Americans Take on More Auto and Student Loans, Credit Card Debt Total Unchanged

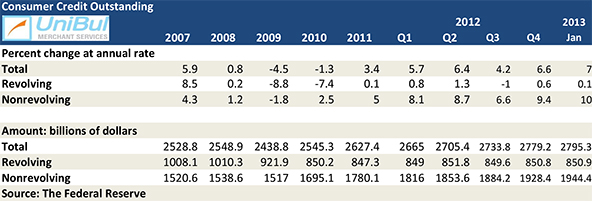

The U.S. consumer debt total rose again in January, we learn from the latest Federal Reserve consumer credit data release. It is the sixth consecutive such increase, which is once again exclusively the result of continuing strong growth of the non-credit-card part of the total and especially of its federal educational loan and car sale components.

However, even as they kept loading up on auto and student debt, Americans kept a close eye on their outstanding credit card balances, whose total at the end of January was virtually unchanged from the level measured in December and not much above the total recorded at the end of last year’s first quarter. So, even as the housing market is slowly improving, the stock market is setting new record-highs and unemployment is falling, there are no signs that Americans are about to return to their pre-Lehman pattern of excessive credit card use, which was one of the most prominent features of the hosing bubble years. Let’s take a look at the latest Fed data.

Credit Card Debt Unchanged in January

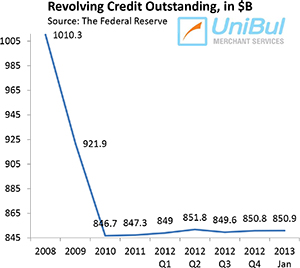

The total amount of outstanding consumer revolving credit in the U.S., which is made up almost exclusively of unpaid credit card balances, rose in January at a seasonally adjusted annual rate of 0.1 percent, or $0.1 billion, from December’s level, bringing the total up to $850.9 billion — just 0.5 percent, or $4.2 billion, above the total measured at the end of 2010.

The total amount of outstanding consumer revolving credit in the U.S., which is made up almost exclusively of unpaid credit card balances, rose in January at a seasonally adjusted annual rate of 0.1 percent, or $0.1 billion, from December’s level, bringing the total up to $850.9 billion — just 0.5 percent, or $4.2 billion, above the total measured at the end of 2010.

Following the financial crisis of September 2008, Americans’ credit card debt total had been falling continually until the end of 2010. That trend ended in 2011 when half of the Federal Reserve’s monthly releases for that year, including each of the last four reports, showed increases in the revolving debt total. Yet, as the chart to the right clearly illustrates, the revolving debt total has barely changed since reaching its lowest point at the end of 2010. And now the Fed tells us that at the end of January of this year, the revolving total was still lower by 15.8 percent, or $159.4 billion, than the $1,010.3 total measured at the end of 2008.

Overall Consumer Credit up 7%

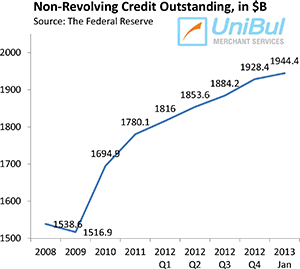

The non-revolving portion of the consumer debt total, made up of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, continued its long-standing upward trend. The Federal Reserve reported a $16 billion — or 10 percent — increase in January from December’s level, lifting the total up to $1,944.4 billion. This latest increase follows an even stronger $18.3 billion spike (11.5 percent) in the previous month, which was the biggest gain in non-revolving credit since November 2001, when the big car makers rolled out zero-percent financing and other major promotions and discount programs in desperate attempts to get customers to start buying cars again after the huge disruption caused by the September 11 terrorist attacks.

The non-revolving portion of the consumer debt total, made up of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, continued its long-standing upward trend. The Federal Reserve reported a $16 billion — or 10 percent — increase in January from December’s level, lifting the total up to $1,944.4 billion. This latest increase follows an even stronger $18.3 billion spike (11.5 percent) in the previous month, which was the biggest gain in non-revolving credit since November 2001, when the big car makers rolled out zero-percent financing and other major promotions and discount programs in desperate attempts to get customers to start buying cars again after the huge disruption caused by the September 11 terrorist attacks.

January’s rise of non-revolving debt was once again driven primarily by increases in the auto and educational loan totals. November through February was the strongest four-month period the auto industry has had in five years, according to Ward’s Automotive Group. In December and January, the automakers sold 15.3 million and 15.2 million cars and light trucks, at an annual rate, respectively. And the Fed’s report shows that lending by the federal government, which is primarily for educational loans, rose by $25.9 billion in January, before seasonal adjustments.

The Fed has now reported an increase in the non-revolving debt total in every month since July 2010, with the sole exception of August 2011 when it fell by 5.2 percent. The figure for January is higher by 21.6 percent, or $345.7 billion, than the total of $1,598.7 billion, measured at the end of 2008.

The Fed has now reported an increase in the non-revolving debt total in every month since July 2010, with the sole exception of August 2011 when it fell by 5.2 percent. The figure for January is higher by 21.6 percent, or $345.7 billion, than the total of $1,598.7 billion, measured at the end of 2008.

The aggregate amount of outstanding U.S. consumer credit — the sum of its revolving and non-revolving components — rose by 7 percent, or $16.1 billion, to $2,795.3 billion in January. The new total is larger by $207.9 billion, or 8 percent, than the pre-Lehman record-high of $2,587.4 billion, measured in July 2008.

The Takeaway

So, once again, the latest Federal Reserve data reveal no new trends. Americans are still paying down their credit card balances as fast as they can, as evidenced not only by a credit card debt total that has remained stubbornly flat over the course of the past two and a half years, but also by the historically low delinquency and charge-off rates. According to the latest data, released by TransUnion — a credit reporting agency — the U.S. credit card delinquency rate at the end of 2012 was 0.85 percent, up from the previous quarter’s level of 0.75 percent, but low by historical standards and well below the peak of 1.42 percent measured in 2003 Q4.

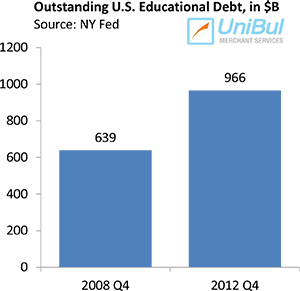

At the same time, the student debt total is increasing very rapidly. According to the NY Fed, in the fourth quarter of last year, the student debt total rose by $10 billion to $966 billion. Over the course of the past four years, that total has increased by $327 billion — or 51.2 percent — while all other forms of debt have fallen by a combined $1.7 trillion. These are astonishing statistics, which clearly indicate that a new credit bubble is being inflated. Like all bubbles before it, this one will burst, too, and if history is any guide, the aftermath will be very messy. Yet, we are seeing no prospect of a change in the federal government’s policy of giving student loans to everyone, irrespective of their ability to pay them back. And the problem is that 85 percent of the outstanding student debt is owed to the government.

At the same time, the student debt total is increasing very rapidly. According to the NY Fed, in the fourth quarter of last year, the student debt total rose by $10 billion to $966 billion. Over the course of the past four years, that total has increased by $327 billion — or 51.2 percent — while all other forms of debt have fallen by a combined $1.7 trillion. These are astonishing statistics, which clearly indicate that a new credit bubble is being inflated. Like all bubbles before it, this one will burst, too, and if history is any guide, the aftermath will be very messy. Yet, we are seeing no prospect of a change in the federal government’s policy of giving student loans to everyone, irrespective of their ability to pay them back. And the problem is that 85 percent of the outstanding student debt is owed to the government.