Getting Around the Money Laundering Roadblock

The Liberty Reserve shutdown last week was merely a cause for annoyance for the cybercriminals who were relying on its digital currency exchange service, but not a major setback, the BBC’s Paul Rubens reports this morning in a long and excellent piece. Yes, the exchange’s users, virtually all of whom were criminals, according to the New York District Attorney’s indictment, did lose quite a bit of money, but they would have figured out another channel for laundering the proceeds of their activities “within twenty-four hours”, we are told.

So does the Liberty Reserve takedown count for nothing? Will there always be another payment system able to pick up the slack when a competitor is taken out? Well, that is precisely what the experts Rubens has talked to are telling us, all of them. But I have my doubts. See, in Liberty Reserve’s case, the exchange’s executives are likely to spend quite a bit of time in jail, in addition to having their assets seized, which will surely make people who contemplate replicating their business model think hard before doing it. To me, the most striking feature of Liberty Reserve’s story is just how openly the exchange was being operated — it is as if these guys really believed that they would never be caught. In any case, as Rubens reports, that is precisely what their users believed. Well, this is a perception that will now surely change.

A Shock to the System

Liberty Reserve, Rubens tells us, was the preferred payment system for many criminals, because it was “based outside the United States and Russia” and so presumably it was beyond the reach of these two countries’ law enforcement authorities. Well, I find this kind of thinking slightly amusing, as apparently did said authorities. In the words of one cybercrime expert quoted by Rubens, named “The Grugq” and believed to act as an intermediary between hackers and U.S. and European governmental agencies:

I would be confident that some people had tens or even hundreds of thousands of dollars in their accounts that have now vanished, and people I know that are involved in law enforcement find this highly amusing.

The criminals, adds The Grugq, simply did not believe that such a thing could happen:

This all came as a huge shock to them. I have never seen anyone being cautious about using Liberty Reserve, no-one ever worried that it wouldn’t be around for ever.

“Never seen anyone being cautious”! What were these guys thinking?! I mean, they must have known what the authorities thought about them. In any case, now they do — the U.S. prosecutors who filed the indictment told us that Liberty Reserve’s users are criminals who use the exchange “for distributing, storing, and laundering the proceeds of their criminal activity”. So one would have expected them to be a bit more concerned with law enforcement actions. Instead, another expert quoted in Rubens’ piece tells us, for Liberty Reserve users, the “biggest risk was always believed not to be that a payment system would be taken down, but that transactions would be investigated”. Well, the transactions are now being investigated, so I guess the criminals’ can take comfort in the fact that their fears proved justified; or maybe not, as I suspect that the funds that have been seized may be of greater importance to them, after all.

The Road Ahead

So now that Liberty Reserve has been closed down, where does that leave us? Here is how The Grugq sees it:

This is not a major setback for cybercriminals, it’s more of an irritant, albeit a very annoying one.

But I have no doubt that within twenty-four hours most of them figured out another way of getting money from point A to point B. There is a lot of money and a lot of people involved in all this, and if you take out one part of the system they use they will adapt very quickly indeed.

But what are the alternatives? Rubens tells us that there is another major money exchange — WebMoney — which some believe to be “emerging as the favoured replacement”. However, there is a major issue with WebMoney — it is rumored to be monitored by the FSB (the Russian Federal Security Service) and so “people are paranoid about using it”. With WebMoney out of the question, The Grugq expects criminals to focus their attention on Bitcoin, but there is an issue there, too:

Bitcoin’s weak points are the fact that its value fluctuates wildly, and that online exchanges which trade coins for cash anonymously could be regulated or shut down.

And that begins to be happening, as U.S. authorities are now applying money laundering rules to virtual currencies such as Bitcoin and the Department of Homeland Security has launched an investigation of Mt. Gox — Bitcoin’s biggest exchange — and served a warrant upon Dwolla — a mobile payment processor — with respect to accounts used for trading with the exchange, in effect freezing the accounts.

There is another, low-tech option, described by The Grugq:

In Thailand there is a guy called Stanislaw who takes 9% commission, and for that he will deliver cash to your door or provide a wire transfer.

In Malaysia I know of a man who will convert your web currency and send it by Western Union anywhere in the world for 9%, and I have no doubt that in the UK there is a Russian immigrant who will provide the same service.

Well, there may well be people doing that, but I just can’t see how such a scheme can be operated on a large enough scale to accommodate all of Liberty Reserve’s ex-users and still fly under the radars of the various authorities charged with policing such things. As The Grugq observes:

It can be very difficult finding someone who has liquid cash in non-trivial amounts.

Indeed, which is why another expert claims that “cybercriminals expect to pay commissions of up to 40% to have “dirty” money laundered”.

The Takeaway

So the Liberty Reserve shutdown is indeed a big deal for the operators of such exchanges and for criminals in need of money laundering services. Yes, there are other payment systems which operate in a similar fashion, but they are much smaller and their owners will now be much more likely to clean their act and concern themselves with the legality of the transactions being processed on their systems, lest they have their businesses shut down and find themselves in jail. And that would make life much more difficult for the money launderers.

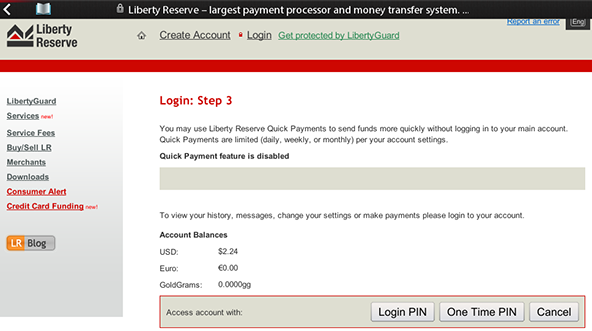

Image credit: Liberty Reserve.