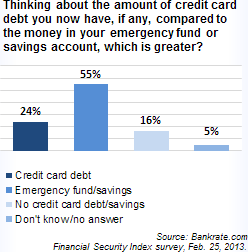

Do You Have More Savings or Credit Card Debt?

If you owe more on your credit cards than you have in your savings accounts, you are not alone, far from it. If it is any consolation, a quarter of Americans are in the same boat as you are, according to a new survey published earlier this week by Bankrate.com. Just over half of the respondents have told the personal finance website that they have more in emergency savings than they do in credit card debt.

The other highlight of the survey is that Bankrate.com’s financial security index has declined in February, even as American consumers’ net worth has improved thanks to rebounding home prices and rising stock markets. What drove the index down was deteriorating job security, savings, debt and the overall financial situation, we learn. Bankrate.com’s survey is conducted on a monthly basis and consists of six questions designed to measure how secure Americans feel about their personal finances compared to 12 months ago. Let’s take a closer look at the latest results.

24% of Americans Have More Credit Card Debt than Savings

Just over half — 55 percent — of the 1,004 respondents said they had more emergency savings than credit card debt, while 16 percent reported neither credit card debt nor savings. So 40 percent of the respondents are living paycheck-to-paycheck, with no room for error.

Just over half — 55 percent — of the 1,004 respondents said they had more emergency savings than credit card debt, while 16 percent reported neither credit card debt nor savings. So 40 percent of the respondents are living paycheck-to-paycheck, with no room for error.

Among the other findings, we learn that more men (60 percent of all who participated in the survey) than women (49 percent) said they had more in savings than in credit card debt. Perhaps unsurprisingly, 29 percent of parents with children younger than 18 have less savings than credit card debt, compared to 21 percent for people without young children. Furthermore, and I suspect that this would shock no one, two-thirds (67 percent) of people making at least $75,000 a year have more savings than credit card debt, which is true for just 41 percent of those making less than $30,000.

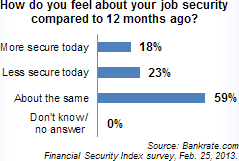

23% of Americans Feel Less Job Security

Less than a fifth (18 percent) of all respondents said they felt more job security today than they did a year ago, while 59 percent reported feeling about the same.

Less than a fifth (18 percent) of all respondents said they felt more job security today than they did a year ago, while 59 percent reported feeling about the same.

Interestingly, a far greater share of Republican-leaning Americans (34 percent) feel less secure about their jobs than do Democrats (20 percent) or independents (20 percent). Midwesterners are especially gloomy, with only 12 percent of them feeling more job security, compared to 21 percent among Southerners.

There is a substantial gender divide on that question, too. Whereas 22 percent of men without children younger than 18 feel more job security, only 12 percent of their women counterparts feel the same way.

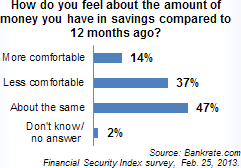

47% of Americans Feel no Different about Their Savings

Whereas one in seven Americans (14 percent) feel more comfortable with the amount of savings they have today, as compared to 12 months ago, the opposite is true for 37 percent of the survey’s respondents, we learn.

Whereas one in seven Americans (14 percent) feel more comfortable with the amount of savings they have today, as compared to 12 months ago, the opposite is true for 37 percent of the survey’s respondents, we learn.

There is a huge difference between the way rural residents feel about their savings today, as compared to a year ago, and how urban and suburban residents feel about it. Whereas only 6 percent of respondents falling into the former group are more comfortable with their savings today, the same is true for 15 percent of urbanites and suburbanites.

Again, it will come as no surprise to anyone to learn that among consumers making more than $30,000 a year the ratio of those who feel more comfortable with their savings — 17 percent — is more than twice higher than it is among those making less than $30,000 — 8 percent.

And here is another telling group of responses for you. Just under a fifth (19 percent) of college grads are more comfortable with their savings, compared to 15 percent among those with some college education and 10 percent with a high school diploma at most.

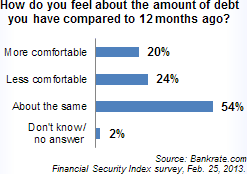

54% Feel no Different about Their Debt

A fifth of all respondents reported feeling better about the amount of debt they carry today, as compared to a year ago, whereas 24 percent said they felt less comfortable. On that question, Northeasterners were the most dejected lot, with less than a tenth (9 percent) of them reporting they felt more comfortable, compared to 22 percent for the rest of the country.

A fifth of all respondents reported feeling better about the amount of debt they carry today, as compared to a year ago, whereas 24 percent said they felt less comfortable. On that question, Northeasterners were the most dejected lot, with less than a tenth (9 percent) of them reporting they felt more comfortable, compared to 22 percent for the rest of the country.

Among college grads, 19 percent are less comfortable about their debt, compared to 26 percent of those less educated. 26 percent of people younger than 65 are less comfortable with their debt, compared to 17 percent of those 65 or older.

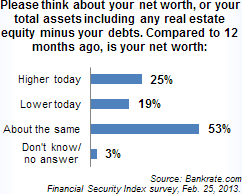

53% of Americans Have Kept Their Net Worth as the Same Level

A quarter of the respondents said their net worth had increased over the past year, whereas less than a fifth (19 percent) said theirs was now lower than 12 months ago.

A quarter of the respondents said their net worth had increased over the past year, whereas less than a fifth (19 percent) said theirs was now lower than 12 months ago.

Suburbanites have reported doing much worse than city-dwellers on that front, with 23 percent of them reporting that their net worth has shrunk, compared to 15 percent of the urbanites. 29 percent of men have reported higher net worth, compared to 22 percent of women. Most interestingly of all, 27 percent of Republicans have said their net worth had decreased, which is more than double the respective share of Democrats — 13 percent (among independents the ratio was 19 percent).

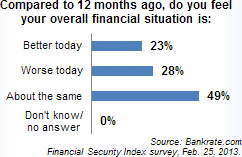

49% Feel no Change in Their Financial Situation

Less than a quarter (23 percent) of Americans feel better about their financial situation today than they felt a year ago, we learn, whereas the opposite is true for 28 percent of the survey’s respondents.

Less than a quarter (23 percent) of Americans feel better about their financial situation today than they felt a year ago, we learn, whereas the opposite is true for 28 percent of the survey’s respondents.

The educational divide is present here as well, with 33 percent of college graduates saying they feel better off today, compared to 19 percent among respondents without a college degree. A much greater share of black respondents (33 percent) reported feeling better off today than Caucasians (21 percent). Unsurprisingly, considering their responses to the previous question, many more Republicans (37 percent of all who responded) said their financial situation was worse today than Democrats (20 percent) and Independents (29 percent).

The Takeaway

Bankrate.com reports a rising share of Americans with more savings than credit card debt over the past few years. In 2011, the ratio was 52 percent, rising to 54 percent in 2012 and to 55 percent this year. Yet, the differences are small enough to fall well within the survey’s margin of error, eliciting the following comment from Greg McBride, Bankrate.com’s senior financial analyst:

Consumers may be deleveraging, but the proportion of people with more emergency savings than credit card debt hasn’t changed much… Given the poll’s 3.5% margin of error, one can make the argument that consumers haven’t moved the needle at all over the past 24 months.

Well, there are plenty of data showing that the debt deleveraging process is real, but the Bankrate.com survey is nevertheless giving us an indication of how Americans feel about their finances.

Image credit: Todaysfamilybudget.com.