How to Recognize a Valid Credit Card

Every valid credit card incorporates a number of security elements that are designed to enable merchants to verify the card’s authenticity. If you accept cards for payment in a brick-and-mortar store, you should educate yourself about where these security features are located and how they should look. It is your responsibility to verify the validity of each card you take, but also you are the first to lose money on a transaction involving a counterfeit card. Furthermore, the process should only take a few seconds of your time and, anyway, there is absolutely no reason not to take advantage of these security features while waiting for an authorization response.

Now, each credit card company maintains its own security standards (for the most part), which means that you should be familiar with each one of them. The good news, however, is that the standards used by the four biggest U.S. card brands are not all that different from one another, which makes your job that much easier. Following is a review of the card identification features of Visa, MasterCard, American Express and Discover. Once you’ve gone through it, you’d have the knowledge you need to spot a fake card and take the necessary action.

How to Validate Credit Card Numbers

But before we take a look at how to recognize a fake card when we see it, I will show you how you can verify that a card’s number is a real one. This technique is especially useful in e-commerce transactions, where you don’t have the luxury of physically inspecting the card itself. You can build a program that does it for you or just buy one that is already available.

The technique for validating credit card numbers uses the Luhn formula (also known as the Luhn algorithm or the “mod 10” or “modulus 10” algorithm). It is a simple procedure, which verifies a card number in the following three-step process:

- Double the value of every odd digit of the card number you are inspecting. If the resulting sum of any given doubling operation is greater than 9 (for example, 6 x 2 = 12 or 8 x 2 = 16), then add the digits of that sum (e.g., 12: 1 + 2 = 3 or 16: 1 + 6 = 7).

- Add up all the resulting digits, including the even digits, which you did not multiply by two.

- If the total you received ends in 0, the card number is valid according to the Luhn formula; otherwise it is not valid.

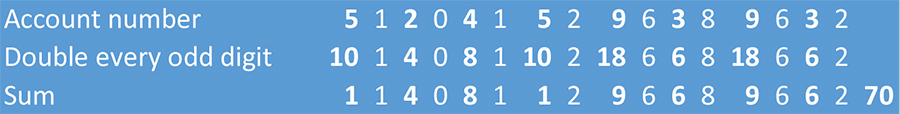

Let’s put the Luhn formula to work and inspect a MasterCard card number: “5120415296389632”. Here is what we get when we follow the three-step process I’ve just outlined:

The end result — 70 — ends in 0, which means that our MasterCard number passes the Luhn algorithm test. Of course, the card number’s validity does not eliminate the possibility that the card may still be counterfeit, so you will need to follow best card acceptance practices. Below I’ve reviewed how this should be done in a card-present environment, where both the card and its cardholder are in front of you.

Visa

All valid Visa credit and debit cards have a set of unique security features, with some of which you are already familiar. Below you will find a complete list, along with tips on how to verify each card’s validity. You should examine these features while waiting for the issuer’s response to your authorization request. Remember that an authorization approval does not necessarily protect you against fraud.

Visa Card Security Features

1. Visa brand mark. The blue and gold Visa logo is typically displayed on a white background in the card’s bottom right, top left or top right corner. However, the upper left placement is allowed only on chip cards.

2. Visa card number. Visa card numbers always start with the number “4” and are 16-digit long — there is no exception to this rule. The numbers must appear in one line and be clear and uniform in size and spacing.

3. BIN number. The first four digits of the card number must be printed directly below the number itself. This is the issuer’s Bank Identification Number (BIN). These two numbers must be identical.

4. Member since. Some Visa cards display the month and year in which the account was open. The date should be in the format “mm/yy” and the location is typically to the left of the expiration date and below the account number.

5. Expiration date. The card’s expiration date should be located below the account number and be in the format “mm/yy”. Expired cards are not valid and should not be accepted for payment.

6. Cardholder name. The cardholder name or a generic title may be printed or embossed on the face of the card, however on some Visa cards the field may be left blank.

7. Micro-chip. Some cards feature a chip, which, if present, is located above the account number.

8. Dove hologram. The Visa dove hologram may be located anywhere on the front or back of the card. This three-dimensional image should appear to move as you rotate or tilt the card.

9. Vertical orientation. Some Visa cards are vertically oriented and the account information is not embossed, but laser-printed. These cards have magnetic stripes and a card verification code on the back, just as their more conventional counterparts.

10. Mini-card. This is a miniature version of a standard Visa Card or Visa Electron Card.

11. Magnetic stripe. The magnetic stripe contains the card account’s identifying information. When the card is swiped through a point-of-sale (POS) terminal, the encoded data are “read” and displayed on the terminal’s screen. The displayed information should match the one on the card itself, so make sure you compare the two.

12. Signature panel. The signature panel is located on the back of the card, with the word “Visa” printed repeatedly within an ultraviolet element within it. Depending on the card’s design, the panel may have the full account number printed on it, only its last four digits or none at all. If the signature panel is scratched or erased, the word “void” appears repeatedly underneath.

13. Card Verification Value 2 (CVV2). The three-digit CVV2 number appears in a white box either to the right of the signature panel or within it. It is used in card-not-present transactions to verify that the customer is in physical possession of the card.

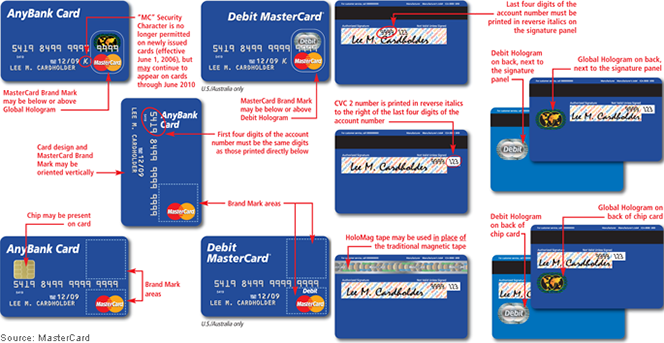

MasterCard

Similarly to Visa, all valid MasterCard credit and debit cards display a set of unique features which you should be familiar with. You will find that the two biggest U.S. card brands maintain very similar security standards for their cards’ designs, but there are some differences, as you will see below.

MasterCard Card Security Features

All cards must include a full-color MasterCard brand mark.

1. MasterCard brand mark. All cards must include a full-color MasterCard brand mark, which is typically displayed in the bottom right corner.

2. MasterCard number. MasterCard card numbers must always start with the number “5” and, similarly to Visa, are 16-digit long. The numbers must be clear and uniform in size and spacing and must appear on one line.

3. BIN number. The first four digits of the card number must be the same as those printed directly below — the pre-printed BIN.

4. Expiration date. A valid card’s expiration date should be in the future and in the format “mm/yy”.

5. Cardholder name. Similarly to Visa cards, MasterCard’s cardholder name is printed on the front of the card.

6. Micro-chip. Some cards carry a chip, which is located above the account number.

7. HoloMag. The MasterCard Hologram, or HoloMag, can be located on the front or back of the card. If located on the front, it will appear above the brand mark. If located on the back, it will be located next to or below the signature panel.

8. Vertical orientation. On some cards, the design and brand mark may be oriented vertically.

9. Signature panel. The signature panel is located on the back of the cards, with the word “MasterCard” printed in multi-colors at a 45?? angle. The last four digits of the account number must be printed in reverse italic letters within the signature panel.

10. Card Verification Code 2 (CVC 2). The three-digit CVC 2 must be printed in reverse italics to the right of the last four digits of the account number within the signature panel.

11. Magnetic stripe. The magnetic stripe must be present and located above the signature panel and appear smooth and straight with no signs of tampering. On some cards the HoloMag tape may be used in place of the magnetic stripe.

Now, there are different MasterCard designs in use today and some of the above identification features may not be present on some of the cards you accept. However, all security features that are present must comply with the above specifications.

American Express

American Express issues the cards with the most unique design in the U.S. and that uniqueness is mostly to be found in the cards’ security features. Yet, just as is the case with Visa and MasterCard, it would only take a few seconds for a well-trained eye to verify that these features have not been tampered with.

American Express Card Security Features

There are several different types of American Express designs and not all of the company’s cards will display all of the security features listed below, but most of them will.

1. Account number begins with “3”. All American Express card account numbers are embossed and begin with “37” or “34”. This rule applies to all AmEx cards.

1. Account number begins with “3”. All American Express card account numbers are embossed and begin with “37” or “34”. This rule applies to all AmEx cards.

2. AmEx card numbers are 15-digit long. They have no alterations and are spaced in groups of four, six and five digits, like this: “xxxx xxxxxx xxxxx”. In contrast, Visa, MasterCard and Discover numbers are all 16-digit long and are spaced in four groups of four digits.

3. Card Identification Number (CID). CID is AmEx’s equivalent to Visa’s CVV2, MasterCard’s CVC 2 and Discover’s CID. Unlike its competitors who all use three-digit security numbers and place them on the back of their cards, within or immediately to the right of the signature panel, AmEx’s CID is four-digit long and is printed above the embossed account number on the right or left of the card.

4. Cardholder name. The cardholder name is printed in the lower left corner of American Express cards, just as the rival brands do it.

5. Member since. The “Member Since” date is embossed to the right of the expiration date. In contrast, Visa, MasterCard and Discover all place the “Member Since” date (where present) to the left of the expiration one.

6. Expiration date. AmEx’s expiration, or “Valid Thru”, date is embossed above the cardholder name field, in the format “mm/yy”.

7. Centurion image. The Centurion image is located in the middle of most, but not all, AmEx cards and of course is unique to the brand (not to mention trademarked). It is phosphorescent and the words “AMEX” are visible under UV light.

8. Centurion hologram. Some AmEx cards feature a hologram of the Centurion image embedded into the magnetic stripe.

9. Card number within signature field. Also uniquely, the account number is printed within the signature field of most AmEx cards and, of course, must match the embossed one on the front of card and the one printed on the transaction receipt. The rival brands typically print only the last four digits of their card numbers within the signature field (but not always, as I already noted).

10. Signature field. The signature field is located below the magnetic stripe on the back of all AmEx cards, much as it is on Visa, MasterCard and Discover cards. The words “Cardmember Signature” are printed directly underneath it.

Again, let me reiterate that some AmEx cards will not display all of the security features listed above. For example, you will not see the Centurion image on American Express Blue cards and there may be other missing features. However, any security features that are present must adhere to the above specifications.

Discover

The smallest of the four major U.S. card networks uses a card design that is very similar to those of Visa and MasterCard. Of course, there are some unique features, along with the more conventional ones and I’ve listed all of them below.

Discover Card Security Features

1. Discover Network. The words “DISCOVER NETWORK” will appear under an ultraviolet light.

2. Discover card number. All Discover card numbers begin with “6” and are 16-digit long. Embossed numbers should be uniform in size and spacing, and extend into the hologram. Unembossed cards may display the account number and expiration date printed flat on the front.

3. Expiration date. As usual, the “Valid Thru” date, which indicates the last month in which the card is valid, is placed underneath the account number and to the right of the “Member Since” date.

4. Business name. A “Business Name” may be embossed below the account name.

5. Stylized “D”. An embossed security character appears as a stylized “D”. However, no stylized “D” is present on unembossed cards.

6. Hologram. Some Discover cards may display a hologram on the card’s face with a globe pierced by an arrow. However, if the card’s back displays a holographic magnetic stripe, there is no hologram on the front.

7. Magnetic stripe. The magnetic stripe should look smooth, with no signs of tampering. Some cards display a holographic magnetic stripe with blue circles.

8. Discover Network on the back. The words “DISCOVER NETWORK” appear repeatedly within the signature panel.

9. Last four digits. The last four digits of the card number are also displayed within the signature panel in reverse indent printing.

10. Card Identification Number (CID). The three-digit CID is printed in a separate box to the right of the signature panel on the back of the card.

11. Discover brand mark. The Discover Network Acceptance Mark will appear on the front and / or back of the card.

The Takeaway

Accepting card payments in a face-to-face setting enables you to physically inspect each card and ensure its validity. It is a huge advantage and you should make the most of it. Add to that the ability to examine your customer’s behavior for signs of anything suspicious or unusual and it should become obvious why a card-present environment is considered lower-risk, and is rewarded with lower interchange fees, than the e-commerce setting. Inspecting a card’s security features should only take you a couple of seconds and there is no better way to spend your time while waiting for an authorization response.

If your examination of a card’s security features leads you to suspect that the card may have been altered in some way or is counterfeit, you will need to make a Code 10 call to your processor’s authorization center to alert them of suspicious activity. You will be connected to the card’s issuer and, following a short series of “yes” and “no” questions, you’ll be instructed on how to proceed with the transaction. If it is necessary to call the police, the operator will do so for you. You may be instructed to retain the card, which you should only do if it is safe.

Image credit: MasterCard.