Growth of Student Loan Debt, Delinquencies Accelerates

That is the headline finding of a newly-released report (registration needed) by FICO—the provider of the most widely used consumer credit scores in the U.S. Student loan defaults are rising in step with the delinquencies, damaging the borrowers’ credit scores and making it more difficult for them to get new credit of any type, we are reminded. And there is no indication that the trend is about to reverse itself. On the contrary, the researchers expect the situation to become worse before it gets better.

Yet, there is one consolation offered in the paper: although in some ways the current student debt situation is mirroring the run-up to the mortgage crisis, which is still haunting us today, we shouldn’t expect it to cause as much damage, because “the student loan industry does not contribute to the US economy to the same degree as the mortgage industry”. Well, I, for one, am not reassured. The longer this bubble is allowed to inflate, the more people it will end up affecting when it eventually bursts. See, in addition to damaging credit scores, which by itself is enough of a penalty, under current law unpaid student debt cannot be discharged even in bankruptcy, so they end up dogging former students throughout their lives. But let’s look at the FICO data.

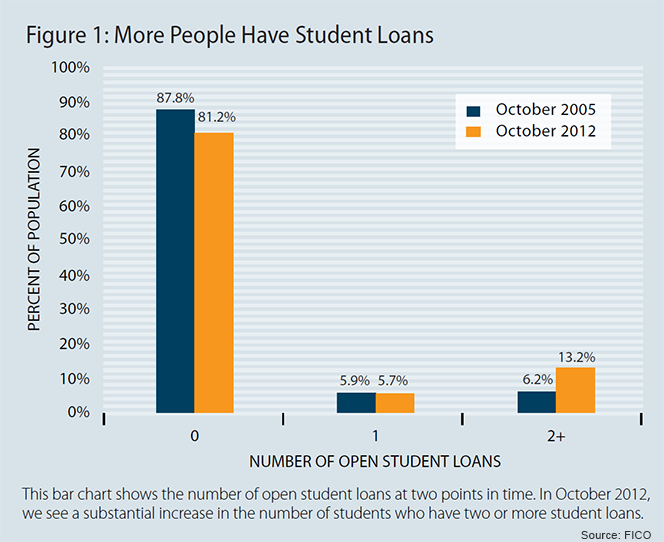

More People Have Student Loans

In October 2012, 18.2 percent of U.S. consumers had an open student loan, up by 49 percent from the 12.2 percent ratio measured in October 2005. Moreover, 13.2 percent of Americans had two student loans or more, up by 132 percent from the 5.7 percent ratio of 2005. Here is the chart:

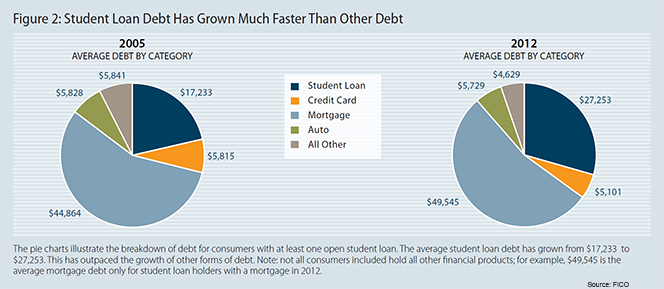

Student Debt Grows Much Faster than Total Debt

In 2005, consumers with an open student loan owed $17,233, on average, we learn. By 2012, that number had risen to $27,253, an increase of 58 percent. By contrast, total debt has only increased by 16 percent for the period, while credit card debt has actually fallen—from $5,815 to $5,101—a decrease of 14 percent. Here is the chart:

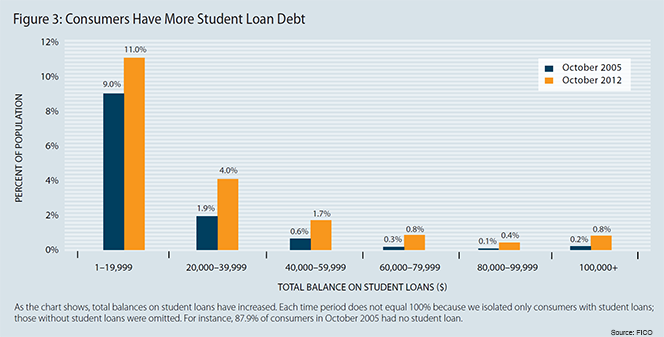

1.2M Americans Owe More than $100K in Student Loans

It should come as no surprise that a quickly rising number of Americans owe exceptionally large amounts in student loans. As the chart below shows, the share of consumers owing more than $100,000 has quadrupled between 2005 and 2012—from 0.2 percent of consumers to 0.8 percent. In other words, there are about 1.2 million Americans with outstanding student loan balances in excess of $100,000.

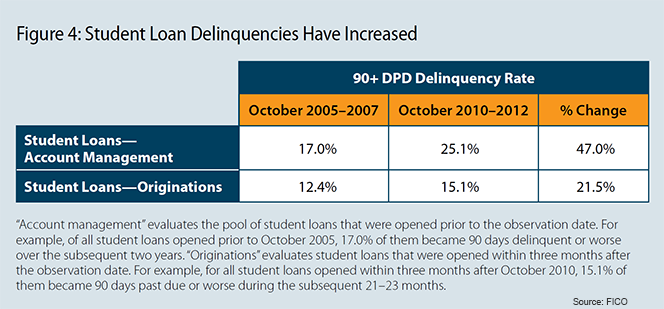

Skyrocketing Delinquencies

Nothing illustrates the severity of the student debt problem better than the skyrocketing delinquency rate. As the chart below shows, during the period between October 2010 and October 2012, a quarter of all student loans were overdue by 90 days or more, up from 17 percent just five years earlier.

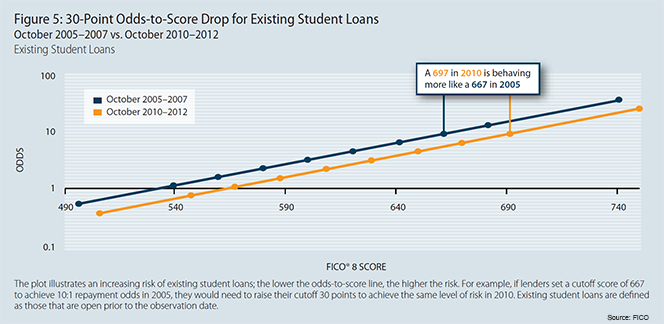

The Effect on Debt Repayment Risk

Unsurprisingly, higher student loan delinquencies and defaults have led to an increased debt repayment risk. The researchers tell us that a FICO score of 667 in 2005 corresponded to repayment odds of 10:1. By contrast, in 2010, the same odds were calculated for a score of 697.

The Effect on Credit Scores

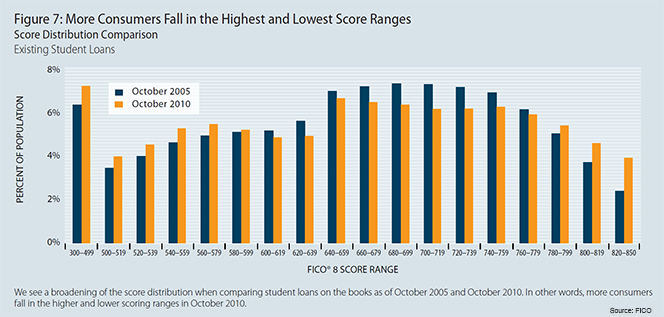

FICO has found that between 2005 and 2010 there was an increase in the shares of consumers in the highest and lowest credit score ranges. However, the median FICO score dropped from 670 to 665 during that period.

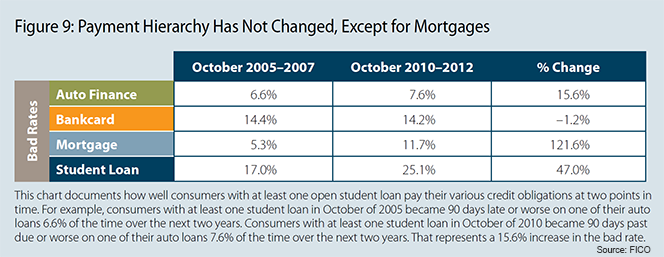

Student Loan Borrowers More Likely to Be Current on Auto Loans

The chart below shows the change in the delinquency rates that student loan borrowers had experienced for the four major consumer debt categories between the periods of October 2005 – 2007 and October 2010 – 2012. As you see, only the credit card debt category has shown a decrease, but even that has been a marginal one. On the whole, consumers with student debt are much more likely to be current on their auto loans than on any other type of debt.

Large Amounts of Student Debt Make Consumers Riskier

Interestingly, FICO tells us, in 2005, consumers with more than $100,000 in student debt performed better than the overall population. However, by 2010, this group had become riskier than the total population. Overall, the increase in risk begins once the student debt load surpasses $40,000.

The Takeaway

Dr. Andrew Jennings, FICO’s chief analytics officer, states the obvious:

This situation is simply unsustainable and we’re already suffering the consequences. When wage growth is slow and jobs are not as plentiful as they once were, it is impossible for individuals to continue taking out ever-larger student loans without greatly increasing the risk of default. There is no way around that harsh reality.

As more people default on their student loans, their credit ratings will drop, making it harder for them to access new credit and help grow the economy. Even people who stay current on their student loans are dealing with very large debts, which reduces the money they have available to spend elsewhere. The stakeholders in the student lending industry have to take a hard look at the terms and repayment rules for student loans, and the industry may have to develop a new lending model to prevent a bad situation from getting completely out of hand.

That statement matches pretty closely what we’ve been saying on this blog for quite some time.

Image credit: Wikimedia Commons.