College Graduates Take on Ever More Student Debt, but the Alternative Is Worse

That is one of the main conclusions of a report just released by the Senate’s Joint Economic Committee which looks into the causes and consequences of the rising student debt in the U.S. The statistic that jumped out at me the most was that, as of the first quarter of this year, workers with a bachelor’s degree earned 68 percent more than workers with only a high school diploma. The authors are quick to add that the higher levels of debt incurred to obtain that bachelor’s degree will still negatively impact graduates and their families, but it seems overwhelmingly clear to me that the alternative is not worth contemplating.

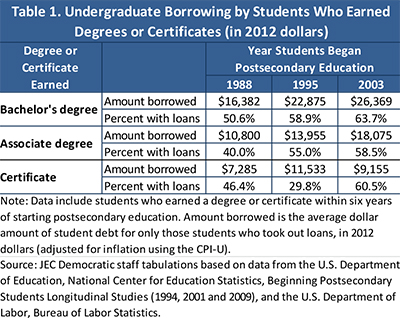

However, student debt is nevertheless a huge issue and, as the Senate report is only the latest one to make abundantly clear, the cost of college education is rising at an alarming rate. The authors use the cost of obtaining a bachelor’s degree as a case in point. Among Americans who earned a bachelor’s degree, we learn, individuals who started their college education in 1988 accumulated $16,400 in student loan debt, on average. By 1995, that total had risen to $22,900, an increase of 40 percent. For individuals who started their college education in 2003, the total debt at graduation had risen to $26,300, an increase of 60 percent over 1988’s total. So let’s take a closer look at the report.

Two-Thirds of College Graduates Have Student Debt

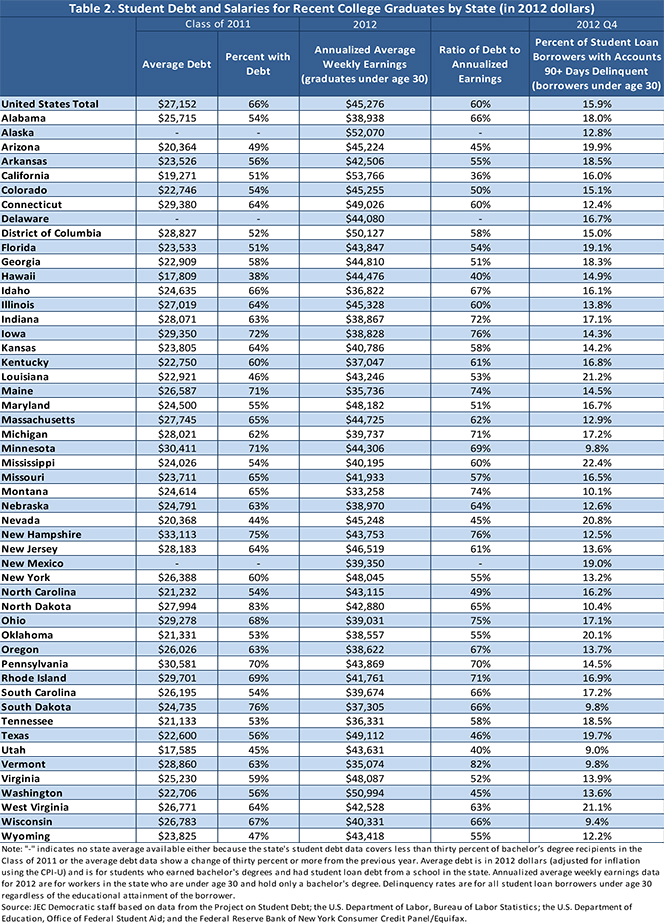

Over the past decade, both the number of student loan borrowers and their average debt total at graduation have risen. Two-thirds of graduates of the class of 2011 carried student debt, with an average balance of $27,152, which is 60 percent of the annualized weekly earnings of young graduates, we learn.

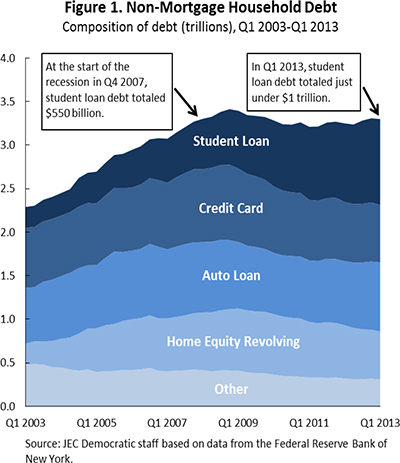

Student debt, the authors remind us, is the only type of consumer debt that continued to rise throughout the recent recession and the subsequent recovery, and did so at an incredibly high rate, increasing from $550 billion at the start of the recession to about $1 trillion at the beginning of this year (see chart below).

Tuition at Public Universities up by 114% Since 2000

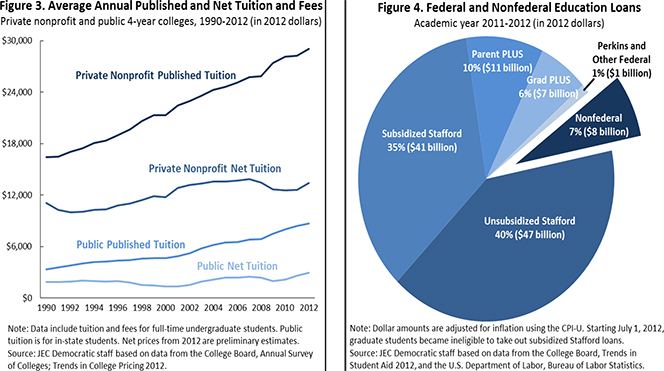

The average in-state tuition at public 4-year universities has risen by 86 percent between 2000 and 2012, from $4,650 to $8,660, we learn, while the average net tuition at these universities, which excludes grants and scholarships, has increased by 114 percent for the period. As Figure 3 below shows, the in-state tuition at private non-profit 4-year universities has risen much less quickly during the same period — by 36 percent (from $21,310 to $29,060) — and the net tuition has increased even more modestly — by 14 percent.

Lending by the federal government — through its various programs — is responsible for the lion’s share of the student loan total — 93 percent ($107 billion) for the academic year 2011 – 2012, as Figure 4 above shows. The remaining seven percent of student loans come from private lenders (banks, credit unions and Sallie Mae).

More Students Take out Loans

Both the number of students taking out student loans and the average amount of these loans have been rising in step with the increasing tuition cost over the past 25 years, as shown in the table below.

College-Educated Americans Earn Much More than Those without a Degree

The most staggering comparison in the report, I think, is the one of the earnings of college-educated and high-school-educated workers. As of the first quarter of this year, American workers with a bachelor’s degree earned 68 percent more than workers with only a high-school education — $1,095 per week vs. $651 per week. The authors issue the following warning:

A high student debt burden may influence the educational, career and life choices of students. Graduates saddled with student loans may feel constrained about the types of jobs they can accept, avoiding lower-paying jobs in teaching, the arts or public service, and instead opting for higher-paying jobs.

Well, I, for one, fail to see why choosing a higher-paying job would be an unwelcome side-effect of education — whether expensively obtained or otherwise. Rather than shaming graduates into accepting lower-paying jobs, wouldn’t it be better to make teachers’ salaries more competitive to what the private sector has to offer to workers with comparable skills? Of course, pay packages are only part of the issue here and I am not going to go any deeper into it, but it seems to me that this is one area into which you can never invest enough.

The Takeaway

This report clearly shows that workers with higher levels of education have experienced faster wage growth and lower unemployment rates than less well educated workers. So getting Americans to go to college and obtain a higher education degree is obviously a sensible thing to do. Yet, as the authors repeatedly point out, and as we have documented in many blog posts before, quickly rising student debt is a huge concern. However, all the authors can suggest as a way of dealing with the problem is for Congress to take “actions to ensure that graduates do not leave college with overwhelming debt burdens”. Could they have been any more timid?

Finally, here is a state-by-state comparison of the levels of student debt and salaries for recent college graduates in the U.S.

Image credit: Wikimedia Commons.