Americans Keep Paying Credit Card Bills on Time, Set New Records

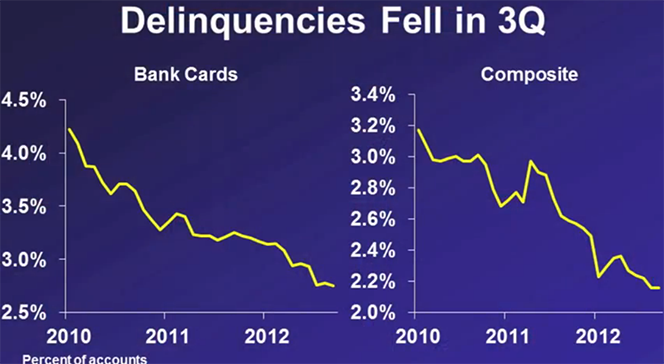

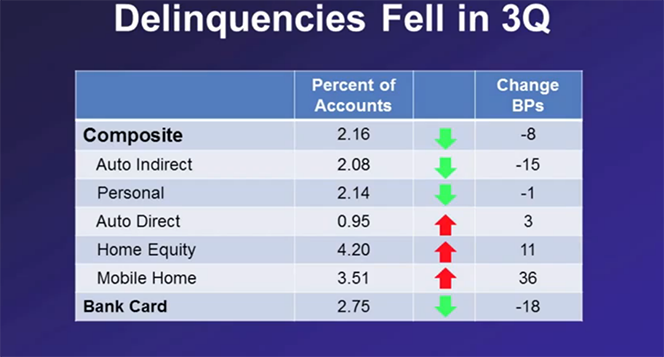

Delinquencies on consumer loans in the U.S. continued to fall in the third quarter of 2012, we learn from the latest data released by the American Bankers Association (ABA). The composite consumer loan delinquency index, which tracks the rates of payments late by 30 days or more in eight different loan categories, fell by 8 basis points to 2.16 percent of all accounts in the period, well below the 15-year average of 2.40 percent.

Now, the picture is not entirely rosy, as delinquencies didn’t fall in all of the consumer loan categories tracked by the ABA; in fact they rose in half of them. Moreover, ABA’s report does not cover student loan delinquencies, which we know are going upwards at a frighteningly high rate. On the other hand, credit card delinquencies keep setting new record-lows. Let’s take a look at the data.

Credit Card Delinquencies Hit an 18-Year Low

Credit card delinquencies fell by 18 basis points to 2.75 percent of all accounts—well below the 15-year average of 3.89 percent and their lowest level since 1994.

Delinquencies on Direct Auto Loans, Home Equity Up

Late payment rates did not fall across the board, however. Direct auto loan delinquencies rose from 0.92 percent to 0.95 percent in the third quarter of last year, we learn, and late payments on mobile homes also rose—from 3.15 percent to 3.51 percent. Home equity delinquencies also rose—from 4.09 percent to 4.20 percent.

James Chessen, ABA’s chief economist, had the following comment on the housing-related delinquencies:

In spite of the fact that housing, we think, has definitely turned a corner and is improving, it is going to take many more quarters to see the delinquencies on housing-related home equity loans go down.

Making the Household Debt More Manageable

Chessen went on to make the following observation:

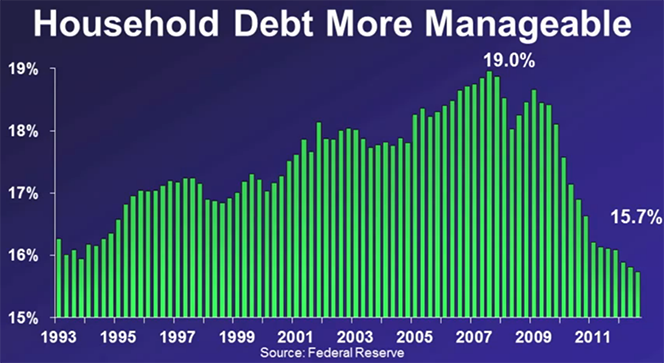

One of the positive things we’ve seen over the last several years certainly is that consumers are doing a better job managing their finances, getting their debt levels down. And in fact when you look at the debt-to-disposable-income [ratio], those levels have dropped to the lowest they’ve been in about 20 years.

Here is what Chessen is referring to:

Chessen concludes that “consumers are really taking to heart managing that debt and creating a better financial base for themselves.”

Consumer Confidence Down

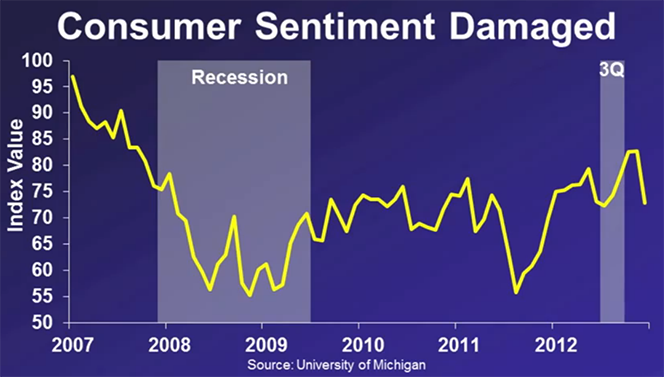

Consumer confidence has taken a hit, Chessen tells us, and goes on to explain:

Consumer confidence has been really hurt with all the debate over the fiscal cliff. That is still going to be an issue as we have the debt ceiling debate coming back up only in the next several weeks. And when we look at what happened with consumer confidence the last time we had a debt ceiling problem, it was at the lowest it has been in more than 20 years. So consumer confidence plays a very big role.

Here is the chart:

The Takeaway

The fact that most types of consumer loan delinquencies are at historic lows and still going down is unquestionably a good thing. Americans certainly look as if they are getting a handle on their finances. Here is Chessen’s bottom line:

Overall we are feeling pretty positive. The delinquency rates are down, consumers are doing a better job managing their debt and we think if we can get rid of some of this uncertainty that consumers are going to have a financial base to be back into the market, back buying the things that they want and seeing this economy improve.

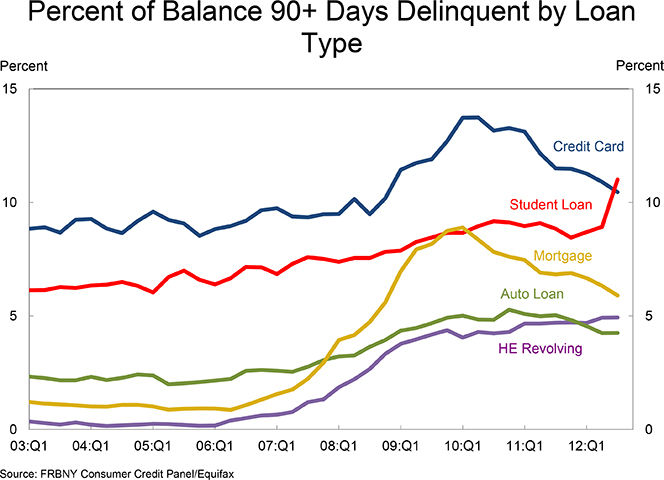

Yet, I am not quite as optimistic about the future, as Chessen is. For the fact is that there is one consumer debt category—student loans—in which borrowing is totally out of control and still growing at an accelerating rate. At the end of the third quarter of 2012, the student debt total stood at $956 billion, up by $345 billion from 2008 Q3, and its delinquency rate had already reached 11 percent. Here is how its trajectory compares to the other major consumer categories:

So until we have dealt with the student debt issue, we can’t feel good about the state of consumer finances in the U.S.

Image credit: Walmart.com.