U.S. Credit Card Use up at Fastest Rate since Lehman Fall

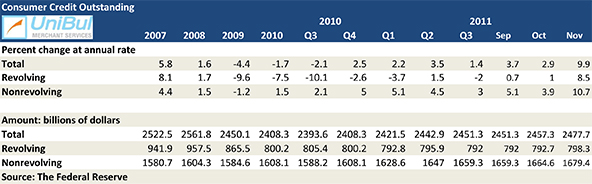

Americans took on more credit card debt in November, much more, according to the latest Federal Reserve data, released on Monday. It was the biggest gain since well before the financial crisis struck and the third consecutive monthly increase — the first time that has happened in the post-Lehman era — following upward revisions of both October’s and September’s totals.

Impressive as the surge in credit card borrowing was, non-revolving consumer credit grew even faster in November, pushing the aggregate borrowing total up to nearly pre-recession levels. These statistics were not exactly unexpected, as we already had data showing huge spikes in holiday spending, but the magnitude of the uptick was nevertheless impressive. If anyone was still unsure about whether Americans would have responded to positive economic news by ratcheting up their spending, these latest numbers should have provided the proof they were looking for.

Credit Card Debt up 8.5% in November

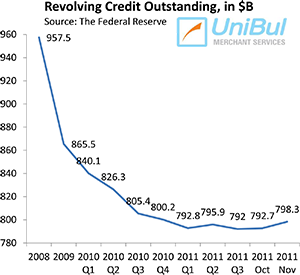

The aggregate amount of outstanding U.S. consumer revolving credit, comprised almost entirely of outstanding credit card balances, spiked in November by 8.5 percent, or $5.6 billion, bringing the total up to $798.3 billion, 1.09 percent above the post-Lehman low of $789.6 billion registered in April 2011, which was also the lowest level in more than seven years.

The aggregate amount of outstanding U.S. consumer revolving credit, comprised almost entirely of outstanding credit card balances, spiked in November by 8.5 percent, or $5.6 billion, bringing the total up to $798.3 billion, 1.09 percent above the post-Lehman low of $789.6 billion registered in April 2011, which was also the lowest level in more than seven years.

It seems that we may have now turned a corner and seen the beginning of a new trend. Following the Lehman collapse, revolving credit had been continuously falling until December 2010. In the eleven Federal Reserve data releases since then we’ve had six increases, including one in each of the past three reports.

Yet, the current revolving credit total remains way below the level measured in August 2008, the month before the fall of Lehman Brothers. The November total of $798.3 billion is lower by 18 percent, or $175.3 billion, than the $973.6 pre-crisis high.

Overall Consumer Credit up 9.9%

The non-revolving component of the consumer debt total, comprised of auto loans, student loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, rose in November at a double-digit rate. The Fed reported a 10.7 percent surge, bringing the total up to $1,679.4 billion, up $14.8 billion from October. In a marked contrast to the revolving credit trend, non-revolving debt has been rising consistently since July 2010, with August 2011’s 6.4 percent downtick being the sole exception.

The total amount of outstanding U.S. consumer credit — the sum of revolving and non-revolving debt — surged by 9.9 percent, or $20.4 billion, to $2,477.7 billion in November. It was the third consecutive monthly increase and the biggest one in a decade.

The Takeaway

There can be no question that the huge rise in borrowing reflects an improvement in consumer confidence. We’ve now had six consecutive months in which the economy has added at least 100,000 jobs and the December number — 200,000 — was the highest one in the series. As a result, the unemployment rate has fallen to 8.5 percent, the lowest level in close to three years. Americans are clearly encouraged by these numbers, even as their paychecks may not have grown at all in real terms.

On the other hand, even as Americans are using their credit cards more freely once again, they are not falling behind on their monthly payments. On the contrary, the credit card delinquency rate in November — 3.03 percent — was the lowest one on record, according to Moody’s, a credit ratings agency. Lower delinquencies lead to lower default levels, which is why Moody’s expects the default rate to fall to under four percent from its current level of 5.38 percent.

Then there is another metric that gives us advanced warning for any shift in consumer sentiment toward credit card debt. The November monthly payment rate (MPR) — measuring the portion of their outstanding credit card debt Americans pay back at the end of each month — was 20.56 percent. While high when compared to a historical average in the mid-teens, the November MPR was lower by 0.35 percent than October’s level and was down by 1.35 percent from the all-time high of 21.91 percent reached just two months before that — in August. Ultimately, the future delinquency and default rates will be determined not by the fall or rise in credit card use, but by the direction in which the MPR will go. In the aftermath of the financial crisis, it rose to record-high levels, as consumers were scrambling to offload as much debt as they could, eventually pushing delinquencies and defaults to record-lows. Now it has started to slide back downwards.