Citibank Socializes Credit Card Rewards

Citibank has launched a Facebook app that allows its customers to share their credit card rewards, the bank is telling us in a press release. This is by far the boldest step a major bank has taken in the direction of socializing a rewards program to date and one that will surely provoke a response from Citi’s rivals.

Up until now the big issuers have been quite tentative in their experiments with the possibilities of any interplay between credit card and social media accounts. The only similar move that I can think of is American Express’s decision to allow its cardholders to sync their card and foursquare accounts, but that is a much more modest, campaign-based strategy, which actually leaves out the social element that makes Citi’s move so interesting. Let’s take a look.

What Does Citi’s Facebook App Do?

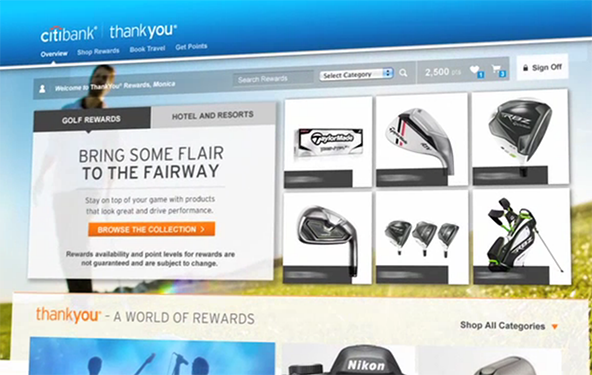

Citi’s Facebook app

makes it quick and easy for ThankYou(R) Rewards members who are Facebook friends to pool their points together, and use their points’ collective value towards a shared goal or reward. ThankYou members on Facebook can combine their points to make a charitable donation, or choose from millions of rewards on www.thankyou.com, from travel to electronics.

To help convince customers to start using the app, Citi is giving away?á2,500 ThankYou points to the first 4,000 customers who download the app and link their card account to their personal Facebook page.

What’s In It for Consumers?

Citi’s app is a truly social media tool. It lets everyone in a group of friends to participate in a shared project. Such a project could take the form of a donation to a charity or a payment for an event everyone is participating in. Additionally, a pool of rewards points can be seen as a virtual gift card that can be used on Citi’s www.thankyou.com rewards website.

Of course, there is an obvious limiting factor to this type of a point-sharing program: participation is restricted to Citi cardholders. From a consumer point of view, and we have advocated for this approach on multiple occasions before in regards to mobile payments, it would be far preferable to have access to a program that does not discriminate among different card issuers and rewards programs. To extend the gift card analogy, such a program would look very much like an open-loop prepaid card. To be fair to the issuer, though, such an open-loop program would be much harder to design for a point-sharing social project than for an m-payment one. And anyway, Citi’s perspective is rather different.

What’s In It for Citi?

Launching such a program is a very smart move on Citi’s part on at least two levels. Firstly, they are testing a totally new approach to building a social media presence that no other big bank has tried out before. Point-sharing among Facebook friends makes sense and even if it doesn’t work as well as the bank hopes, there really isn’t anything the bank can possibly lose from giving it a try.

But there is another aspect of this new program, one that is more subtle and that has nothing to do with social media. This experiment can be seen as another attempt by a major issuer to drive customers away from using their debit cards by giving them an incentive to use their credit cards. I don’t know whether the Citi guys have thought of that when designing their point-shar?¡ing program, but we do know that processing debit transactions in the post-Durbin world is much less profitable for them than credit card payments.

The Takeaway

I expect that the other big issuers will soon launch similar social media programs of their own. They may or may not use Citi’s approach as a template, but I think that the ability for joint user participation in shared projects will be at the heart of the most successful among them. After all, sharing and collaboration is what social media is about.

Image credit: Thankyou.com.