Jack Dorsey Rails Against Credit Card Industry’s Misleading Pricing, His Square Does the Same

Square aims to enable babysitters, small coffee shop owners, flower stand businesses and other small businesses to accept credit cards at a flat rate of 2.75 percent per transaction, reveals the mobile payment start-up’s founder in a long interview with The Telegraph’s Emma Barnett.

Jack Dorsey, who is still more famous for co-founding Twitter, estimates that there are 30 million small business owners who can potentially become Square customers. Only 6 million of them currently accept credit cards, he says.

OK, let’s first take a look at how Barnett, with Dorsey’s help, describes Square and then we’ll break it down:

In order for Square to work, the vendor has to own an iPhone, iPod Touch, iPad or an Android-powered phone. They then need to download the free Square app, apply for the plastic reader – which is delivered free of charge within two to three working days – and then plug it into the headphone socket of the device.

A vendor then swipes a customer’s card through the plastic square plug-in to process the sale. The Square device reads the card information through the device’s microphone. The customer then signs using their finger on the touchscreen and chooses whether to receive their receipt via text or email.

So this is how Square users will be accepting payments and it is an incredibly simple process. But then there is this:

For every card payment, the vendor is charged the flat rate of 2.75pc and Square takes its cut from that percentage. The amount varies due to the different deals it has in place with credit card companies such as Amex or Visa.

It is this unchanging 2.75pc commission that Dorsey thinks is one of Square’s major selling points to business owners.

Business owners, when being sold a credit card terminal, are blinded by the offer of 1.79pc rate. However, that rate only applies on qualified cards, and so come the end of the month, the business owner has paid a range of commission costs, which go up to 4.5 pc, depending on the card, and end up paying out more of their profits than they wanted to. Square’s rate is flat across all type of credit cards.

Now, that statement is wrong. It’s actually worse than that, it is misleading. Square’s rate is neither “flat,” nor “unchanging.” Dorsey is right that business owners are often duped into signing contracts with complicated “tiered” pricing structures, where the advertised “qualified” rates often only apply to a small percentage of the transactions. The “non-qualified” transactions are processed at substantially higher rates.

For example, our own two-tiered pricing structure for retail merchants has a qualified rate of 1.65 percent + $0.20 per transaction, while our non-qualified rate is 3.05 percent + $0.20. The difference comes from the fact that Visa and MasterCard charge us higher fees for payments involving certain types of cards and for payments processed not by swiping but by key-entering the transaction data. If we don’t charge higher rates for these types of cards, we would be paying these fees out of our pockets. We actually advise merchants to consider the interchange-plus pricing model, but that is the subject of another discussion.

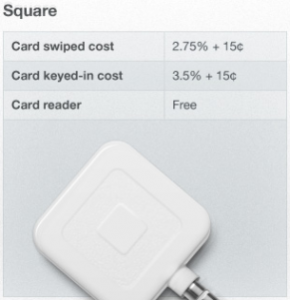

These are the rules of the game and we are all bound by them, including Square. See, Dorsey’s start-up too uses a two-tiered pricing structure. All swiped payments are processed at 2.75 percent + $0.15 per transaction, and all key-entered (yes, there is such an option) – at 3.50 percent + $0.15. The reason why Square’s rates are substantially higher than ours is that they charge no fees other than the processing fees, whereas we are forced to require a monthly minimum. That means that our merchants must generate a certain amount of fees for us, otherwise we charge them for the difference. We do that because our processing bank charges us about $10 for the monthly maintenance of each of our accounts.

These are the rules of the game and we are all bound by them, including Square. See, Dorsey’s start-up too uses a two-tiered pricing structure. All swiped payments are processed at 2.75 percent + $0.15 per transaction, and all key-entered (yes, there is such an option) – at 3.50 percent + $0.15. The reason why Square’s rates are substantially higher than ours is that they charge no fees other than the processing fees, whereas we are forced to require a monthly minimum. That means that our merchants must generate a certain amount of fees for us, otherwise we charge them for the difference. We do that because our processing bank charges us about $10 for the monthly maintenance of each of our accounts.

So yes, Square is an extremely appealing credit card acceptance solution for small businesses and consumers with low monthly transaction volumes. It is easy to set up, works great and the associated costs are reasonable. That doesn’t mean, however, that Jack Dorsey can be justified in spreading misinformation about either his own service or about his competitors.

Image credit: Square.

I do not believe that Dorsey’s explanation of Square’s fees is wrong, incorrect, OR misleading. You quote Dorsey as saying “Square’s rate is flat across all type of credit cards.?¥ To the best of my knowledge (as a brand new Square merchant) this is totally accurate. The fee remains the same whether the card is Visa, MC, Amex, etc. What changes the fee is whether the card is swiped or whether the transaction is keyed in; that is where the two different fees come into play. Based on the research I’ve done while considering the option to accept credit cards, keyed-in transactions seem to have a higher rate of problems (stolen cards, etc.), so it only makes sense that the keyed-in fee would be higher!

As a long-time online seller who is used to PayPal’s 2.9% + 30 cents per transaction fee, I am THRILLED with the prospect of paying a flat fee of 2.75% for processing transactions with Square!

So please don’t go reinterpreting someone’s words just to make your own card processing service seem more appealing. That is JUST NOT RIGHT!

Hello,

If you are a regular reader of this blog, you would know that we like Square and we’ve explicitly said so in several articles. That does not mean, however, that we will not criticize them when they deserve it. In this particular case, Jack Dorsey claims “the vendor is charged [by Square] the flat rate of 2.75pc,” without mentioning that there is a non-qualified rate of 3.5% + $0.15. This would be OK if he didn’t then proceed to talk about competitors charging “qualified rates” and others, “which go up to 4.5 pc, depending on the card,” in essence describing non-qualified rates. This statement deserved criticism and our article does a fair job in explaining why.

The pricing on square’s website is VERY clear. 2.7% swiped, 3.7% keyed. You are snipping a statement out of an interview, but there is nothing hidden from the consumer or buried in indecipherable fine print like most other services.

Hello M,

Square’s pricing is clearly communicated on their website, but that fact doesn’t make our criticism of Dorsey’s comment any less valid. Square is in fact using a tiered pricing model, so the 2.75 percent per-transaction rate is indeed neither “flat” nor “unchanging.” We do like Square here at UniBul, as all regular readers of our blog know full well, but when they make such comments, we will call them out on them.