PayNearMe vs. Prepaid Cards

Bloomberg’s Ari Levy goes through a list of Silicon Valley financial start-ups, which have recently managed to attract some venture capital attention and, much more importantly, money. Of particular interest to me was to find out how one of these start-ups was doing, mostly because the prospects of its business model have always been unclear to me, but also because it’s been more than two years since we reviewed it on this blog. So it was time for an update.

The start-up in question — PayNearMe — enables consumers to make online payments by taking cash to the nearest 7-Eleven or ACE Cash Express location. I will go over the details of how this is done in a moment, but the critical point to understand about PayNearMe is that its service is designed to be used by the “unbanked” — consumers with no access to credit cards and no bank accounts — and, as such, it competes directly against one of the fastest-growing, both in volume and in quality, payment instruments in the U.S. — the prepaid card. The question, then, is how well PayNearMe measures up against the best of the prepaid cards and the answer is, not well enough.

What Is PayNearMe?

Here is how the start-up describes what it does:

PayNearMe provides an easy and convenient payment mechanism for consumers to make many remote transactions, and then pay with cash at a local retail location.

First, a transaction is staged on the web, by phone, or through other methods (for example, in-person with a loan disbursement officer). Next the consumer prints a PaySlip or sends it to their mobile phone. The consumer then presents that PaySlip at the register of a local store along with payment and, in real time, the bsuiness is notified, the instructions that were staged are executed, and the payment is accepted. A detailed receipt prints and other notifications can be triggered through PayNearMe’s technology platform.

Here is a video of the transaction process:

It all looks quite straightforward, if not exactly anyone’s ideal of convenience. But more on that in a minute. Before we get there, let’s see how much the PayNearMe charges its users — merchants and consumers.

How Much Does PayNearMe Cost?

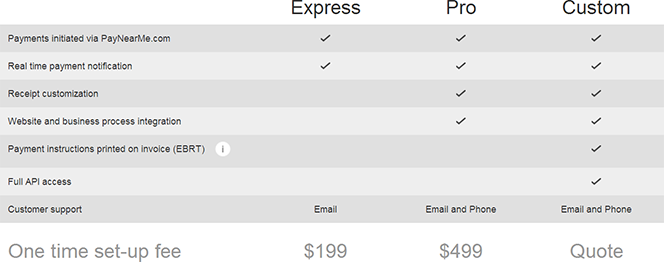

Well, once we attempt to answer this question, we immediately run into trouble, for it is really difficult to make out the start-up’s pricing structure. Firstly, let’s take a look at what the company says it charges merchants. Here is what you find on their website:

That’s all. We learn how much it costs to set up a PayNearMe account, but nothing about the transaction fees paid by merchants. Are there no transaction fees? Well, if that were the case, surely the company would’ve been more than happy to prominently state it on its website. And anyway, they would not be able to survive on a set-up fee alone. Back when we first reviewed the start-up — in November 2010 — their website was marginally more explicit about the company’s pricing model, stating the following:

For online commerce merchants, we offer a discount rate that is comparable to interchange, with the added benefit of no chargeback risk. For money transfer, loan payments and other remote transaction services, we offer a variable convenience fee structure that is more affordable than traditional walk-in payment solutions.

Again no details, but at least we got an acknowledgment that there were some payment acceptance fees. And what about fees payable by the end users? Well, once again, the answer is that we don’t know. Back in 2010, we were told that PayNearMe payments were free for consumers and I would have thought that this were still the case, if I hadn’t seen the video above. In it, we are told that one of the benefits of using PayNearMe for consumers was that there were “low fees”.

So how much does it cost?

PayNearMe vs. Prepaid Cards

Prepaid cards are the fastest-growing payment type in the U.S. As they were exempted from the Durbin Amendment, which placed a cap on the fees card issuers could collect from debit transactions, prepaid cards suddenly became quite attractive to credit card companies eager to make up for lost revenue. As a result, over the past year or so, we have seen the launches of a number of really good prepaid products and none as good as Bluebird, which is issued jointly by American Express and Wal-Mart. Incidentally, AmEx was unaffected by the debit reform, as it only issues credit cards, but evidently the company decided to stake its claim in a fast-growing market.

So how does Bluebird compare to PayNearMe? Well, to begin with, both services are available to the unbanked — there are no credit checks, which would exclude consumers with low credit scores. However, using the prepaid card is incomparably more convenient. At checkout, you would simply provide your card account information, as you would do if paying with a credit or debit card, and the payment would be processed immediately. You wouldn’t have to go to a 7-Eleven to complete the transaction. Moreover, the AmEx prepaid card is a veritable checking account substitute — you can use it at an ATM network of more than 22,000 machines nationwide, to pay bills and is accepted everywhere AmEx is accepted. The only difference from a checking account is that it comes with no checks.

Then there is the question of fees. Whereas we simply don’t know how much PayNearMe costs to end users, we do know that Bluebird is virtually fee-free. There are no fixed or transaction fees of any kind, with the sole exception of a $2 charge if the card were used at an ATM not belonging to the MoneyPass network. So the advantage clearly goes to Bluebird. In fact, I don’t see what would prompt anyone to choose PayNearMe over it.

The Takeaway

I can’t help but being reminded of another payment service, which PayNearMe used to run. Called Kwedit, the service in question allowed users to purchase digital content or virtual products and receive the goods immediately, provided they promised to pay for them later. No, I’m not making this up! At some point the company disclosed that about 33 percent of the payment promises were being kept. Unsurprisingly, in due time Kwedit, whose logo featured a duck of sorts, went the way of the dodo. Well, I would not be surprised at all if PayNearMe met the same fate, venture money and all.

Image credit: Vimeo / PayNearMe.

While many re-loadable debit card programs are laden with fees, reasonably priced programs can effectively serve as bank account replacements for consumers who are looking for that sort of product. Examples include Amex’s Bluebird and GreenDot’s new mobile bank. None of that takes away from the advantages PayNearMe offers to merchants and consumers who simply seek a replacement for money orders and walk-up bill payments. I wrote a fairly detailed post for our blog entitled “Thoughts on PayNearMe Express, walk-up bill payment, money orders, and fees” that you can find by visiting the PayNearMe website and clicking the “blog” link in the upper nav bar. I think it provides a useful perspective on some of the issues raised in this article.