will keep expanding, as the share of the out-of-pocket expenditures keeps shrinking. For how long the government will allow this to go on is anyone’s guess.

Image credit: Flickr / thisisbossi.