On Boston, Mountain View and Big Data vs. Credit Card Fraud

These days you can’t turn without bumping into someone talking about “Big Data” — a nebulous concept that is typically taken to mean software that can analyze vast amounts of information for patterns or correlations that otherwise might not be observable. It is “the next frontier for innovation”, The McKinsey Global Institute (MGI) informs us in a new report, something that is “becoming a factor of production, like physical or human capital”, in the words of The Economist, which adds ominously that “[c]ompanies that can harness big data will trample data-incompetents”, before delivering the punch line: “Data equity, to coin a phrase, will become as important as brand equity”. Oh boy!

Eager to trample the barbarians data-incompetents, FICO has just released its latest report on its own usage of Big Data (yes, I will keep capitalizing the term for as long as I take pleasure in doing so) and it is dedicated on an issue, which has frequently been discussed on this blog as well: the ability to correctly identify fraudulent credit card transactions, without confusing them with legitimate ones, which just happen to deviate from an established pattern. Needless to say, both card issuers and cardholders would be extremely pleased if that issue could be solved and FICO happens to know precisely who can do that for us. Yes, I am having fun!

The Problem: Being Forced to Leave Boston

So here is the problem that needs solving. Imagine that you live and work in the beautiful city of Boston. You have no car, because why would you ever want to get out of town? After all, you have everything you can possibly ask for: quaint little neighborhoods you can walk about with friends for hours while discussing the things of life, European-style outdoor cafes to sit down at for a cappuccino and some French pastries and continue the discussion, a bunch of amazing Spanish restaurants, each with their own unique ways of cooking the same dishes to add flavor to the conversation, a host of first-class museums to help open your eyes to the things you should be spending more time educating yourself about and offer new topics for debate, legions of incredibly smart people from all over the world attracted to places like MIT and Harvard to put you in your proper place in the universe, etc.

However, one day a friend of yours from the Silicon Valley decides to get married and invites you over for the wedding. Now, you hate the Valley, it’s such a wasteland — it’s ugly, dull, sterile and spread-out, so that you have to drive everywhere and fight the traffic in the process. To make matters even worse, the place is full of engineers. And, most of all, it’s not Boston. But you can’t really say “no”, so you end up going to Mountain View. Once there, you decide to spend an afternoon and evening in Napa Valley and while there, you stroll into a local winery (I think they call them chateaus nowadays) and decide to buy several bottles of wine. You pull up your Chase Visa credit card and hand it over to the cashier, but she tells you that the transaction is denied and if you don’t like it, you have to call your card issuer and sort it out. “Perhaps you would like to pay in some other way?”, she helpfully suggests. But you politely decline and call Chase instead, whereupon you are informed that they had detected an “unusual usage pattern” involving your card, which prompted them to block the transaction. The bank representative proceeds to verify your identity, unfreezes your account and you can finally get back in line and pay for your wine.

The Solution: Big Data

The thing is that the transaction in Napa represents a change in behavior, because you live in Boston and normally shop there. In FICO speak:

If this change were a sign of fraud, traditional detection analytics would be likely to pick it up: There’s the out-of-town point of sale, and the transaction velocity and spending amounts on a compromised card may look unusual compared to [your] historical spending patterns.

In this case, however, we know the purchase is actually being made by [you], the legitimate cardholder. So the question is: Could fraud analytics do a better job of protecting not just [your] account, but [your] buying experience?

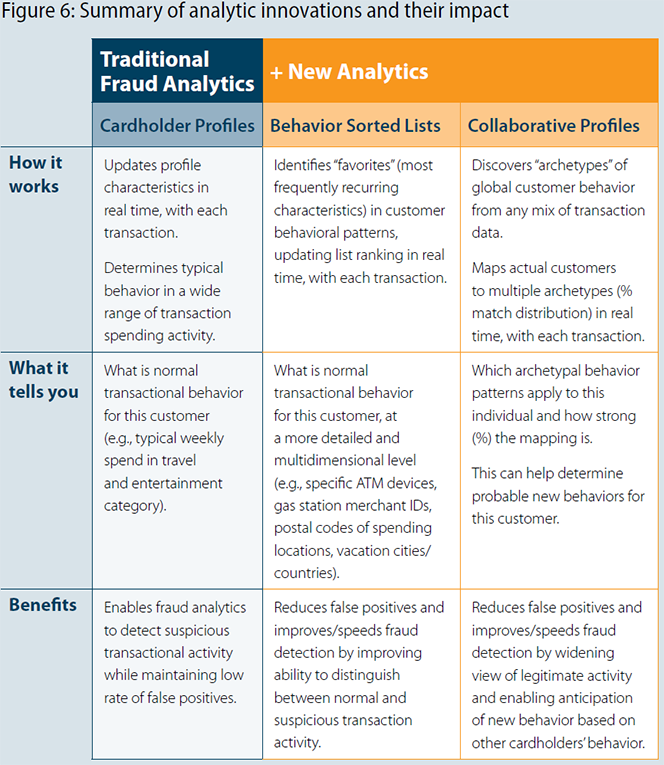

Then, of course, we are informed that, if it only had FICO’s latest big data-based tool, “the bank would have a deeper understanding of who [you are] and be able to make the right decision, to let the transaction go through without a hitch” and the author proceeds to educate us on how it works. Here is the essence:

Lest anyone had any lingering doubt about the usefulness of FICO’s latest big data-powered tool, the report concludes by informing us that:

The streaming analytics discussed in this paper represent a new breed of machine learning–potentially applicable to a wide range of customer interactions–that is dramatically improving the ability to make complex, high-stakes decisions in real time.

There it is, “a new breed of machine learning” will finally replace our stone-age tools and everything will be fine in our lives, even when out of Boston.

The Takeaway

I am a huge fan of Big Data. It is already changing the way business is done and it is also changing our lives — mostly for the better. To take one obvious example, Google is tapping into the world’s biggest ocean of data to continuously improve the relevance of the information it serves us. The trade-off — letting the search giant track our every move on the web — is more than worth it, I believe. I, for one, am not at all concerned with the possibility that Google, knowing how often I went to The Economist’s website or Paul Krugman’s blog today, would use the information to pursue some nefarious objectives of its own, having to do with things like world domination. But it is the personality of the person whose job is to analyze Big Data that clinches it for me. Here is the anatomy of a data scientist:

Image credit: Wikimedia Commons.