How Mobile Payments Are Making Life Easier in Africa

While reading about an Egyptian mobile payments (sort of) start-up in the Financial Times this morning, I found myself making a parallel between Fawry, as the company is called, and Kenya’s famous M-Pesa. See, whereas the two companies provide very different types of payments services, they both bring financial innovation to parts of the world that badly need it. While M-Pesa enables Kenyans and others to send money to one another in places where no other means for transferring money is available, Fawry makes it possible for Egyptians to pay their utility bills without having to line up at the service provider’s office. To an American ear that may not sound like a huge step forward, but in a country where, as the FT reminds us, 90 percent of the population is without a bank account, it is just that.

So Fawry, like M-Pesa, is an example of a payments service that could not possibly be successfully implemented in a developed country, but can be hugely disruptive in one with an underdeveloped financial system. But the more exciting takeout is that such start-up successes are actually possible in places better known in the West for corruption and chronic mismanagement. I don’t think that M-Pesa and Fawry will put an end to all of these countries’ problems, but they do demonstrate that change is possible. Indeed, it is happening. So it is worth taking a closer look at the Egyptian start-up. Let’s do it.

What Is Fawry?

Here is how the Egyptian start-up describes itself on its website:

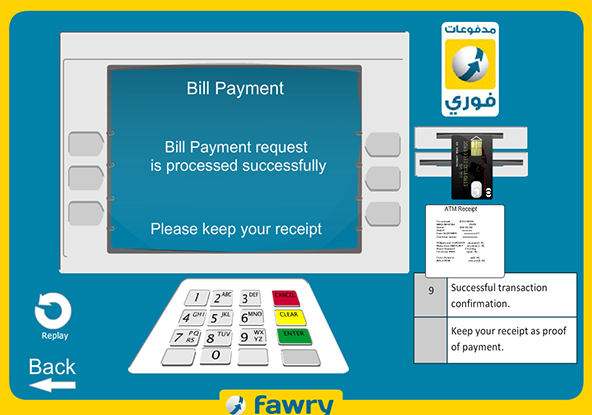

Fawry is a payment service available through banks and a nationwide network of retailers and also Egypt Post offices, that enables you to pay for your bills or recharge different services like, recharging your mobile phones or other services like your CashU account.

As consumers, Fawry provides you with convenient and secure payment channels available 24/7 via your bank’s ATM machines as well as other electronic banking channels such as internet banking, mobile banking and IVR. By making this payment service also available in retail stores, Fawry relieves you from current payment hassles by allowing you to pay for your bills at the closest retail outlet that is a member of our network.

The hassles at issue are the long waits in line to pay a utility bill, as mentioned above, or, alternatively, the need to be at home when a utility company’s employee comes by to collect the monthly payment. The FT tells us that affluent Egyptians send their servants to pay the household bills, but, of course, that is not an option for the vast majority of their compatriots. But more importantly, this practice reveals that even people with bank accounts and access to the internet find it either necessary or more convenient to dispatch a person to physically carry the cash to its destination. Indeed, the FT informs us, only 1.5 percent of all “household consumption” is paid via electronic channels, even as there are 13 million payment cards in circulation in a country with a population of 85 million.

For more details on Fawry’s operations and penetration in Egypt, read the FT article.

Start-ups in Africa

Similarly to M-Pesa, Fawry was not founded by a heroic Steve Jobs-type entrepreneur. Rather, it was the result of a collaborative effort by a number of big Egyptian and international companies, including a technology development fund, a public-private partnership, a technology company and a group of banks. So it would probably be somewhat premature to conclude that the company’s success proves that Egypt has become a fertile ground for aspiring entrepreneurs. Yet, as M-Pesa’s story clearly illustrates, success is contagious.

You may recall that about a month ago we commented on an Economist story about Kenya’s burgeoning start-up scene, in which we learned, among other things, that

In 2002 Kenya’s exports of technology-related services were a piffling $16m. By 2010 that had exploded to $360m. To its boosters, Nairobi is “Silicon Savannah”.

And among the main drivers of this transformation, right alongside a supportive government, The Economist found to be none other than M-Pesa:

Kenya has undergone a revolution since 2007, when M-PESA, a mobile-payments system operated by Safaricom, a phone company, was launched (see chart). Many start-ups at Pivot East use it as a base for their business. One team streamlined the payment of school fees through the service by helping institutions and parents keep track of upcoming and late deposits. Another offered an electronic version of Kenya’s popular informal savings groups. M-PESA has also inspired others. In May Google launched Beba, a pre-paid card for commuters using Nairobi’s local buses. Insiders say that this is a test run for a much larger cashless-payment system.

Success does indeed beget success.

The Takeaway

Will Fawry have the sort of positive effect on the Egyptian start-up scene, which M-Pesa is having on Kenya’s? I don’t know. After all, one should be mindful of the fact that Egypt is a country in the midst of a huge political transformation and, although we hope it will all turn out well, we don’t know what the future will bring to its citizens. But at least we have seen that positive change in an industry in bad need of reform is possible and, which is far more important, there is now a model to follow.

Image credit: Fawry.