Holiday Spending 2012: When Actions Diverge from Intentions

A new survey conducted by myFICO — the consumer-facing outfit of the credit score maker — tells a story of a cautious American consumer, fully intent on reining in spending this holiday season. Not only do we read that close to two-thirds of the respondents will be tightening their belts this time around, but we learn that they are also “losing sleep” over fraud concerns.

Well, that is all very well, but I am not at all convinced that the survey’s findings have much in common with the reality on the ground. In fact, looking at the numbers from the first holiday weekend, I am tempted to conclude that consumers were more likely to lose sleep over the possibility of missing out on a deal than of spending more than they had planned. For spending records on Thanksgiving, Black Friday and Cyber Monday were not just broken, they were all shattered. And that was true not only for overall spending, but also for online and mobile sales — precisely the type of transactions that are most vulnerable to fraud. But then, this wouldn’t be the first instance of actions diverging from professed intentions, would it? Let’s take a look at the numbers.

Consumer Spending Plans, 2012 Holiday Season Edition

Credit card debt continues to be the American consumer’s biggest financial concern as the new year approaches, myFICO’s survey tells us. Only a fifth of the respondents are planning on opening up new credit card accounts and 65 percent of them expect to charge less than $500 on the credit cards they have. Furthermore, 62 percent have expressed a concern about fraud or identity theft during the holidays, we learn. Here are the findings, presented in an infographic:

Now let’s take a look at the actual numbers from the first holiday shopping weekend.

The Data: Breaking All Records

Here are some of the raw data for U.S. retail e-commerce spending during the first holiday weekend, as released by comScore, an internet analytics company, in two separate reports (sources here and here):

- Total spending for the period November 1 – 26, which includes Thanksgiving and Black Friday and ends on Cyber Monday, was $16.4 billion, a 16 percent increase from last year.

- Total spending on the Thanksgiving day alone was $633 million, 32 percent more than the 2011 total.

- Black Friday’s total was $1,042 million, a 28 percent increase over the previous year.

- Cyber Monday’s spending was $1,465 million, 17 percent up from the 2011 total. That was also the heaviest U.S. online spending day in history, comScore tells us.

- The total for that weekend (November 24 – 25) was $1,187, a 15 percent increase over the 2011 figure.

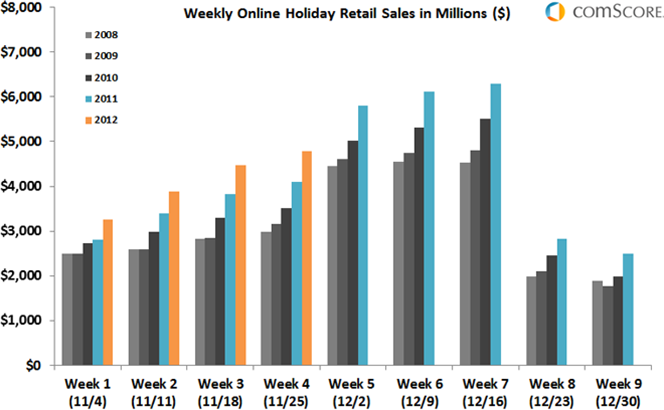

Here is how online holiday retail sales have grown since 2008:

So, again, if consumers have become more conservative with their holiday spending, there is no evidence for such a behavioral shift in the data, nor do we see any sign of concern about fraud.

The Takeaway

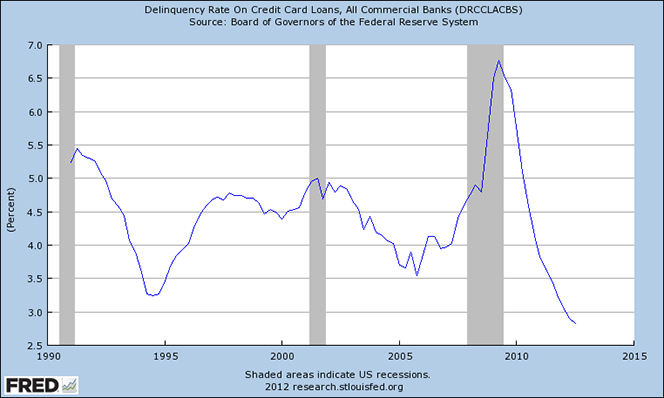

While it is clear that Americans are not exactly afraid of using their credit cards during this holiday shopping season, the data also show that they have been quite prudent with their plastic in the post-crisis years. Every major indicator shows that consumers are continuing to pay their credit card bills on time and are paying back more than they spend. Here is how credit card delinquencies have been trending:

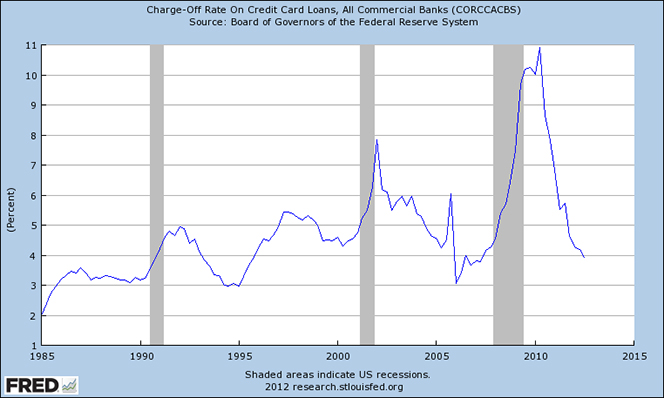

Here is the credit card charge-off chart:

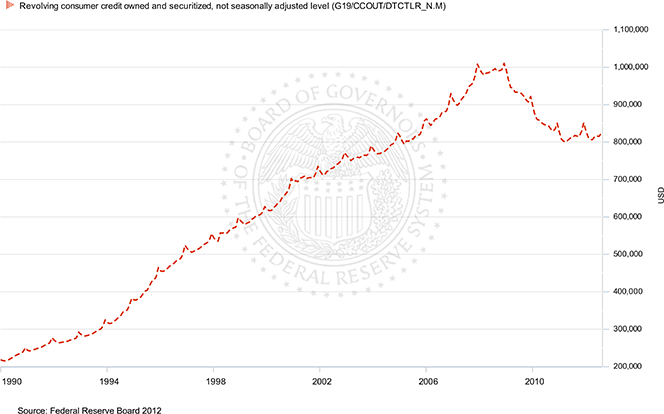

Finally, here is the aggregate amount of outstanding credit card debt:

So consumers have been using credit cards well within their means for several years now and there is no indication of a break with this trend. For as long as that is the case, the rising spending will not be an issue.

Image credit: Wal-Mart.