50 Percent of Finns Use SMS for Mobile Payments

Finland leads the way in SMS-based mobile payments. According to BookIT Oy, a company providing interactive two-way text messaging service for enterprise applications, half of the Finns are making m-payments through a service called iSMS, which BookIT bills as the next version of SMS.

BookIT has developed iSMS together with Luottokunta, a payment processor, and Microsoft. The press release describes iSMS as “the world’s first authentication service, which allows for mobile payments from any mobile phone and via any operator.”

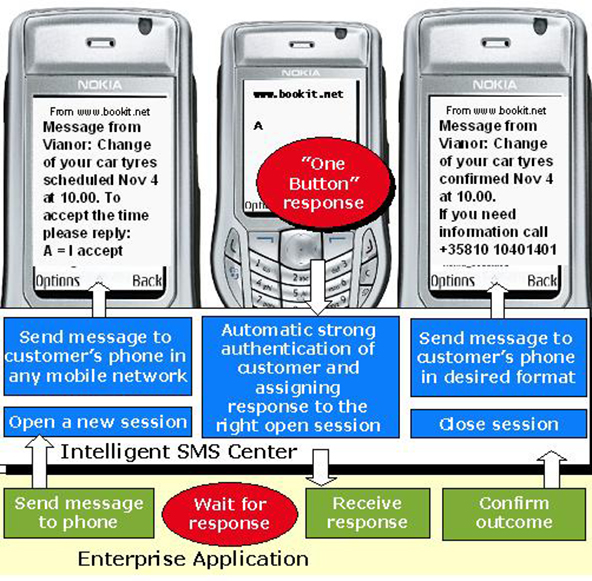

Here is how BookIT describes its m-payment offering:

The advantage of iSMS?« is that the use of the service does not require additional accessories or applications for the phone. Earlier systems have been based on authenticating the mobile phone and its user. For this purpose, a separate certificate was needed on the phone’s SIM card. In iSMS?«, the system is entirely within the network, and no separate certificates or mobile wallets are necessary. The payment method can be any card registered for the service by the consumer. Authentication is done as a cloud service, where an unforgeable “fingerprint” is created for each transaction.

“The iSMS?« is already used by 3.7 million Finns in the form of various services. One of the most popular is undoubtedly Finnair’s flight check-in service. The new development is that the iSMS?« can be used to pay for various services. Business travellers do not have time to queue up for additional services, and Finnair believes that its services will grow in popularity when they can be ordered and paid for conveniently on the phone,” explains BookIT CEO Jukka Salonen.

Luottokunta takes care of the data protection throughout the transaction. Its eMobile m-payment service will be free for consumers, and it can be used with any European bank card, in addition to the Finnish payment cards. As with regular credit card transactions, merchants will be charged for accepting iSMS payments.

Europeans, as well as others, have used SMS messages to make payments for years, so the new service is not exactly revolutionary, even though its providers would have us believe otherwise. Still, it is more secure than regular SMS payments and it can be used in a wider array of applications, including e-commerce.

U.S. mobile carriers and payment processors seem to have taken a different approach to mobile payments. Near-field communication (NFC) is all the rage on this side of the Atlantic. NFC is a short-range high frequency wireless communication technology, which enables the exchange of data between devices over a distance about 4 inches. An NFC-enabled device can communicate with both smartcards and readers, as well as with other NFC devices.

AT&T, T-Mobile and Verizon recently launched Isis, a NFC-based joint venture that will create a national mobile commerce network. Both Visa and MasterCard have launched NFC pilot programs of their own. An array of banks, department stores, coffee chains and others have also got on the NFC band wagon. All smart phone manufacturers have either already introduced a NFC-enabled device or will do so in the near future.

There are other mobile payment technologies and approaches that are being tested in the U.S. as well and, given the incredibly fast growth and enormous potential of the m-payment market, it is likely that there is enough room for all of them. It is somewhat curious that, with all that variety, SMS-based payments have been largely neglected.

Image credit: BookIT.