Why You Should Ditch the Daily Deals and Opt for Loyalty Cards

Some time ago, the CEO of a major U.S. airline was overheard dismissing customer complaints over the quality of his company’s service by saying something in these lines: “Let them whine. All they care about is how much they pay and the next time they want to fly, they will still buy the cheapest ticket they can find.” So you can treat customers as badly as you want and get away with it, as long as your price is low enough.

Being in the payments industry, I couldn’t help but extend this executive’s rather crass analysis to the types of deals offered by daily deal sites like GroupOn. While it is obvious why a consumer would love to get a 30-percent discount, it’s always been a mystery to me what a merchant stands to gain from such a deal. After all, such a sale is unlikely to be profitable and, as our airline CEO would have told us, to turn a bargain-hunter into a regular customer, you would have to keep giving him the lowest price out there, which is not always possible, nor does it make much business sense.

Well, there is an alternative to the daily deal programs, as BusinessWeek’s Olga Kharif is reminding us. Loyalty cards make it possible for merchants to exclusively reward returning customers, while making it easier to collect more data about them. Moreover, loyalty programs are typically much less expensive to maintain and therefore make much more sense than the GroupOn-types of deals.

How Loyalty Programs Work

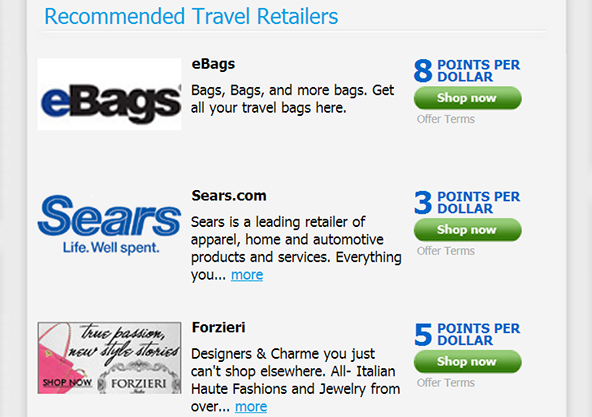

The main focus of Kharif’s article is on a company called Cartera Commerce whose loyalty programs allow consumers to link their credit or debit cards to participating merchants’ rewards program. Here is how it would work. Using Cartera’s platform, called OfferLink, a retailer would create an offer for, say, a 5-percent sales discount, which would be automatically applied when a customer uses a card that has been linked to the merchant. Consumers would learn about such deals from their card statements, or through e-mails from their credit card companies or frequent-flier programs, mobile alerts or digital ads.

What makes this type of loyalty programs especially appealing to consumers is the fact that the rewards are piled on top of the ones the cardholder may be getting from her credit card company. So there is huge incentive to participate.

There is another type of loyalty program that is briefly mentioned in Kharif’s piece, but one that we reviewed in some detail last week. It is the digital version of the punch card that many of us used to carry around, so that we could get a free coffee for every ten we purchased. Now Square has made it possible for merchants using its Register app to keep track of our purchases and give us that free coffee, without the need for punching holes through a piece of paper.

Why Loyalty Cards Are Better than Daily Deals

Crucially, as Kharif points out, loyalty programs are much less costly to merchants than the daily deals:

LivingSocial and Groupon, the biggest provider of daily discounts, typically take a 30 percent cut of a transaction, versus 5 percent to 15 percent when a loyalty-linked card is used.

Moreover, merchants can collect much more data about their customers’ purchases:

Businesses like Avezzano’s [a bakery featured in Kharif’s piece] can use the programs to collect data on when customers shop, how often they return and how much they spend — way beyond the scope of old-fashioned paper punch cards. That can make them even more valuable than coupons from Groupon and LivingSocial.

The more information you gather about your customers, the better you can optimize your marketing message. With GroupOn, on the other hand, you would have to purchase a deal upfront and hope that you would be able to turn at least some of the deal seekers into repeat customers. Not surprisingly, as Kharif reminds us, many businesses have found that not to be the case:

A survey earlier this year by Susquehanna Financial Group and daily-deal aggregator Yipit showed that about half of businesses that had offered an online deal-of-the-day weren’t planning to do so again in the following six months. Merchants were concerned about a low rate of repeat business from new customers gained through such offers, the survey found.

Well, they are right to be concerned, but should not be surprised.

The Takeaway

The Group-On types of deals are unlikely to go away anytime soon, simply because they are hugely appealing to consumers and I have no doubt that many merchants will keep finding the prospect of doubling or tripling their sales volume irresistible, whatever the cost. That may work for some high-margin businesses, but for most it will not prove a sustainable growth strategy. Loyalty programs make much more sense, because they only reward repeat customers. After all, to get that free eleventh coffee, you have to have already purchased ten of them. Our airline CEO would undoubtedly have appreciated such an approach.

Image credit: BarclaycardRewardsBoost.com.