Americans Take on More Student Debt, Auto Loans, Cautious with Credit Cards

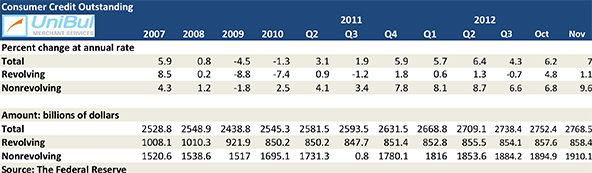

The U.S. consumer credit card debt total rose modestly in November, we learn from the latest Federal Reserve consumer credit data release. The small increase fits well into a trend that began just over two years ago. Prior to that, in September of 2008, the financial crisis triggered a combination of rapidly rising credit card delinquency and charge-off rates. Anxious consumers were either unwilling or unable to take on new credit and focused on paying down the debt they had already accumulated. As a result, credit card debt repayment rates rose sharply, which, coupled with increasing default rates caused the total amount of consumer credit card debt in the U.S. to plummet. However, that free fall came to a halt sometime in the second half of 2010 and since then the consumer credit card debt total has been bouncing up and down, but has remained largely unchanged.

On the other hand, the financial meltdown has had a much less noticeable impact on the much larger consumer debt category that includes auto and student loans. The non-credit-card debt total (the “non-revolving credit” in Fed speech) did fall slightly in 2009 from its 2008 level, but it has been rising continually ever since. As a result, the total amount of U.S. consumer debt—the sum of credit-card and non-credit-card debt, but excluding home mortgages—is now well above its pre-Lehman level. Let’s take a look at the latest Fed data.

Credit Card Debt up 1.1% in November

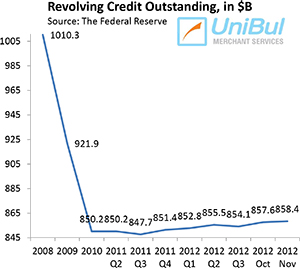

The total amount of outstanding consumer revolving credit in the U.S., made up almost exclusively of outstanding credit card balances, rose in November at a 1.1 percent seasonally adjusted annual rate, or $0.8 billion, from October’s level, lifting the total up to $858.4 billion.

The total amount of outstanding consumer revolving credit in the U.S., made up almost exclusively of outstanding credit card balances, rose in November at a 1.1 percent seasonally adjusted annual rate, or $0.8 billion, from October’s level, lifting the total up to $858.4 billion.

Following the collapse of Lehman Brothers in September 2008, the U.S. consumer revolving debt total had been falling uninterruptedly until the end of 2010. Then it all changed and half of the Federal Reserve’s monthly releases in 2011, including each of the last four, reported increases in the revolving debt total. Now the Fed data tell us that at the end of November the total was still lower by 15 percent, or $151.9 billion, than the $1,010.3 figure recorded at the end of 2008.

Overall Consumer Credit up 7%

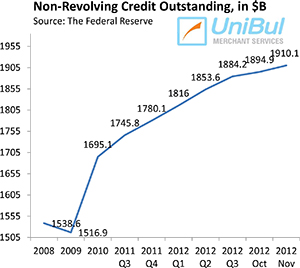

The non-revolving component of the consumer debt total, made up of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, continued its long-standing upward trend. The Federal Reserve reported a $15.2 billion—or 9.6 percent—increase in November from October’s level, bringing the total up to $1,910.1 billion.

The non-revolving component of the consumer debt total, made up of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, continued its long-standing upward trend. The Federal Reserve reported a $15.2 billion—or 9.6 percent—increase in November from October’s level, bringing the total up to $1,910.1 billion.

The Fed has reported an increase in the non-revolving debt total in every month since July 2010, with the sole exception of August 2011 when it fell by 5.2 percent. The figure for November is higher by 19.5 percent, or $311.4 billion, than the total of $1,598.7 billion, measured at the end of 2008.

The aggregate amount of outstanding U.S. consumer credit—the sum of the revolving and non-revolving portions—rose by 7 percent, or $16.1 billion, to $2,768.5 billion in November. The new total is greater by $181.1 billion, or 7 percent, than the pre-Lehman record-high of $2,587.4 billion, measured in July 2008.

The Credit Card Takeaway

Once again, the Federal Reserve data are painting a picture of continuation of long-established trends. U.S. consumers are still refusing to expand their credit card balances in any meaningful way—even in a holiday shopping month—as they have been ever since the financial crisis struck in 2008. Moreover, they continue to pay down whatever balances they have on time. Consequently, as Fitch Ratings recently told us, the credit card charge-off rate in November was at its lowest level in more than 20 years.

On the other hand, auto loans and, especially, student loans are growing very rapidly. At the end of the third quarter of 2012, the student debt total was greater by 56 percent than the corresponding figure recorded just four years earlier. I can’t help but being reminded of what a famous economist once observed: that which is not sustainable cannot be sustained. I guess the question is for how long the unsustainable can go on, before the music stops.