Why Americans Slash Credit Card Debt, Even as Overall Indebtedness Rises

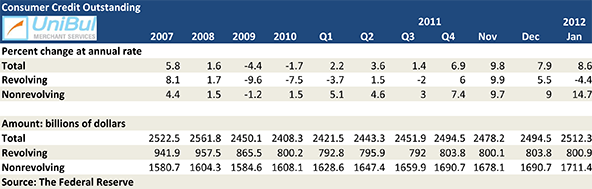

The latest Federal Reserve report on outstanding consumer credit in the U.S. painted a very interesting picture for the month of January. While credit card debt decreased, following four consecutive monthly increases (the first time that has happened since the fall of Lehman Brothers in September 2008), outstanding non-revolving debt had skyrocketed, pushing the total considerably upwards in the process.

What’s interesting about it is that credit card debt is falling, even as consumer confidence is improving as a result of a string of increasingly good unemployment numbers in the past few months. And it’s not like revolving credit is unavailable. As the NY Fed told us this week, in the final quarter of last year Americans had more credit cards, as well as more available credit than they did in the previous quarter. In fact, there have been reports in the past few months showing that Americans are not reluctant to use their credit cards. On the contrary, they’ve been gaining ground on debit cards for a first time in years. So what’s going on?

Well, I think that at least a partial explanation may be found in another piece of statistics that shows that post-crisis Americans are much quicker to repay their credit card debt than they’ve ever been. Let’s take a closer look.

Credit Card Debt down 4.4% in January

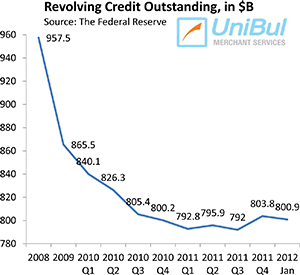

The aggregate amount of outstanding consumer revolving credit, comprised almost entirely of unpaid credit card balances, fell in January by 4.4 percent, or $2.9 billion, pushing the total down to $800.9 billion. That is only 1.41 percent above the post-Lehman low of $789.6 billion recorded in April of last year, which also happens to be the lowest level since October 2004.

The aggregate amount of outstanding consumer revolving credit, comprised almost entirely of unpaid credit card balances, fell in January by 4.4 percent, or $2.9 billion, pushing the total down to $800.9 billion. That is only 1.41 percent above the post-Lehman low of $789.6 billion recorded in April of last year, which also happens to be the lowest level since October 2004.

Following Lehman’s collapse, revolving credit in the U.S. had been falling uninterruptedly until the end of 2010. Then in 2011 the Federal Reserve reported a rise in outstanding credit card debt in half of its monthly reports and in each one of the last four releases. Yet, the total still remains far below the peak reached in August 2008. January’s $800.9 billion figure is lower by 17.74 percent, or $172.7 billion, than the $973.6 pre-crisis high.

Overall Consumer Credit Up 8.6%

The non-revolving component of the consumer debt total, made up of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, spiked in January. The Fed recorded a 14.7 percent increase, bringing the total up to $1,711.4 billion, an increase of $20.7 billion from December. That is the biggest increase in absolute terms since November 2001.

Non-revolving debt didn’t fall at anything close to the rate of decrease of the revolving total in the wake of the financial crisis and was much quicker to resume its upward trajectory. With the exception of August 2011 when it declined by 6.4 percent, the non-revolving total has increased in every month since July 2010. The current total is higher by 5.5 percent, or $94 billion, than the pre-Lehman peak of $1,617.4 billion, recorded in July 2008.

The total outstanding consumer credit in the U.S. — the sum of revolving and non-revolving debt — rose by 8.6 percent, or $17.8 billion, to $2,512.3 billion in January, its fifth consecutive monthly increase. The new total is still lower by $75.8 billion, or 2.9 percent, than the all-time high of $2,588.1 billion, reached in September 2008, but the gap is closing quickly.

The Takeaway

We know what’s causing consumer credit to rise. The economy has added 100,000 jobs or more in each of the last seven months for which there are data and the numbers for December and January — 200,000 and 243,000 respectively — were the highest in the series, pushing the unemployment rate down to 8.3 percent, the lowest level in three years. The February number is expected to be somewhere between December’s and January’s. So consumers are understandably beginning to feel better about their prospects, even as the good news is yet to spread to their wages, which have been rising at a lower pace than the inflation rate. And so they are beginning to once again take up more credit.

Conspicuously, though, the rise in outstanding credit has completely bypassed credit cards. And I think that fact strongly indicates a shift in consumer sentiment toward credit card debt. There is one indicator that I’ve been paying a close attention to, which is especially useful when trying to make sense of these dynamics. It is the monthly payment rate (MPR), which measures the ratio of their outstanding credit card debt repaid by Americans at the end of each month. According to Moody’s, a credit ratings agency, the MPR in January was 22.08 percent, the highest ever recorded and much higher than the historical averages which have hovered in the mid-teens. What we learn from this piece of statistics is that, if Americans had stuck to their pre-crisis credit card debt repayment habits, the revolving portion of the Fed’s total would have been rising in step with the non-revolving one, if not faster. So this change is a positive development and I really hope that it will outlive the recovery.

Since 2009 I have financed 2 new cars, at 0% and 1.9%, an easier to digest way to add debt.

Paul,

This is more than “an easier to digest way to add debt.” You are using free money, because your interest rate is lower than the headline inflation. Good job!