Credit Card Processing Fibs

It’s been a while since I’ve posted anything about a “game-changing” payment processing start-up and it isn’t due to the field getting any less crowded. Rather, I just haven’t come across anything worth writing about. Well, that changed this morning when I read a piece about Noca in TechCrunch (by the way, why do so many TechCrunch articles sound like press releases?), which prompted me to check out the company’s website.

There are several things that jumped out at me and none of them were good. I read some incredibly misleading statements coming from people who really should know better. Let me explain.

What Is Noca

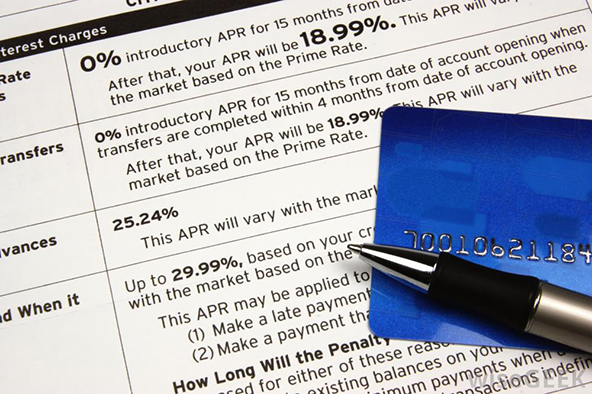

Noca offers check and credit card acceptance services to web-based U.S. merchants. Check acceptance costs merchants 1.49 percent of the transaction amount, while the equivalent rate for credit cards is 3.49 percent. It isn’t explicitly stated, but it looks like Noca may only provide Visa and MasterCard acceptance.

When a customer selects the Noca payment option at the checkout, they can choose to store their credit card information with Noca, which would allow them to complete each subsequent transaction simply by entering a PIN.

What Stands Out (For All the Wrong Reasons)

The reason I went to Noca’s website was that the TechCrunch piece told me that they charge a hefty 3.5%. Not only is that correct, but Noca promises to “deliver substantial cost benefits.” Then there is this:

Noca has a new payment processing network that provides end-to-end payment settlement for a fraction of the cost of incumbent systems.

While the first part of this statement is true, the second is incorrect. In fact, Noca is, if anything, more expensive for merchants than the vast majority of credit card processing services that are currently available.

Then there is this:

It [Noca] decreases interchange (payment processing) costs to 0.99% and, combined with the reduction in chargeback costs, enables online merchants to get a significant competitive advantage.

Leaving aside the totally erroneous equation of interchange with payment processing fees, this statement is patently misleading. Interchange fees are set by Visa and MasterCard and neither Noca nor any other payment processor has any influence over them. Moreover, I have no idea where this 0.99 percent figure comes from (nor is an explanation even attempted).

The Takeaway

I really don’t know what to make of all this. I can’t think of another payment processor that is providing so much misleading information on its website. What makes things even more perplexing is the fact that Noca’s president (P. J. Gupta) is a former Visa executive who presumably should know that the claims his website is making are false. In fact, the latest post on his blog shows that he clearly does know what interchange is and who has control over it.

The thing is that, whatever Noca may choose to write on its website, the types of rates they charge speak for themselves and merchants can do the math. Noca’s pricing is simply not competitive.

Image credit: Flickr / Hakan Dahlstrom.