The Month in Numbers – November 2011

Today we begin a new monthly column — The Month in Numbers — in which we will be summarizing the most interesting credit card-related statistics of the previous month. Some of them we will have already published and discussed on this blog, while others we will not have had the time to write about.

So if you see a graph, table, infographic or a chart that you think tells an interesting credit card story, let us know. We will be having dozens of items to choose from each month and many will be left out of the final selection, but we will be doing our best to pick the most newsworthy and insightful among them and we hope you’ll help us do that. Here are or picks for November 2011, in chronological order.

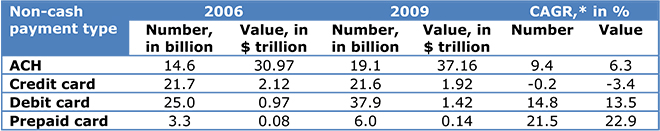

1. Prepaid on the Rise

This table uses Federal Reserve data showing that prepaid cards are by far the fastest-growing non-cash payment method in the U.S.

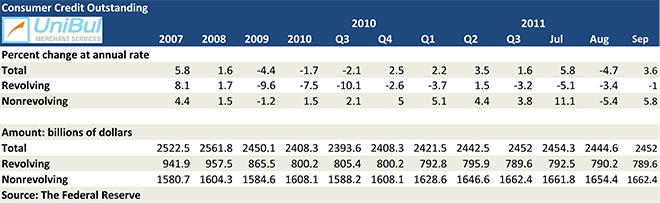

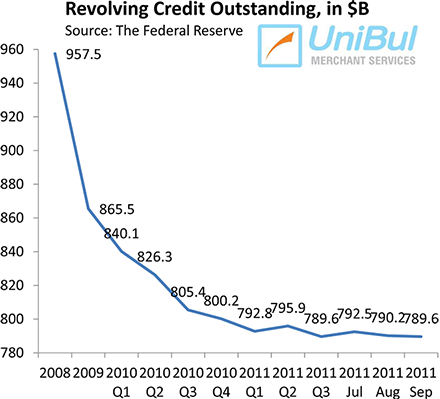

2. Americans Continue to Slash Credit Card Debt

The Fed’s G.19 report told us that the aggregate consumer credit card debt in the U.S. fell to its lowest level on record in more than seven years.

Here is how the decline in credit card debt since 2008 looks like:

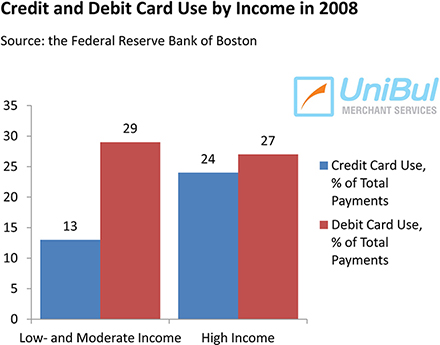

3. Young, Less-educated and Low-income Americans Hardest Hit by Higher Debit Cost

The increase in the cost of debit card use, a direct result of the Durbin Amendment, will have the greatest impact on young, less-educated and low-income consumers, who are the ones most reliant on debit, a paper by Joanna Stavins, an economist at the Federal Reserve Bank of Boston, told us. Here is how low- and moderate-income consumers differ from high-income ones in their credit and debit card use:

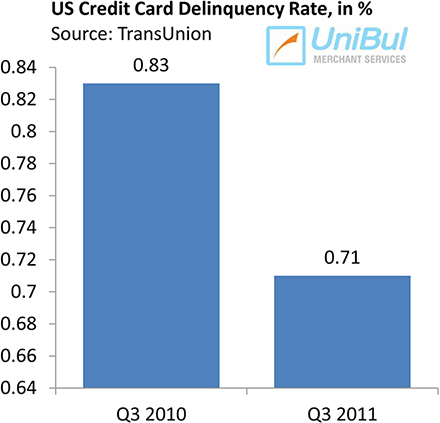

4. 90-Day Credit Card Delinquencies Down in 2011 Q3

The latest TransUnion report showed 90-day credit card delinquencies were up to 0.71 percent in 2011 Q3 from the previous quarter, but were still down from 2010 Q3.

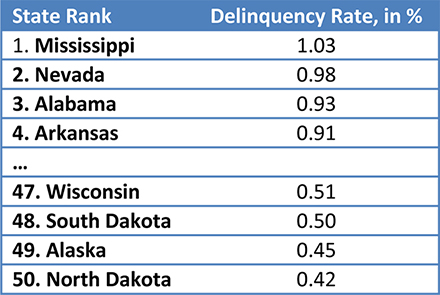

Here is a list of the leading states on both ends of TransUnion’s table of quarterly credit card delinquencies:

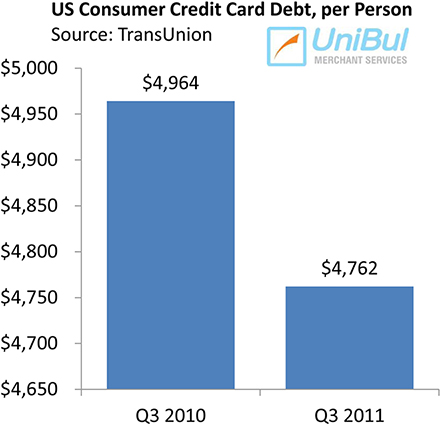

5. Credit Card Debt Down in 2011 Q3

The same TransUnion report told us that consumer credit card debt was, on average, slightly up in 2011 Q3 on a quarter-over-quarter basis, but was down from 2010 Q3.

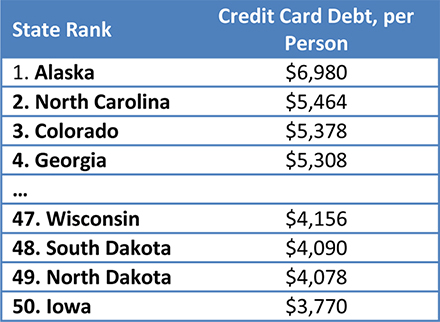

Here is a list of the leading states on both ends of TransUnion’s table of quarterly credit card debt:

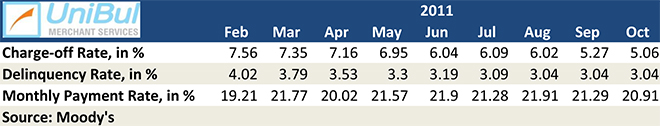

6. Credit Card Defaults Fall Again

That is what the latest monthly report from Moody’s told us.

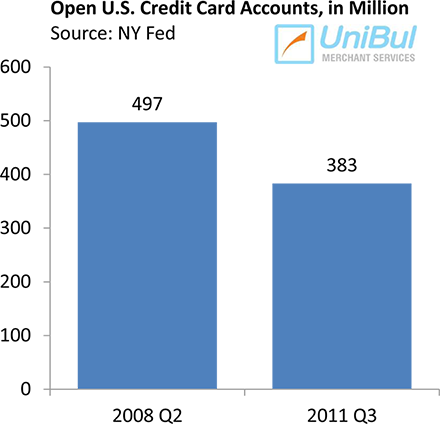

7. Americans Have Fewer Credit Cards, Lower Credit Limits

The number of active credit card accounts fell by 6 million in the third quarter of this year, the latest NY Fed’s Household Debt and Credit quarterly report told us.

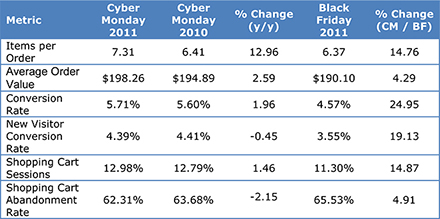

8. Cyber Monday 2011 Breaks Records

This year’s Cyber Monday sales were up by a third from 2010’s. Here are the main statistics, from an IBM report:

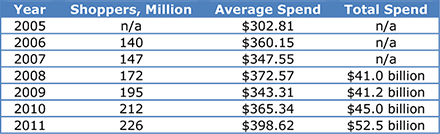

For the whole Thanksgiving shopping weekend, Americans spent $52.5 billion:

Have you seen an interesting stat that you think should be on our November list? Let us know in the comments below.

Image credit: Justaskfreeman.com.