You Can Now Turn Auto Loans into Credit Card Debt, but Should You?

Credit card comparison website CardHub.com has recently published a study on a very interesting topic: the conversion of non-revolving debt — auto loans, student loans, business loans and even mortgages — into credit card debt. I have to admit that I wasn’t even aware that such an option existed, but then the CardHub.com guys explicitly state that their “study will strive to close that knowledge gap by bringing clarity” to the issue for the benefit of people like me.

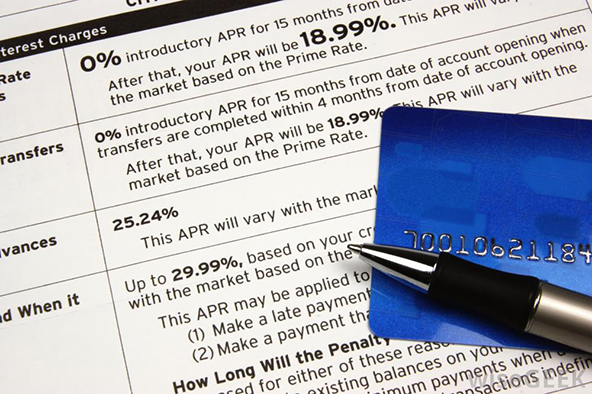

To a consumer, the most obvious benefit of such a transaction is the savings on interest payments, provided the non-revolving debt is transferred to a credit card with a zero-percent introductory interest rate. And today there are introductory rates that last for 18 months and I’ve even received offers from Citi where that period was extended to 21 months. Moreover, such a transfer converts a collateralized type of debt into an unsecured one, so that if you use your credit card to pay off your auto loan or mortgage, you won’t have to worry about your car or house being repossessed in the case of default. But there are also downsides to such a deal, the most obvious being that, once your card’s introductory APR expires, the regular one will be in the double digits — a far higher interest rate than what you are likely to be paying on either your mortgage or car loan. So should you be doing such transfers? Well, it depends.

Most Issuers Allow Transfers of Non-Revolving Debt to Credit Cards

CardHub.com has surveyed eleven issuers and has found that seven of them, including Capital One, Citi and Wells Fargo, allow you to transfer most types of consumer debt, including mortgages, auto loans, small business loans and student loans, to credit cards. Among the big issuers, American Express, Bank of America and Chase do not support such an option. The following chart shows you the types of balance transfers offered by each of the major issuers:

All issuers prohibit the transfer of debt between two of their own credit cards and most of them also prohibit the transfer of their own non-revolving loans to their credit cards, the study tells us.

In an article for The Christian Science Monitor, Odysseas Papadimitriou, founder and CEO of Evolution Finance — CardHub.com’s parent company — calculates that “these zero-percent balance transfer promotions?? could save you as much as $1,000 while expediting debt freedom”.

The conversion of an interest-carrying non-revolving debt into a zero-percent-APR credit card debt is an obvious money saver, at least for the duration of the introductory period. There is also a benefit which will be of greater value to many consumers, as explained by Papadimitriou:

Besides snagging a lower interest rate and paying off what you owe months faster, you’re also effectively converting secured debt into unsecured debt. In other words, while your car secures your auto loan and can be repossessed as the result of a lack of payment, a bump in the road with a credit card won’t cost you your vehicle. You’ll also get the title to your car upon transferring your balance.

So there are some real advantages here.

Should You Do It?

But then there are the things that need to be considered, before making a transfer. To begin with, there are the balance transfer fees and these are easy to calculate. The more difficult part is calculating whether or not you’d be able to pay off the transferred balance before the zero-percent interest rate expires and the regular one kicks in. And you would definitely want to do that, because otherwise you may end up paying even more in credit card interest than you would have paid in interest on the original loan. Moreover, if you plan on keep rolling balances from one card to another in the future, Papadimitriou has a word of advice for you:

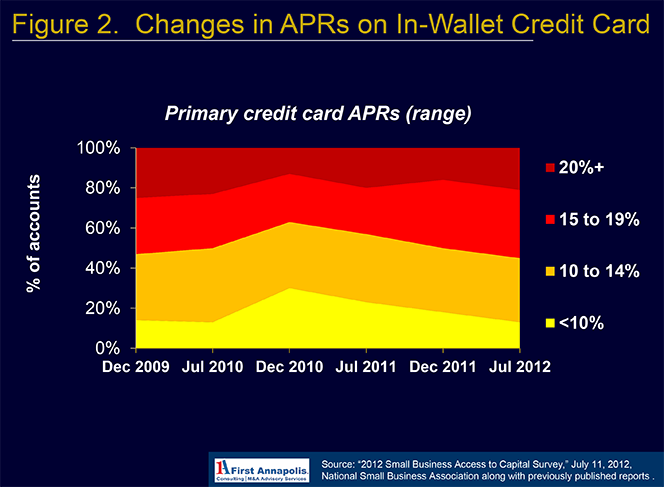

You can’t count on zero-percent balance transfer cards always being around either. Many people learned that lesson the hard way during the recession, and you certainly don’t want to repeat their costly mistakes. Otherwise, your savings opportunity will quickly become an expensive endeavor.

Indeed. There is always the chance that the whole scheme would backfire in a big way, leaving you much worse-off than before you made the transfer. So, unless you are absolutely clear on what your financial position would be at the end of the introductory interest-free period, you should not do a transfer. On the other hand, if you know that the debt will be fully repaid by then, or if you will have the cash to pay off whatever outstanding balance there may still remain, the transfer will end up saving you some money.

The Takeaway

As you might expect, zero-interest transfer deals are only offered to consumers with excellent credit and that is actually a good thing, because these are borrowers who have proved that they can manage debt and, it is reasonable to expect, can do the necessary calculations. On the other hand, borrowers with shaky credit histories and less-than-stellar debt management track records will not be given the chance to place themselves into a disadvantage. So, on the whole, these balance transfer deals can do much more good than harm.

Image credit: Wisegeek.com.

Thank you for an informative post with good advice given. I am glad that these zero percent balance transfer deals are not given to poor credit risks. They would be so tempted, and most likely so screwed in the long-run if they took advantage of the deal! It is interesting that several of the largest financial institutions do not allow transfers of mortgages, car loans, etc. They must know from experience that it is not a good deal for them or their customers. I’d definitely avoid doing this unless as you said the entire balance can be paid off when the zero percent period ends. I know we are in no position to do this, so our low fixed mortgage will have to suffice.