American Express Merchant Card Acceptance Guide

Merchants accepting American Express cards are required to follow certain rules to keep on the good side of the credit card company and avoid penalties and, in extreme cases, the possibility of their merchant accounts being terminated.

American Express is different from its major competitors, Visa and MasterCard, in that it operates a closed payment system, in which it operates both as card issuer and acquirer, so its merchant rules are somewhat different from its rivals.

Card Acceptance

The merchant must accept American Express cards as payment for goods and services sold (other than those goods and services which are contractually prohibited), or (if applicable) for charitable contributions made, at all of your establishments, except as expressly permitted by applicable law. You are jointly and severally liable for the obligations of your establishments under your American Express merchant agreement.

By accepting American Express cards at your establishment, you are providing your customers with convenience and flexibility in the choice of payment methods offered.

Treatment of the American Express Brand

American Express restricts merchants from engaging in activities that would harm American Express’ business or brand.

Except as expressly permitted by applicable law, you must not:

- Indicate or imply that you prefer, directly or indirectly, any other payment products over American Express cards,

- Try to dissuade cardmembers from using American Express cards,

- Criticize or mischaracterize AmEx cards or any of American Express’ services or programs,

- Attempt to persuade or prompt cardmembers to use any other payment products or any other method of payment (e.g., payment by check),

- Impose any restrictions, conditions, disadvantages, or fees when an AmEx card is accepted that are not imposed equally on all other payment products, except for electronic funds transfer, cash or check,

- Suggest or require cardmembers to waive their right to dispute any transaction,

- Engage in activities that harm American Express’ business or the American Express brand (or both),

- Promote any other payment products (except your own private label card that you issue for use solely at your establishments) more actively than you promote AmEx cards, or

- Convert the currency of the original sale transaction to another currency when requesting authorization or submitting transactions (or both).

You may offer discounts or in-kind incentives from your regular prices for payments in cash, ACH funds transfer, check, debit card, or credit/charge card, provided that (to the extent required by applicable law):

- You clearly and conspicuously disclose the terms of the discount or in-kind incentive to your customers,

- The discount or in-kind incentive is offered to all of your prospective customers, and

- The discount or in-kind incentive does not differentiate on the basis of the card issuer or, except as expressly permitted by applicable state statute, payment card network (e.g., Visa, MasterCard, Discover, JCB, American Express).

Treatment of the American Express Marks

Whenever payment methods are communicated to your customers, or when customers ask what payments are accepted, you must indicate your acceptance of AmEx cards and display American Express’ marks (including any AmEx card application forms provided to you) as prominently and in the same manner as any other payment products.

American Express’ corporate logo, the “American Express® Blue Box” logo, is the strongest visual symbol of American Express’ image. The “Blue Box” represents and reinforces the high quality service and values of American Express.

The appropriate version of the “Blue Box” logo must be displayed on all point-of-purchase materials and signs. The following guidelines apply to your use of the “Blue Box” logo in communications:

- The space around the “Blue Box” must equal at least 1/3 the size of the box.

- The “Blue Box” logo minimum size is 3/8″ and 1/2″ is the preferred size.

- The “Blue Box” logo must always be shown in the pre-approved “American Express blue” or, in one- or two-color communications, black.

- A minimum distance of 1-1/2 times the size of the “Blue Box” must be allowed between the “Blue Box” logo and a non-American Express mark.

You must not use American Express’ marks in any way that injures or diminishes the goodwill associated with the American Express mark, nor in any way (without American Express’ prior written consent) indicate that American Express endorses your goods or services.

You must only use American Express’ marks as permitted by the merchant agreement and must cease using American Express’ marks upon termination of the agreement.

For additional guidelines on the use of American Express’ marks, contact your merchant services provider.

Prohibited Uses of the Card

You must not accept AmEx cards for any of the following:

- Adult digital content sold via Internet Electronic Delivery,

- Amounts that do not represent bona fide sales of goods or services (or, if applicable, amounts that do not represent bona fide charitable contributions made) at your establishments; for example, purchases at your establishments by owners (or their family members) or employees contrived for cash flow purposes, or payments that you have accepted in order to advance cash to cardmembers in connection with the transaction,

- Amounts that do not represent bona fide, direct sales by your establishment to cardmembers made in the ordinary course of your business,

- Cash or cash equivalent; for example, purchases of gold, silver, platinum, and palladium bullion and/or bars (collectible coins and jewelry are not prohibited), or virtual currencies that can be exchanged for real currency (loyalty program currencies are not prohibited),

- Charges that the cardmember has not specifically approved,

- Costs or fees over the normal price of the goods or services (plus applicable taxes) that the cardmember has not specifically approved,

- Damages, losses, penalties, or fines of any kind,

- Gambling services (including online gambling), gambling chips, gambling credits, or lottery tickets,

- Unlawful/illegal activities, fraudulent business transactions or when providing the goods or services is unlawful/illegal (e.g., unlawful/illegal online internet sales of prescription medications or controlled substances; sales of any goods that infringe the rights of a rights-holder under laws applicable to American Express, you, or the cardmember),

- Overdue amounts or amounts covering returned, previously dishonored or stop-payment checks (e.g., where the AmEx card is used as a payment of last resort),

- Amounts that represent repayment of a cash advance including, but not limited to, payday loans, pawn loans, or payday advances,

- Sales made by third parties or entities conducting business in industries other than yours, or

- Other items of which American Express or your merchant services provider notifies you.

You must not use AmEx cards to verify your customer’s age.

Prohibited Merchants

Some merchants may not be eligible to accept AmEx cards. A merchant will be denied the privilege to accept AmEx cards if it is determined that a merchant meets one or more of the criteria for a prohibited merchant. For additional information regarding prohibited merchants, contact your American Express merchant services provider directly.

Treatment of American Express Cardmember Information

Any and all cardmember Information is confidential and the sole property of the issuer, American Express or its affiliates. Except as otherwise specified, you must not disclose cardmember information, nor use nor store it, other than to facilitate transactions at your establishments in accordance with the American Express merchant agreement.

Completing a Transaction at the Point of Sale

All valid transactions begin with a cardmember’s purchase at the point of sale. Whether the physical card is used to facilitate a card-present charge, or the cardmember provides his or her cardmember information over the phone, via mail order, or the internet, the transaction must not be completed without the card and/or information provided by the cardmember.

To accept an AmEx card for charges at your establishments, at the point of sale, you must:

- Clearly and conspicuously, disclose all material terms of sale prior to obtaining an authorization, and

- Clearly and conspicuously inform cardmembers at all points of interaction (e.g., sales conducted in person, over the internet, mobile or via mail or telephone order) what entity is making the sales offer, so that the cardmember can clearly distinguish you from any other party involved in the interaction (e.g., a vendor of goods or provider of services you may engage, or another merchant seeking to conduct business with the cardmember).

The transaction data you collect to facilitate the charge must be, or have been, provided directly to you by the cardmember.

You must not accept or have accepted transaction data from, nor shall you provide or have provided transaction data to, any third parties other than your covered parties.

If you fail to comply with this requirement, you may be assessed non-compliance fees and/or have your American Express merchant card acceptance privileges at your establishments suspended or disentitled.

Processing an In-Person Charge

In-person charges refer to charges in which the AmEx card and cardmember are present at the point of sale. An example of this is when a cardmember presents a card to the merchant at a retail store.

For all in-person charges, the card must be presented. There are several ways in which an in-person charge can be conducted. The steps taken vary according to how the following two types of in-person charges are conducted:

- Electronic charges,

- Key-entered charges.

Electronic Charges

Electronic point-of-sale (POS) systems automatically capture required information from the card so it can be used to request authorization for the charge. Electronic charges can be conducted in a variety of ways depending on the type of card presented.

- Magnetic stripe cards – contain cardmember and card account information on the stripe on the back of the card, or in a contactless chip embedded in the card.

- Chip cards – contain a chip on which data is stored (including Cardmember and card account information), which the POS system can read in order to guide the processing of the transaction.

- Mobile devices – an issuer approved and American Express recognized electronic device (including but not limited to, a mobile telephone, tablet, or wearable device) that is enabled to initiate a digital wallet payment transaction.

Some magnetic stripe, chip cards and mobile devices may be read over the contactless interface of the POS system. The charge record is then created from the information captured during the electronic charge.

You must work with your American Express merchant services provider if you have questions related to your POS capabilities.

Magnetic Stripe Card Charges

When presented with a Card at the point of sale, you must:

- Verify that the AmEx card is not visibly altered or mutilated,

- Verify that the customer is the cardmember (cards are not transferable),

- Capture magnetic stripe data by swiping the card (unless the Charge was already initiated by waving the contactless chip card in close proximity to thePOS system,

- Obtain an authorization approval,

- Obtain signature (excluding charges at CATs) and verify that the signature is identical to the name on the Card. Obtaining a signature may not be required if your establishment and the charge qualify for the No Signature/No PIN Program,

- Compare the signature (when obtained) on the charge record with the signature on the card,

- Verify the card’s expiration date,

- Match the card number and the expiration date on the card to the same information on the charge record, and

- Ensure the name that prints on the charge record matches the name on the front of the card.

Contact Chip Card Charges

When presented with an AmEx chip card to be inserted into a chip card reader, you must inform the cardmember to:

- Verify that the card is not visibly altered or mutilated,

- Verify that the customer is the cardmember (cards are not transferable),

- Capture Chip Card Data by inserting the Card into the Chip Card reader. The POS System will advise cardmembers to enter their PIN (a chip and PIN charge) or sign for the charge (a chip and signature charge):

- Chip and PIN charges: Cardmembers will enter their PIN into the POS system using the keypad. If the chip and PIN charge is unable to be completed due to a technical problem, the POS system will show an error message. Follow the procedures for a swiped charge. Failure to validate the PIN, when required, can render you liable for chargebacks if the cardmember disputes the charge. Validating a PIN may not be required if your establishment and the charge qualify for the No Signature/No PIN Program.

- Chip and signature charge: Obtain the cardmember’s signature on the charge record and compare the signature on the charge record to the name and signature on the card. Obtaining a signature may not be required if your establishment and the charge qualify for the No Signature/No PIN Program.

- Obtain an authorization approval,

- Verify the card’s expiration date,

- Match the card number and the expiration date on the card to the same information on the charge record, and

- Ensure the name that prints on the charge record matches the name on the front of the card.

If you use enabled chip and PIN POS systems to process a chip transaction for other payment products, then you must configure those enabled chip and PIN POS systems for American Express chip cards in accordance with the technical specifications and other requirements American Express makes available.

To avoid chip Card fraud liability shift, you must use an enabled chip and PIN POS system that can process chip cards at the time of the transaction and you must comply with all applicable card acceptance procedures. Chip card fraud liability shift does not apply to contactless transactions or digital wallet payments.

Chip card fraud liability shift applies to all industries. Chip card fraud liability shift will apply to CATs attached to automated fuel dispensers – MCC 5542, in October 2017. Please note, this exception does not apply to MCC 5541 or any other MCCs.

If your POS system is not an enabled chip and PIN POS system that can process chip cards, and a chip card is presented, chargeback may be exercised for EMV counterfeit, EMV lost, stolen, or non-received fraud except for the following “EMV Chargeback Exclusions” (for the purposes of this section):

- For the period of July 22, 2016 through April 12, 2018, you will not be held liable for new EMV chargebacks for EMV counterfeit and EMV lost, stolen or non-received fraud on any chip card transactions under $25 for cards issued in the United States (which includes Puerto Rico, the U.S. Virgin Islands, and other U.S. territories and possessions).

- For the period of October 14, 2016 through April 12, 2018, American Express will limit the number of EMV counterfeit fraud chargebacks, on cards issued in the United States (which includes Puerto Rico, the U.S. Virgin Islands, and other U.S. territories and possessions) for which your are liable, to a total of 10 per card account.

If your POS System is a capable chip and PIN POS system that can process chip cards and a chip card is presented:

- Chargeback may be exercised for counterfeit, lost, stolen, or non-received fraud if a chip card with PIN functionality is presented and the charge is not submitted as a chip and PIN charge because at the time of the transaction, your capable chip and PIN POS system was not configured to process the chip and PIN Charge. Chargeback will not be exercised for the “EMV Chargeback Exclusions”.

- Chargeback will not be exercised for counterfeit, lost, stolen, or non-received fraud for fallback transactions, if after inserting the chip card, your POS system prompts you to complete the transaction by swiping the magnetic stripe of the card, provided you follow all applicable card acceptance steps.

If you are presented with a chip card and manually key-enter the transaction, you may be subject to counterfeit, lost/stolen and non-received chargebacks in the event of a fraud dispute.

Chargeback will not be exercised for the “EMV Chargeback Exclusions”. Refer to your merchant services provider’s information on disputes and chargebacks for further information.

American Express Quick Chip

Chargeback may be exercised for EMV counterfeit or EMV lost, stolen or non-received fraud if you implement American Express Quick Chip and the following applies:

- You implement the No Signature/No PIN program, and

- You are using a POS device which supports a provisional transaction amount, and

- The final transaction performed is over the No Signature/No PIN threshold.

For more information on American Express Quick Chip, please work with your merchant services provider to determine which implementation approach best meets your business needs.

Contactless Chip Card Charge

Some card charges involve transmission of payment information when the card is waved in close proximity to a contactless reader.

When presented with an AmEx card to be read via a contactless reader, and the charge qualifies for the No Signature/No PIN Program, you must:

- Capture magnetic stripe or chip card data using the contactless reader, and

- Obtain an authorization approval.

For charges that do not qualify under the No Signature/No PIN Program, follow the relevant card acceptance procedures.

Digital Wallet Payments

Digital wallets within a mobile device facilitate transactions as follows:

- For a digital wallet contactless-initiated transaction, the mobile device completes a card present charge by waving the device in close proximity to a contactless-enabled POS system.

- For a digital wallet magnetic secure transmission transaction, the mobile device completes a card-present charge by waving the device in close proximity to the magnetic swipe-enabled POS system.

- For a digital wallet application-initiated transaction, the mobile device completes a card-not-present charge (typically made online) using a software application within the mobile device and not the contactless payment application.

When presented with a mobile device for a card-present charge, you should:

- Capture magnetic stripe or chip card data by having the cardmember wave the mobile device in close proximity to the contactless reader or magnetic swipe-enabled POS system.

Note: If you choose to accept contactless payments, you should consult with your merchant services provider to ensure compliance with the current American Express contactless POS system requirements.

- Obtain an authorization approval.

- Obtain a signature or have the cardmember complete a Consumer Device Cardholder Verification Method (CDCVM) on contactless initiated Transactions. For Magnetic Secure Transmission Transactions, you must continue to obtain a signature (excluding charges at CATs and charges that qualify for the No Signature/No PIN Program).

- Continue to include an indicator in the authorization that the transaction is a contactless transaction, if applicable.

- If a mobile device-initiated transaction cannot be processed for any reason, you should request that the cardmember provide the companion physical card and complete the transaction by following the relevant card acceptance procedures.

For application-initiated transactions, you should follow card-not-present charge policy.

For a transaction to be recognized as digital wallet application-initiated transaction, you should:

- Consult with your American Express merchant services provider to arrange for certification for digital wallet application-initiated transactions.

- Include appropriate indicators in the authorization and submission that the transaction is a digital wallet application-initiated transaction.

Key-Entered Charges

There are instances when you may need to key-enter an in-person charge. This occurs most often when the POS system cannot read the card. If the card cannot be read electronically, and you wish to key-enter the transaction, then you must:

- Verify that the card is not visibly altered or

- Verify that the customer is the cardmember (cards are not transferable),

- Key-enter the data,

- Obtain an authorization approval,

- Obtain a signature and verify that the signature is identical to the name on the card. (Obtaining a signature may not be required if your establishment and the charge qualify for the No Signature/No PIN program.),

- Compare the signature (when obtained) on the charge record with the signature on the card,

- Verify the card’s expiration date,

- Match the card number and the expiration date on the card to the same information on the charge record, and

- Validate the card’s presence by taking an imprint of the card (the imprint is for your records). Failure to validate the card’s presence by taking an imprint of the card can render you liable for chargebacks if the cardmember disputes the charge.

You may still be subject to chargebacks, including counterfeit, lost, stolen and non-received for manually key-entered transactions. Key-entered charges that occur when a chip card is presented are subject to chargeback for counterfeit, lost, stolen, and non-received fraud.

If you are presented with a chip card and manually key-enter the transaction, you may be subject to counterfeit, lost/stolen and non-received fraud chargebacks.

Charges initiated with a contactless-enabled mobile device must not be key-entered.

Contact your merchant services provider for additional guidance or to obtain information on fees assessed on key-entered charges.

You may also validate the card’s presence by ensuring the charge meets the criteria of the Keyed No Imprint Program.

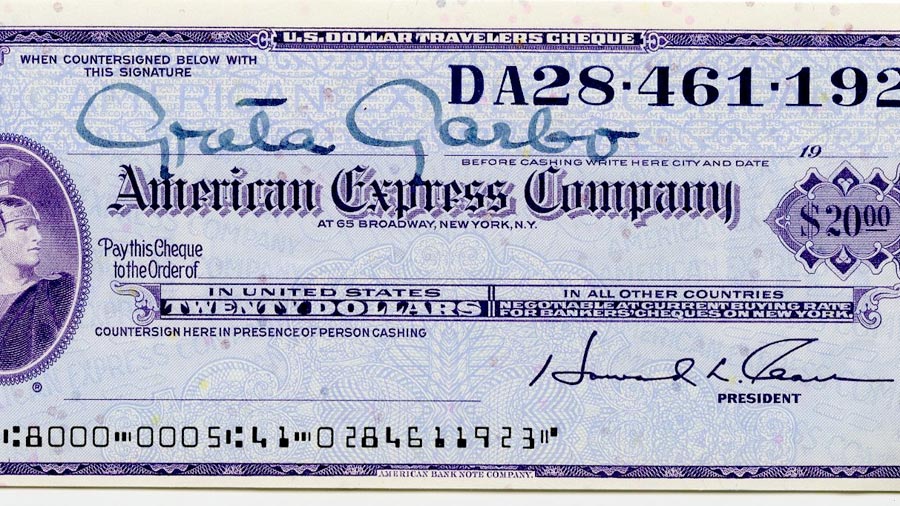

Image credit: Wikimedia.