Mobile Banking Use in U.S. Soars, Still Far Behind South Korea, India

We learn that and much more from the latest Customer Loyalty in Retail Banking report just released by Bain & Company, a consultancy. The researchers have looked into 14 markets around the world and have surveyed 5,200 American consumers to gauge their traditional banking habits and attitudes toward newer channels, such as mobile banking.

The report is full of interesting data, so I thought I should give you the bits and pieces I found most revealing of the current state of mobile banking in the U.S. I do, however, strongly encourage those of you who are in the m-payments industry to review the whole paper—there is a lot to be learned in it.

A Third of Americans Use Mobile Banking

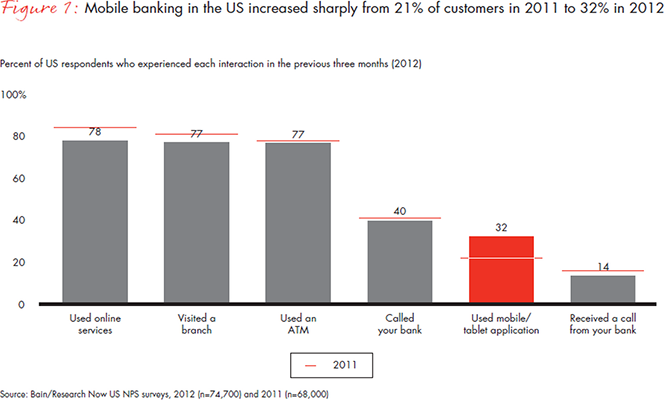

In the U.S., 32 percent of the respondents have told the researchers that, during the previous three months, they had used their smartphones or tablets for some type of banking interaction. That was up from 21 percent in 2011. Here is the chart:

Bain’s U.S. survey revealed that Americans are using their mobile devices mostly for simple tasks such as checking their account balance or activity.

U.S. Lags Korea, China, India in Mobile Banking

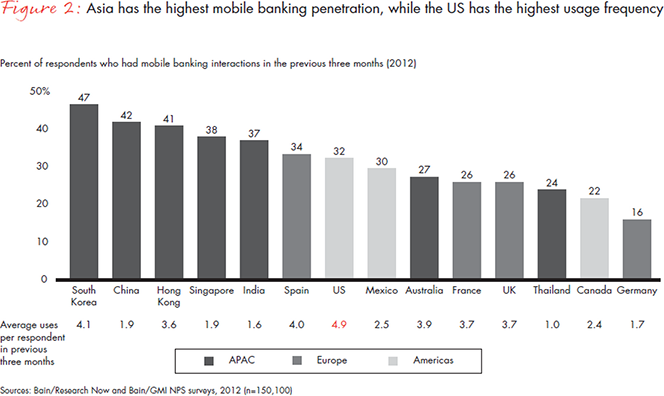

Asian countries occupy the top five spots in the mobile banking penetration chart, with the U.S. coming in at seventh place among the fourteen examined countries. However, we learn, the U.S. has the highest “usage frequency”, and by quite a margin. Here are the full rankings:

The Young and Affluent Most Likely Mobile Banking Users

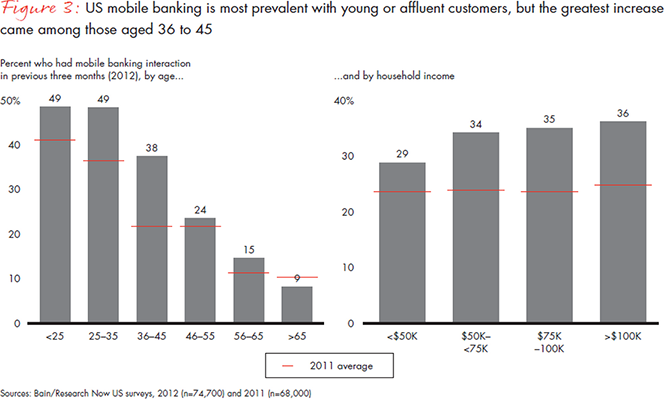

That finding should come as no surprise to anyone, I suspect. As you can see in the chart below, about half of Americans under the age of 35 have said they had engaged in some form of mobile banking or other, whereas the ratio for those aged 36 to 55 is only 31 percent and the one for consumers over 55—a mere 12 percent. Here is the chart:

However, we also learn that the biggest gainers in the U.S. were consumers in the age group 36 to 45, whose mobile usage rose to 38 percent from 22 percent the year before.

On the income scale, 36 percent of the surveyed U.S. consumers whose households earn more than $100,000 per year participated in mobile banking, whereas the corresponding ratio for Americans with household incomes under $50,000 was just 29 percent.

The Delighted American

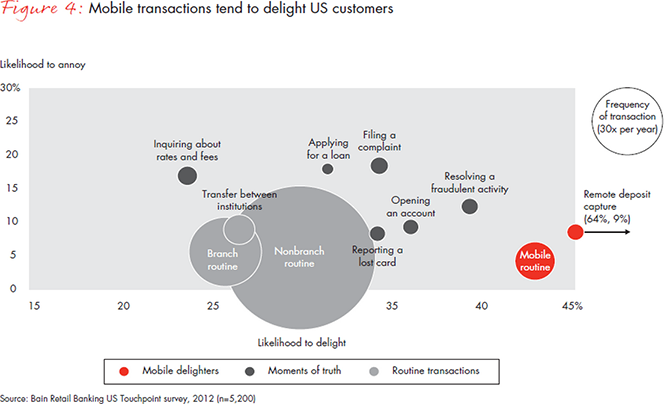

I am quite skeptical of banks’ abilities to “create more “wow” experiences that use new technologies to delight customers”, as the researchers put it, but, for what it’s worth, here is the Bain chart:

The More, the Better

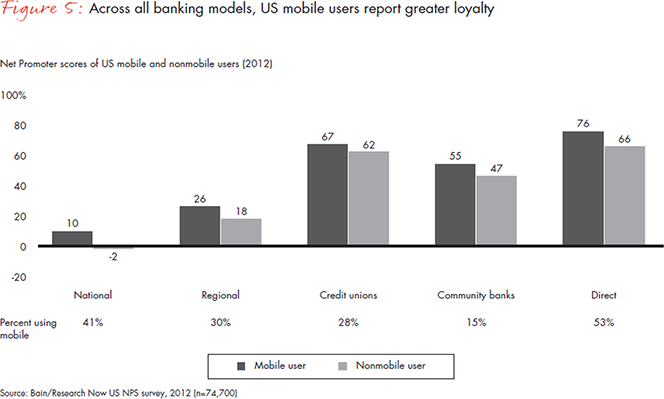

The more consumers use mobile banking, the more likely they are to recommend their bank to non-users, we learn. That holds true for all age groups. Here is Bain’s chart, presenting their findings, using “promoter scores”:

Keeping Things Simple

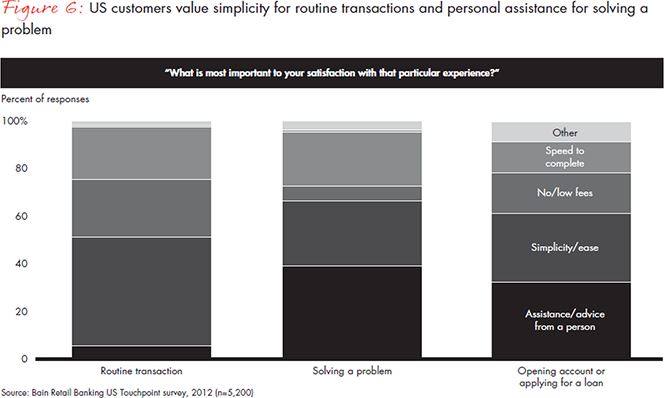

Simplicity for routine transactions and personal assistance for solving a problem top the list of most important factors for keeping consumers happy with their banking service. Here is the chart:

Sharing the Burden

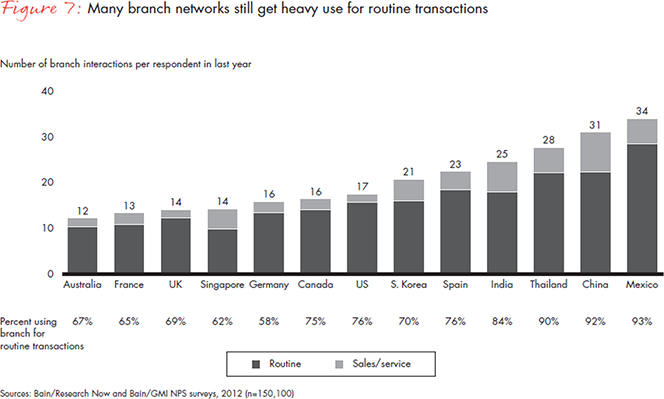

Mobile banking is alleviating the pressure on brick-and-mortar banking locations by absorbing an increasing share of the transaction volume. That is especially important for the U.S., where “the average customer reported making more branch visits per year than in other developed markets”, we are told. Here is the comparison chart:

Affluent Consumers Get Better Treatment in Developing Markets

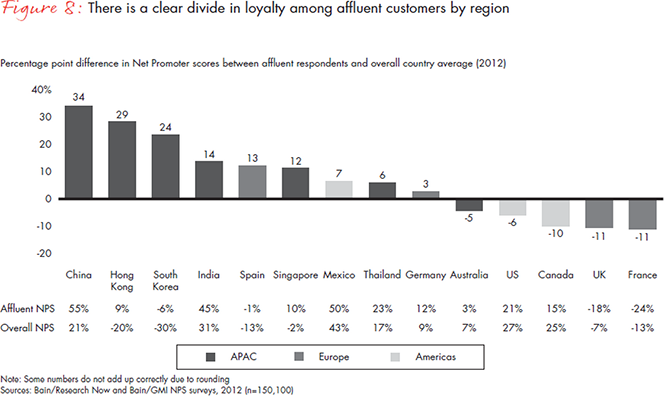

Banks in developing countries in Asia and elsewhere “have developed differentiated modes of targeting and serving the affluent and have far more extensive wealth management operations than in the U.S.”. Unsurprisingly, the wealthy enjoy having access to personalized service, where available, and give their banks higher loyalty scores than do customers of more modest means. Here is the chart:

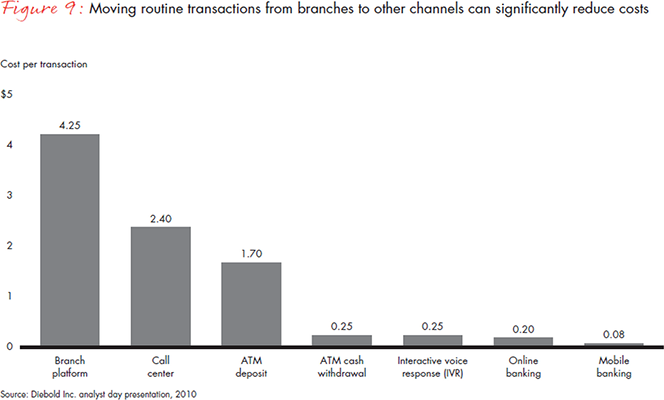

‘Omnichannel’ Is the Future

An integration of the various digital and physical channels into a single experience—an “omnichannel”—would allow banks to address the priorities of each individual customer segment more effectively, the researchers conclude. Such an approach would enable banks to “serve mass segments more profitably and invest disproportionately in high-margin services for the affluent.” This chart illustrates how the shift away from physical branches would help banks reduce costs:

The shift to digital channels “is increasingly common in many regions, though it’s still at an early stage in the U.S.” However, I think it wouldn’t be a stretch to project that, as mobile banking continues to gather speed, American banks will eventually catch up with the leaders in that category.

Image credit: Burnsmcdmedia.com.